National Pension Service lowers KT stake to '9.99%'

With less than 10%, pension fund's shareholder rights restrictions nearly vanish

Expresses intent to engage in full-scale proxy battle at the general meeting

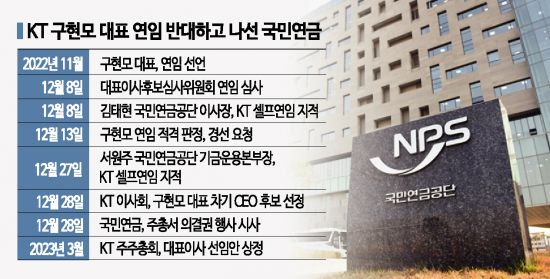

[Asia Economy Reporter Kang Nahum] Many people are curious about the background behind the National Pension Service (NPS), which expressed a negative stance on the reappointment of KT CEO Koo Hyun-mo, selling part of its KT shares. The NPS is the largest shareholder of KT. There is a high possibility of a vote battle over the reappointment of the KT CEO at the shareholders' meeting this March.

Some speculate that the shares were sold to freely exercise shareholder rights while avoiding financial regulatory restrictions. It is said to be a strategic move ahead of the 'Koo Hyun-mo push-out.'

According to KT disclosures on the 12th, the NPS sold 941,209 KT common shares (0.36%) on two occasions, March 29 and April 2, through on-market sales. As a result, the NPS's shareholding ratio became 9.99%.

Prior to this, Seo Won-ju, CIO of the NPS Fund Management Headquarters, stated regarding the KT board's decision to recommend Koo Hyun-mo as the sole CEO candidate, "The CEO candidate decision does not conform to the basic principles of a primary election."

Many interpreted this as a statement expressing the intention to exercise the Stewardship Code (fiduciary responsibility principle).

Why did the NPS lower its KT shareholding ratio despite the obvious prospect of a vote battle at the shareholders' meeting? The industry believes the NPS was mindful of the 'short-term capital gains return obligation (10% rule).'

The 10% rule requires investors holding more than 10% of shares to return any short-term capital gains realized within six months to the company if their investment purpose changes to management participation. For example, if the NPS buys 1 million KT shares today at the closing price of 34,000 KRW and sells them a few days later at 35,000 KRW, it must return all gains minus transaction fees and securities transaction taxes to KT.

Of course, since 2020, the NPS has been relatively free from the short-term capital gains return obligation due to an exemption granted by the Financial Services Commission and other financial authorities to activate the Stewardship Code for public pension funds. However, the exemption conditions are stringent, making it still difficult to actively exercise shareholder rights.

To be recognized for the exemption, the pension fund must establish a strict 'Chinese wall' (an information barrier between the pension fund's asset management and shareholder activity departments). Furthermore, the exemption is only recognized if the Financial Services Commission approves the adequacy of the Chinese wall and internal control standards. In other words, exercising the Stewardship Code requires financial authorities' approval and passing strict procedures.

To escape these restrictions, the shareholding ratio can be lowered below 10%. Since the NPS held 10.35% of KT shares, lowering it by just 0.36% allows it to freely cast dissenting votes at the shareholders' meeting.

The '9.99% shareholding' is interpreted by the industry as the NPS's expression of intent to actively engage in the vote battle. The fact that the NPS has been adjusting its KT shares since CIO Seo's appointment supports this interpretation.

However, whether the NPS can enforce its opposition to CEO Koo's reappointment at the shareholders' meeting remains uncertain. In fact, there are not many cases where the NPS exercised its voting rights to oppose a board agenda and the agenda was ultimately rejected. The rate of agenda rejection after voting rights exercise was only 1.4% in 2015, 0.3% in 2016, 1.3% in 2017, and 0.6% in 2018.

Also, Hyundai Motor Company (7.79%) and Shinhan Bank (5.48%), the second and third largest shareholders of KT, are 'blood alliance' companies that exchanged shares during CEO Koo's tenure. They are considered friendly shareholders of CEO Koo. If Hyundai Motor and Shinhan Bank support the reappointment, it is possible even if the NPS opposes it.

However, the NPS is the largest shareholder of Shinhan Financial Group (8.29%) and the second largest shareholder of Hyundai Motor (7.78%). Thus, variables remain.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)