Government Reviews Enactment of New Foreign Exchange Act

Change from Prior Notification to Post-Notification

Background of Improved External Soundness

Foreign Exchange Reserves at 423.2 Billion USD

Strengthened Monitoring of Tax Evasion and Money Laundering

[Asia Economy Sejong=Reporter Dongwoo Lee] The government is considering enacting a new Foreign Exchange Management Act (Foreign Exchange Act) that eliminates the regulation requiring prior notification for foreign currency remittances exceeding $50,000 annually. The main content is to abolish the prior notification obligation in the process of routine foreign currency transactions such as studying abroad, travel, and personal remittances, and to switch to post-notification as early as next year.

According to government officials on the 16th, the Ministry of Economy and Finance plans to announce the basic direction of the new Foreign Exchange Act, including these details, as early as the end of this month. The new Foreign Exchange Act aims to repeal the Foreign Exchange Management Act enacted in 1999 and introduce a foreign exchange transaction law that meets global standards. This is based on the judgment that it is difficult to establish a legal and regulatory system suitable for the current economic scale under the existing Foreign Exchange Management Act, which was enacted to prevent capital outflow.

The core of the new Foreign Exchange Act is to eliminate the prior notification obligation in foreign exchange transactions such as studying abroad, travel, and personal remittances from the perspective of citizens. According to the current foreign exchange transaction regulations, overseas remittances up to $5,000 are free, but if it exceeds this amount, the foreign exchange bank handling the transaction must be designated before remittance. If the total foreign exchange remittance amount exceeds $50,000 in a given year, remittance can only be made through a foreign exchange bank branch. Prior notification of the reason and amount with supporting documents is required before remittance.

For example, if a family of four stays in the United States for one year for study purposes, it was not easy to prove when the remittance amount exceeded $50,000 for purposes such as monthly rent deposit, vehicle purchase, and school admission fees. It was also pointed out as contradictory that the transaction must be documented before the sale, even though the sale occurs after the remittance. If failure to report is detected, a fine of up to 100 million won, a penalty, or imprisonment of up to one year may be imposed.

If the new Foreign Exchange Act is introduced, the principle of prior notification in routine foreign exchange transactions will disappear, allowing freer transactions. Only parts such as transaction type, counterparty, and amount need to be reported afterward. However, transactions requiring prior notification will be enumerated by law. Transactions that require monitoring by authorities, such as large-scale foreign exchange inflows and outflows or transactions requiring prior recognition by authorities, will be separately classified and remain subject to reporting.

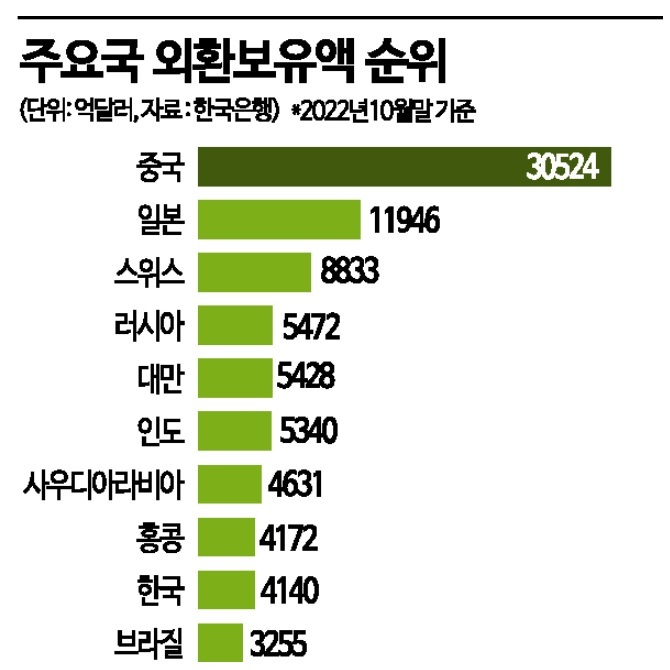

The background for the government’s promotion of the new Foreign Exchange Act is the growing need to supplement the foreign exchange transaction system, which has complicated procedures, to fit the scale of the Korean economy. External soundness, which was affected by the 1997 foreign exchange crisis and the 2008 global financial crisis, has greatly improved, and foreign exchange reserves rose to 9th in the world as of the end of November last year. According to the Bank of Korea, foreign exchange reserves stood at $423.2 billion at the end of last year, 12.7 times higher than $33.2 billion in 1996 before the foreign exchange crisis. The proportion of short-term debt maturing within one year among external debt also decreased from 211.4% in 1996 to 35.6% in 2021 relative to foreign exchange reserves, improving external payment capacity.

The increasing demand for foreign exchange transactions is also a key reason for the need to enact the Foreign Exchange Act. As of the end of 2021, Korea’s external financial assets amounted to $2.1784 trillion, 13.9 times higher than $157.1 billion in 1999. This is due to increased investments in external assets such as direct investment including equity investment, stocks, bonds, and derivative financial products. During the same period, the average daily foreign exchange transaction volume of foreign exchange banks was $58.31 billion, a 10.3% increase from $52.84 billion in 2020, the highest since the 2008 statistical revision. In contrast, the convenience of foreign exchange transactions has been criticized as significantly lagging. The Financial Supervisory Service explained that there were 1,408 cases of violations of foreign exchange transaction regulations in 2021, indicating that many financial consumers were unaware of the legal reporting and notification obligations when conducting foreign exchange transactions. This underscores the need to enhance the convenience of foreign exchange transactions based on improved external payment capacity.

The government is also reportedly considering expanding foreign exchange transaction institutions, currently limited to banks, to the secondary financial sector that meets monitoring capabilities and other criteria. It plans to prepare amendments to laws, enforcement decrees, and enforcement rules within this year and proceed with the legislative process aiming for implementation as early as the second half of next year. Meanwhile, as foreign exchange transaction restrictions are lifted, the government intends to maintain a monitoring system through post-reporting to prepare for an increase in crimes such as tax evasion and money laundering. There are opinions that these can be prevented through other laws such as the Act on the Aggravated Punishment of Specific Economic Crimes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.