High Competition Achieved Targeting High Pre-Sale Prices

But Became a Burden Within a Year

[Asia Economy Reporter Kim Hyemin] Last year, apartment complexes that aimed for high pre-sale prices and sold only 29 units are facing consecutive setbacks as the housing market enters a downturn. Some units are being listed with so-called 'Mafi (Minus Premium)' prices, where the asking price is more than 200 million KRW lower than the pre-sale price, and some places have not completed sales even after nearly a year despite small-scale pre-sales.

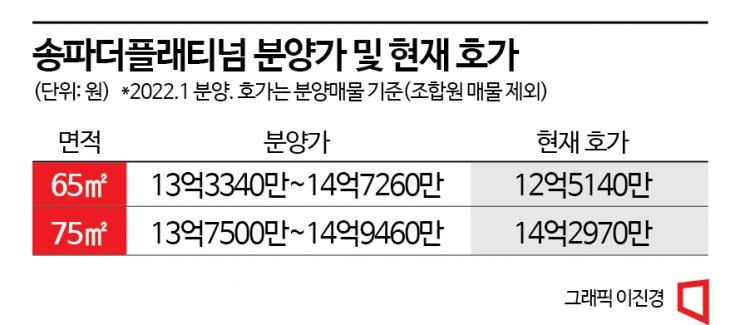

According to the industry on the 20th, a 65㎡ unit in 'Songpa The Platinum' in Ogeum-dong, Songpa-gu, Seoul, was recently listed at 1.2514 billion KRW. This 'Mafi' price is about 220 million KRW cheaper than the highest pre-sale price of 1.4726 billion KRW for the same size unit, one year after the general pre-sale began in January last year. There are also pre-sale rights for union members that have dropped to as low as 1 billion KRW.

This complex, remodeled from Ogeum Anam Apartments, was the first remodeled complex in Korea to launch general pre-sales. At that time, the pre-sale price set by the union was 52 million KRW per 3.3㎡, making it the second most expensive in the country. Although it is located in Songpa-gu, the general consensus was that the pre-sale price was somewhat high considering the location and the small scale of 328 households. The pre-sale price for a 65㎡ unit was set at a maximum of 1.4726 billion KRW, and 72㎡ units were priced at 1.4946 billion KRW.

The reason apartments in Songpa-gu, which was under the pre-sale price ceiling system at the time, could receive such high pre-sale prices was because only '29 units' were sold. According to current regulations, apartments selling 30 or more units in speculative overheated districts must undergo pre-sale price ceiling or high pre-sale price review, limiting the ability to raise prices. Conversely, if fewer than 29 units are sold, these regulations do not apply, allowing free pricing. During the housing price rise period when units sold out immediately, many apartments tried to add only 29 units to take advantage of this, leading to some criticism as 'loophole pre-sales.'

Songpa The Platinum was not free from controversy over high pre-sale prices, but it achieved a record-breaking success with 75,382 applicants competing for 29 units, resulting in an average competition rate of 2,599 to 1. However, the real estate market changed drastically within a year, and the situation became completely different.

The situation is even more precarious for Jamsil The Sharp Ruben in Songpa-gu, which followed with general pre-sales. This complex, remodeled from Songpa Seongji Apartments, originally planned to add 42 units but reduced it to 29 units to avoid pre-sale price regulations. The pre-sale price was set at an unprecedented 65 million KRW per 3.3㎡, reaching 2.6 billion KRW for a 106㎡ unit.

This complex also sold out during the April pre-sale last year with an average competition rate of 252 to 1. However, 15 units were canceled, resulting in unsold inventory. The project owner immediately started first-come, first-served sales, but it has been confirmed that the inventory has not yet been absorbed. Currently, the lowest asking price for union member pre-sale rights, which will be expanded to 106㎡ after remodeling, is 1.35 billion KRW for an 84㎡ unit. The contribution fee is about 300 million KRW, so even adding this, the total is 1.65 billion KRW, nearly 1 billion KRW less than the pre-sale price.

The situation is no different for The Sharp Songpa Lumistar, a small-scale reconstruction of Garak Hyundai 5th Complex in Songpa-gu. This complex also sold only 29 units and set a pre-sale price exceeding 60 million KRW per 3.3㎡. However, the timing of the pre-sale in October last year coincided with the housing price decline, and most units reportedly remain unsold. The pre-sale price for an 84㎡ unit in this complex is about 2.2 billion KRW, while a unit of the same size in the adjacent Raemian Park Palace was traded at 1.8 billion KRW in April last year. An industry insider said, "This is a glimpse of the final stage of loophole pre-sales during the real estate boom. Unless discount sales are offered, it seems difficult to clear the unsold inventory."

Yeo Kyung-hee, senior researcher at Real Estate R114, said, "Although the pre-sale price ceiling system has disappeared in most areas of Seoul, there are cases where pre-sale prices cannot be raised arbitrarily. Project owners will have many concerns about setting appropriate pre-sale prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.