Korea Institute for Industrial Economics and Trade Publishes 'Future Strategic Industries Brief'

"Response Needed for Korea's Semiconductor Manufacturing Capabilities"

[Asia Economy Reporter Kim Pyeonghwa] Japan and the United States are showing movements to expand their influence in the global foundry (semiconductor contract manufacturing) market. This is the background for the prospect that a new competitive structure may emerge in the semiconductor manufacturing sector, which has been a strength of South Korea. Experts advise that South Korea should also enhance its system semiconductor capabilities, including foundries, to respond accordingly.

US and Japan Growing Foundries... Targeting Single-Digit Nanometers

The Korea Institute for Industrial Economics & Trade recently published the 28th issue of the 'Future Strategic Industry Brief,' which contains forecasts for new industries. In this latest issue, the institute pointed out the entry of the US and Japan into the foundry sector as a new industry issue to watch this year.

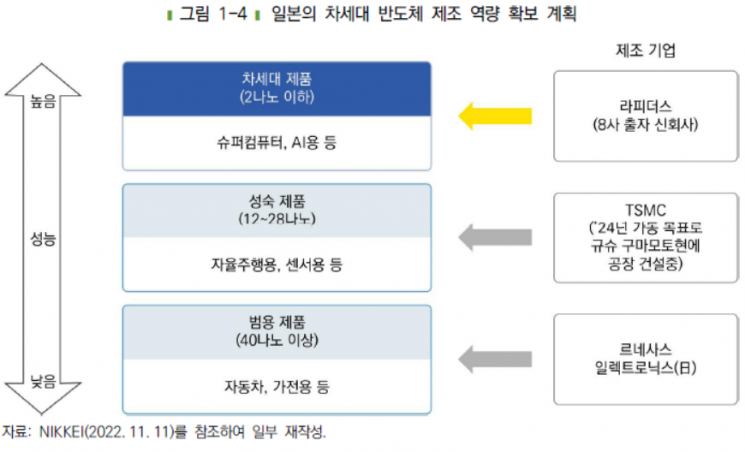

Japan is expanding its foundry operations across all fields, including both advanced and mature processes. This is an attempt to overcome its weakness in manufacturing, unlike its well-developed semiconductor materials and equipment industries.

Within Japan, the advanced process is handled by 'Rapidus,' which appeared in November last year. Rapidus is a corporation established by eight Japanese companies including Toyota Motor, Sony, and Kioxia. It has set a goal to produce next-generation logic semiconductors using processes below 2 nanometers (nm; 1 nm is one-billionth of a meter). They also plan to showcase state-of-the-art foundry technology in Japan. Japan is providing subsidies of 70 billion yen to Rapidus.

In the process of expanding mature processes ranging from 12 to 28 nm, they attracted investment from Taiwanese foundry company TSMC. TSMC is investing 1.1 trillion yen to build a foundry factory in Kumamoto Prefecture, Japan. The Japanese government announced that it will support about half of the investment cost for this factory, approximately 476 billion yen.

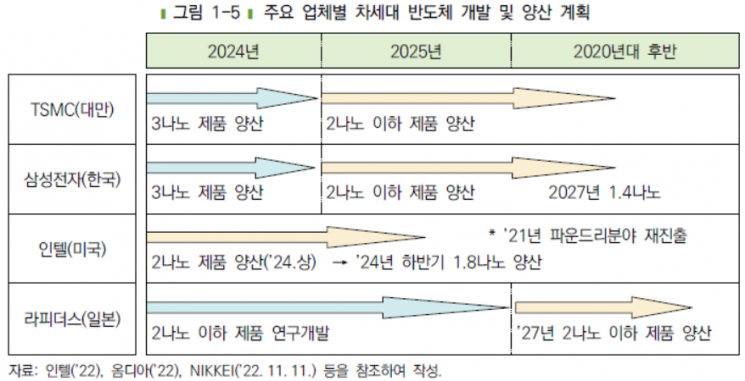

In the US, Intel's efforts to grow the foundry industry stand out. Intel, which had focused on semiconductor design, announced in 2021 that it would nurture foundry as a core business. It plans to produce products using 3 nm processes this year and 2 nm processes from the second half of next year. Intel is also actively investing to increase foundry production capacity, including building a factory in Arizona.

The US government introduced the Chips and Science Act (CSA), which provides a 25% tax credit and subsidies to companies building semiconductor factories domestically. Similar to Japan, the US is adding various supports to strengthen its semiconductor manufacturing capabilities. Administrative support is also generously provided when global companies like Samsung Electronics establish foundry factories in the US.

"Need to Grow Systems... Careful Attention to China's Rise"

If the challenges by Japan and the US succeed, the competitive structure of the foundry market is expected to change. By 2025, competition centered on Taiwan, South Korea, and the US may emerge. By 2027, Japan may also join the competitive structure. This situation could cause a sense of crisis for South Korea, which has strengths in semiconductor manufacturing.

The Korea Institute for Industrial Economics & Trade advised that to respond to this, South Korea must enhance its system semiconductor capabilities, including foundries. This includes fostering fabless (semiconductor design) companies in industries with increasing demand and preparing foundry growth strategies through industry-academia cooperation.

Strengthening core semiconductor materials, parts, and equipment competitiveness and increasing manpower are also tasks. Kim Jong-gi, senior research fellow at the Korea Institute for Industrial Economics & Trade, explained, "In the mid to long term, it is necessary to closely prepare for China's rise in the system semiconductor field."

Market research firm Counterpoint Research reported that in the third quarter of last year, Taiwan's TSMC ranked first in the global foundry market with a 59% market share. Following were Samsung Electronics (12%) and Taiwan's UMC (7%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.