Government to Ease Regulations to Reduce Unsold Housing Risks

Securities Sector Up 8.9% This Year... Trend of Continued Rise Uncertain

[Asia Economy Reporter Hyungsoo Park] Since the beginning of this year, stock prices of securities companies have shown a recovery trend. As the government hinted at active deregulation to stabilize the real estate market, investment sentiment toward the securities industry also revived. However, stock market experts do not expect the rebound trend of securities stocks seen at the beginning of the year to continue. With the high interest rate environment expected to persist, the profitability deterioration of securities firms is also anticipated to continue for the time being.

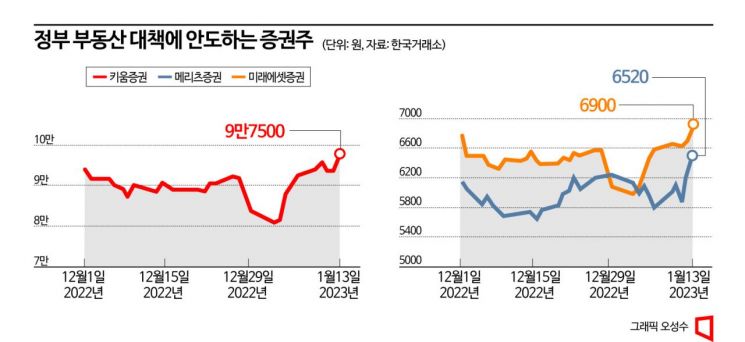

According to the financial investment industry, the securities sector index has risen 8.9% since the beginning of this year. This increase is larger than the 6.7% rise in the KOSPI during the same period. Kiwoom Securities and Mirae Asset Securities led the sector index increase, rising 16.1% and 13.5%, respectively.

Last year, the securities sector fell 24.6%. As the Bank of Korea raised the base interest rate consecutively, the securities sector experienced a difficult year. With bank deposit interest rates rising, funds moved to safe assets. As stock market volatility increased, many individual investors exited the stock market. As of the end of December last year, investor deposits stood at 47 trillion won, down 7.5% compared to the end of September last year. The average daily trading volume in the fourth quarter was 13 trillion won, down 5.8% from the previous quarter.

In addition to the deteriorating business environment, increased funding costs led to profitability decline. In the fourth quarter of last year, corporate paper (CP) rates for securities firms rose sharply. Concerns over real estate project financing (PF) loan bonds increased, making it necessary for securities firms to secure liquidity. As demand to raise funds by issuing CP increased, interest rates rose.

Seunggeon Kang, a researcher at KB Securities, explained, "Concerns over real estate PF that emerged after the third quarter of last year have spread to liquidity risks for domestic securities firms," adding, "As liquidity risks increased, funding costs for securities firms also rose."

Although it seemed like the worst situation, concerns about the securities sector eased somewhat as the government intervened. On the 3rd, the Ministry of Land, Infrastructure and Transport announced plans to ease regulations related to residential real estate subscription. Most subscription regulations related to residential real estate will be abolished to reduce the risk of unsold properties. Concerns about unsold properties affect not only construction companies but also securities firms. Securities firms have earned considerable profits from real estate PF over the past several years. The scale of real estate PF investments was significant, and in case of PF defaults, securities firms could also suffer large losses.

As the government moved to ease real estate regulations, concerns about PF defaults for securities firms also subsided. This was reflected in the rebound of major securities firms' stock prices. However, whether the rebound phase will continue remains uncertain. Yudong Yoon, a researcher at NH Investment & Securities, analyzed, "The government's real estate measures are positive news, but it is premature to say that the PF issue has been completely resolved," adding, "It is difficult to view the recent rebound in securities stocks as a sustained upward trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.