Impact of High Interest Rates and Inflation Despite COVID-19 Endemic

Varied Rent Movements by Commercial and Office Areas

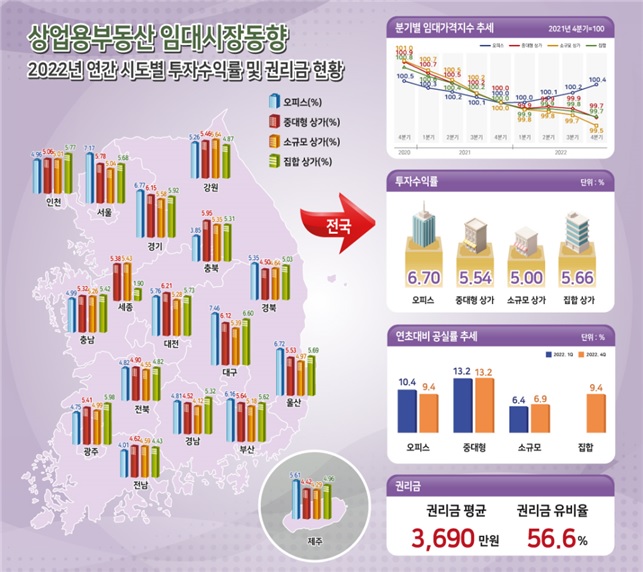

Investment Returns at 5-6% Annually Narrow Gap with Other Products

[Asia Economy Reporter Noh Kyung-jo] It has been revealed that commercial vacancy rates have increased and rental prices have continued to decline due to the impact of the economic recession. On the other hand, office spaces saw a decrease in vacancies as demand surged from startups and IT-based industries. Investment returns fell across both commercial and office properties.

According to the Korea Real Estate Board on the 25th, the commercial real estate rental price index for the fourth quarter of last year showed a decline of 0.20% for medium-to-large commercial spaces, 0.24% for small-scale commercial spaces, and 0.13% for collective commercial spaces compared to the third quarter.

Despite the COVID-19 endemic phase, the commercial market has not regained vitality due to increased operating costs from high interest rates and inflation, as well as weakened consumer sentiment.

On the 12th, a banner announcing the 'Korea Grand Sale' is hung on the streets of Myeongdong, Jung-gu, Seoul. / Photo by Jinhyung Kang aymsdream@

On the 12th, a banner announcing the 'Korea Grand Sale' is hung on the streets of Myeongdong, Jung-gu, Seoul. / Photo by Jinhyung Kang aymsdream@

There were regional disparities. The rental price index for medium-to-large commercial spaces in Seoul rose by 0.02% quarter-on-quarter, centered around the Yongsan Station commercial area and Myeongdong commercial district, which has recovered due to foreigner inflows. Small-scale and collective commercial spaces also saw increases.

However, medium-to-large commercial spaces in Chungbuk experienced a 0.48% decline in the rental price index compared to the previous quarter due to population aging and prolonged vacancies leading to sluggish commercial recovery. Collective commercial spaces in Sejong fell by 0.25% during the same period due to high rents and immature commercial districts resulting in a lack of hinterland demand.

In contrast, the office rental price index rose by 0.18% in the fourth quarter following a 0.12% increase in the third quarter. This is attributed to limited new supply of prime-grade offices and steady demand from high-quality tenants. On an annual basis, it increased by 0.41% compared to the previous year. However, there were significant regional gaps, with declines observed in all cities and provinces except Seoul, Gyeonggi, and Daejeon.

Vacancy rates showed contrasting trends between commercial and office spaces. Office vacancy rates gradually decreased from 10.0% in the second quarter of last year to 9.6% in the third quarter and 9.4% in the fourth quarter. Particularly, Seoul recorded a vacancy rate of 6.2%, lower than the national average, due to waiting demand for office leases in downtown areas such as Yeouido and sustained demand on Teheran-ro. Gyeonggi, home to Pangyo Techno Valley, had an even lower vacancy rate of 5.6% than Seoul.

In the case of commercial spaces, vacancies slightly increased despite falling rents. Medium-to-large commercial spaces had a vacancy rate of 13.2%, and small-scale commercial spaces had 6.9%, both rising by 0.1% quarter-on-quarter. The Real Estate Board explained, "Recovery is seen mainly in commercial districts with strong hinterlands and high inflows of the MZ generation (born early 1980s to early 2000s), but there is a mixed situation with the decline of old downtown commercial districts in small and medium-sized cities due to population aging, concerns over interest rate hikes, and economic slowdown."

Meanwhile, the investment return rate, which indicates investment performance over a three-month property holding period, fell despite a base effect from property tax payments in the previous quarter, as transaction volume and investment demand decreased, slowing asset value growth. The rates were 1.02% for offices, 0.84% for medium-to-large commercial spaces, 0.80% for small-scale commercial spaces, and 1.07% for collective commercial spaces.

The Real Estate Board stated, "The annual investment return rate for commercial real estate last year was generally higher than other investment products at 5-6%, but the gap narrowed as interest rates rose," adding, "By city and province, Seoul, Gyeonggi, Daegu, Busan, and Ulsan showed investment returns exceeding 6%."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.