High Convenience and Low Side Effects Quickly Replace PPI

HK Innoen's 'K-Cab' and Daewoong Pharmaceutical's 'Pexuclu'

Intense Development of Follow-up Drugs and Generic Preparations

P-CAB gastroesophageal reflux disease treatments HK Innoen's 'K-CAB' and Daewoong Pharmaceutical's 'Pexuclu' (from left)

P-CAB gastroesophageal reflux disease treatments HK Innoen's 'K-CAB' and Daewoong Pharmaceutical's 'Pexuclu' (from left) [Photo by each company]

[Asia Economy Reporter Lee Chun-hee] In the gastroesophageal reflux disease (GERD) treatment market, 'Potassium-Competitive Acid Blockers (P-CAB)' are rapidly growing and quickly replacing the existing 'Proton Pump Inhibitors (PPI)' market. Furthermore, as adverse reactions to PPIs become more prominent, the growth momentum of P-CABs is expected to accelerate, leading to intense strategic competition for the development of follow-up drugs and generics.

According to industry sources on the 16th, P-CAB formulations have recently gained attention in the GERD treatment field due to various advantages over the existing PPI treatments. PPIs require administration 30 minutes before meals and have inconveniences such as acid secretion occurring at night due to stimulation of gastric acid secretion. Side effects like osteoporosis and stroke have also been controversial. However, P-CAB formulations can be taken regardless of meal times and have improved nighttime heartburn. Since HK Innoen's P-CAB formulation 'K-CAB' was first launched in 2019, it has rapidly replaced PPIs and is quickly taking over the market.

Moreover, with the recent announcement by the Ministry of Food and Drug Safety (MFDS) to add adverse reactions related to PPIs, this trend is expected to accelerate further. The MFDS recently sent an official inquiry to pharmaceutical companies regarding changes to PPI formulation approvals to include drug reactions accompanied by eosinophilia and systemic symptoms, known as 'DRESS syndrome,' as adverse reactions. DRESS syndrome manifests with fever and skin rash and can lead to acute hepatitis and renal failure. Although symptoms improve upon discontinuation of the drug, severe cases can result in death.

On the other hand, P-CABs are expected to gain even more momentum from this development. Since its launch, K-CAB's sales have rapidly increased, surpassing 100 billion KRW in prescription sales within three years in 2021. Last year, it achieved 113.6 billion KRW by November, marking two consecutive years of exceeding 100 billion KRW. Daewoong Pharmaceutical's P-CAB formulation 'Pexuclu,' launched in July last year, also showed rapid growth with cumulative sales of about 9 billion KRW by November, indicating the P-CAB market is expanding day by day.

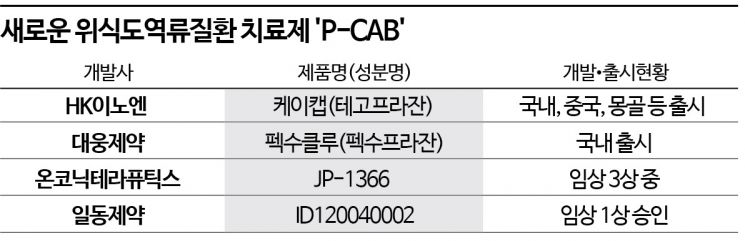

Alongside developing new P-CABs, efforts to swiftly capture the generic drug market are also ongoing. Currently, Cheil Pharmaceuticals is conducting Phase 3 clinical trials of 'JP-1366' through its subsidiary Onconic Therapeutics. The clinical trial for erosive esophagitis has completed patient recruitment, and for gastric ulcers, the clinical trial plan (IND) was approved in May last year, with patient recruitment underway. Ildong Pharmaceutical also received approval for Phase 1 clinical trials of 'ID120040002' in November last year and is recruiting patients.

Some companies have already filed patent trials to enter the generic market quickly. Currently, more than 80 companies, including Samchundang Pharmaceutical, JW Pharmaceutical, SK Chemicals, Boryung, Shinpoong Pharmaceutical, Hanmi Pharmaceutical, and Huons, have filed passive scope confirmation trials against K-CAB's crystalline form patent. K-CAB's patents consist of a substance patent expiring in August 2031 and a crystalline form patent expiring in March 2036. If the claims against the crystalline form patent are accepted, these companies will be able to launch generics starting in 2031. Although there are still eight years remaining, this appears to be a strategy to prepare generics in advance as the P-CAB market rapidly grows.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.