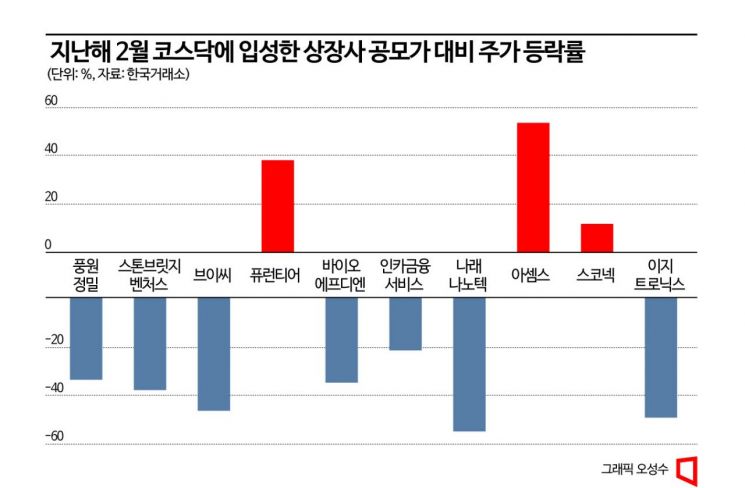

Analysis of Stock Prices for 10 Companies Listed on KOSDAQ in February Last Year

Stock Prices of 7 Companies Below IPO Price... Controversy Over IPO Overvaluation

[Asia Economy Reporter Hyungsoo Park] Although a favorable wind is blowing in the domestic stock market in January, 7 out of 10 KOSDAQ-listed companies that went public in February last year are suffering from a cold spell. This is because their stock prices are below the offering price as the lock-up release date approaches. It is a worsening situation.

According to the financial investment industry on the 26th, among the 10 companies that entered the KOSDAQ market in February last year, 7 companies except Purentier, ASEMS, and Sconic have stock prices below the offering price. In February last year, nine companies including Easytronics, Sconic, ASEMS, Narae Nanotech, BioFDN, Purentier, VC, Stonebridge Ventures, and Pungwon Precision were listed on the KOSDAQ market. Inka Financial Services moved from the KONEX market to the KOSDAQ market.

Narae Nanotech, which has the largest decline rate in stock price compared to the offering price, is a display manufacturing equipment maker established in December 1995. It produces inkjet equipment necessary for display processes and optical adhesive materials (OCR) laminators, among others. During the development of the domestic display industry, it succeeded in domesticating coating and applying machines suitable for liquid crystal displays (LCD) and organic light-emitting diodes (OLED).

As of the third quarter of last year, it recorded cumulative sales of 60.3 billion KRW and an operating loss of 800 million KRW. Sales decreased by 42% compared to the same period last year, and it turned to a deficit. Due to poor performance, the stock price has been on a downward path. It was listed on February 8 last year at an offering price of 17,500 KRW, but the current stock price has dropped to 7,810 KRW. After starting trading nervously with an opening price of 15,750 KRW on the first day of listing, it has not recovered the offering price.

At the time of the initial public offering (IPO), the offering price was fixed at the lower end of the desired range, 17,500 KRW. The competition rate in demand forecasting and public subscription was relatively low. The employee stock ownership association subscribed to 100,000 shares, accounting for 3.2% of the total public offering volume of 3.1 million shares. Approximately 270 employees were allocated employee stock worth 1.75 billion KRW. On average, each employee invested 6.5 million KRW. As of the end of the third quarter last year, the employee stock ownership association held 88,200 shares. It appears that some shares were disposed of due to resignations and other reasons.

The stock price of Easytronics, a power conversion device developer, also halved compared to the offering price. Easytronics was listed on February 4 last year at an offering price of 22,000 KRW, but the current stock price has fallen to 11,060 KRW. Although it rose to 27,000 KRW on the first day of listing, the stock price has been sluggish, with days exceeding the offering price being rare.

The underwriter NH Investment & Securities applied an expected net profit of 12.267 billion KRW for 2023 to calculate Easytronics' offering price. As of the third quarter last year, Easytronics recorded cumulative sales of 8.7 billion KRW and an operating loss of 3.4 billion KRW. Sales decreased by 28.9% compared to the same period last year, and it turned to a deficit. When estimating the desired offering price range, the expected sales and operating profit for this year were presented as 31.6 billion KRW and 4.8 billion KRW, respectively. There is a large gap compared to the actual performance up to the third quarter. Sales of power conversion devices for electric vehicles were expected to increase from 4.4 billion KRW in 2021 to 10.6 billion KRW last year. Sales of power conversion devices for communications were also estimated to increase from 10.1 billion KRW to 17.2 billion KRW.

Institutional investors participating in the demand forecast also highly evaluated Easytronics' growth potential. The competition rate was 1,415 to 1, and the offering price was fixed at the top of the desired range, 22,000 KRW.

The stock price of Pungwon Precision, an OLED material and parts company that recorded a similar competition rate to Easytronics during demand forecasting, also fell about 30% compared to the offering price. Pungwon Precision was the first in Korea to domesticate the 'Fine Metal Mask (FMM)' necessary for producing high-resolution displays. During the demand forecast conducted for institutional investors from February 10 to 11 last year, Pungwon Precision recorded a competition rate of 1,556.53 to 1. The offering price was fixed at the top of the desired range, 15,200 KRW. Among the 10 institutions participating in the demand forecast, more than 9 offered prices higher than 15,200 KRW. Institutions that applied for a lock-up agreement, promising not to sell the public shares for a certain period, accounted for 10%.

Considering that companies' performance plummeted last year due to the triple shocks of high interest rates, high inflation, and high exchange rates, the offering prices seem inflated. In this situation, with the stock market also shaky, employees who bought employee stock cannot help but feel anxious. A financial investment industry official said, "The financial authorities promised to improve the system to enhance the soundness of IPOs by preventing fictitious subscriptions and strengthening institutional demand forecasting," adding, "Discussions on appropriate offering prices should become more active, especially for the sake of employees."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)