Insurance Industry Rises 6.77% in Last 30 Trading Days

Foreign and Institutional Investors Drive High-Dividend Financial Stocks

[Asia Economy Reporter Son Sun-hee] Insurance and financial stocks have recently been strong on the KOSPI. Although the stock market has generally been in a slump due to the high interest rate trend continuing since last year, insurance and financial sectors are rather classified as beneficiaries of the interest rate hike.

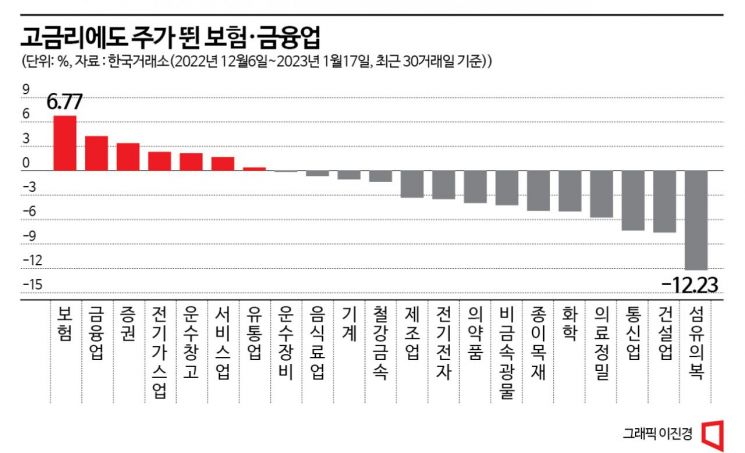

According to the financial investment industry on the 18th, the sector with the highest stock price increase rate on the KOSPI during the recent 30 trading days (December 6, 2022 ? January 17, 2023) was the insurance industry, recording a 6.77% rise. Following were finance (4.25%) and securities (3.39%), with the broad financial sector virtually dominating the top ranks.

In particular, the insurance sector rose about 9.7% even when the KOSPI fell 24.9% annually last year, breaking through the bear market. The biggest issue for the insurance industry is the newly introduced International Financial Reporting Standard 17 (IFRS17) starting this year, which is analyzed to have acted as a positive factor combined with the interest rate hike. The core of IFRS17 is to evaluate insurance liabilities at 'fair value' based on interest rate fluctuations instead of the existing cost. Insurance liabilities refer to the reserves that insurance companies set aside to pay insurance claims to customers.

Kang Seung-kwon, a researcher at KB Securities, said, "The higher interest rate level appears as a deterioration in solvency and a decrease in capital under the current accounting standards, but under IFRS17, it appears as an increase in solvency and capital." He added, "It is judged that the impact of last year's rising interest rates has not been fully reflected in stock prices. Although economic uncertainty remains this year, the insurance sector is relatively preferred because profit stability can be secured after the introduction of IFRS17." He cited Samsung Life Insurance, DB Insurance, and Hyundai Marine & Fire Insurance as related stocks.

At the beginning of the year, the stock prices of listed financial companies, centered on large financial holding companies, rose. The financial sector is a representative beneficiary industry where interest rate hikes directly translate into profits, and it is estimated that last year, financial holding companies recorded their highest-ever performance. Expectations that loans, which had stalled due to recent government real estate regulations easing, will increase also added to the optimism. In particular, financial stocks are classified as traditional high-dividend stocks, leading to concentrated purchases by foreigners and institutions through the year-end and early year. Over the recent 30 trading days, foreign investors and institutions net purchased 846.4 billion KRW and 611 billion KRW respectively in financial sector stocks listed on the KOSPI.

On the other hand, the sector with the largest stock price decline during the same period was the textile and apparel industry, with stock prices falling 12.23% over the recent 30 trading days. This is interpreted as being adversely affected by China's stringent lockdown measures due to the resurgence of COVID-19 in the second half of last year and sluggish domestic demand. Jung Ji-yoon, a researcher at NH Investment & Securities, explained, "In November (last year), sales of main products such as padding were delayed due to warm domestic weather. In China, offline stores were closed due to localized lockdowns in Beijing, Guangzhou, and other areas until November, and in the U.S., margins deteriorated due to large-scale discount events during the year-end shopping season, making the external environment unfavorable for the industry overall."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.