US Inflation Peak and Growing Optimism for China's Reopening

Emerging Markets Raise Funds by Issuing Sovereign Bonds Early This Year

[Asia Economy Reporter Haeyoung Kwon] The emerging market sovereign bond market has been warming up since the beginning of the year. Signals that inflation in the US and Europe has peaked, along with expectations of an economic rebound fueled by China's 'reopening' (resumption of economic activities), have attracted investors to emerging market sovereign bonds. However, with bond issuances close to speculative grade and significant concerns about a recession, there are also skeptical views regarding these bets.

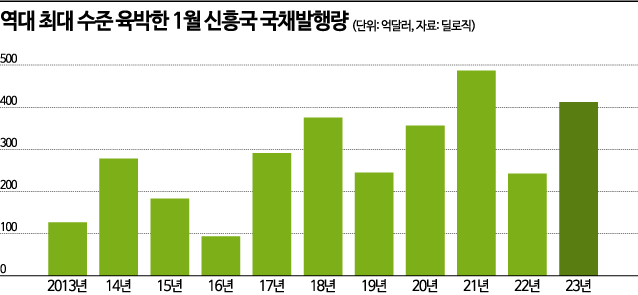

According to financial information firm Dealogic on the 18th, 14 emerging countries including Saudi Arabia, Hungary, Romania, Indonesia, the Philippines, and Mexico have issued sovereign bonds worth $41 billion (approximately 51 trillion KRW) from the beginning of this year through the 12th of this month. This far exceeds the total issuance of $24 billion in January last year. It is close to the monthly issuance amount of $48.7 billion in January 2021, which was the highest monthly issuance on record.

Even T?rkiye, which was downgraded from 'B+' to 'B' by Fitch in July last year due to nearly 90% annual inflation, succeeded in issuing sovereign bonds. T?rkiye's sovereign bond credit rating is essentially 'speculative grade.' However, on the 12th, it issued euro-denominated bonds worth $2.75 billion at an interest rate of 9.75%. Merveille Faza, a strategist at Bank of America (BofA), analyzed, "There is an increasing number of investors willing to invest cash and take risks," adding, "Countries like Romania and Hungary are issuing dollar-denominated bonds with very attractive premiums."

This appears to be a trend where the bond market, which froze last year, is gradually warming up. When major central banks such as those in the US implemented aggressive tightening policies last year to combat inflation, bond prices plummeted sharply. Investors in the global bond market responded to tightening by selling their bond holdings. Major foreign media reported, "As global inflationary pressures ease and expectations for a rebound in China rise, emerging markets are borrowing at a record-fast pace."

The surge in demand for emerging market sovereign bonds is attributed to signals that global inflation has peaked. The US Consumer Price Index (CPI) inflation rate in December last year fell to 6.5%, the lowest in one year and two months. As inflation slows, expectations grow that the Federal Reserve (Fed), the US central bank, will slow the pace of interest rate hikes. The market is betting that the Fed is likely to take a 'baby step' (a 0.25 percentage point increase in the benchmark interest rate) next month.

Furthermore, optimism about the global economy is rising as China, a key growth engine for developing countries, has abandoned its strict 'zero-COVID' policy, including city lockdowns. There is growing hope that China will offset the economic recessions in the US and Europe through a rebound in growth. Commodity prices such as copper, iron ore, aluminum, and zinc?often called 'Dr. Copper' as a barometer of the economy?have been rising since China shifted its pandemic control policies. Udai Patnaik, head of emerging market bonds at Legal & General Investment Management, recently explained the background of the recent surge in emerging market bond purchases: "The abandonment of the zero-COVID policy happened faster than expected," adding, "While advanced economies are expected to face recessions this year, among major emerging markets, except Russia, no country is expected to fall into a downturn."

However, there are also cautious views that this could be a temporary phenomenon since emerging developing countries are more vulnerable if a global recession hits. Christian Maggio, head of portfolio strategy at TD Securities, said, "The recent borrowing activity in emerging markets is too rapid," and added, "If our forecast that some major economies will enter a recession this year is correct, market conditions may not remain smooth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.