Bond Turnover in 3 Months

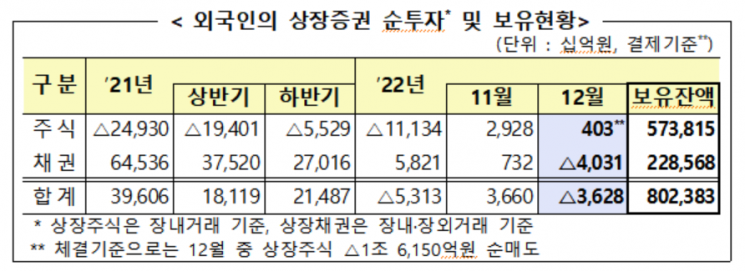

[Asia Economy Reporter Minji Lee] Foreign investors purchased about 400 billion KRW worth of domestic stocks last month, continuing a three-month streak of net buying. Bonds, however, shifted to net redemption after three months.

According to the "December 2022 Foreign Securities Investment Trends" released by the Financial Supervisory Service on the 13th, foreign investors net purchased 403 billion KRW worth of listed domestic stocks in December last year. During the same period, listed bonds saw a net redemption of 4.031 trillion KRW, resulting from net purchases of 2.873 trillion KRW and maturity redemptions of 6.904 trillion KRW.

Looking at stock investment trends, foreign investors net sold 58 billion KRW in the KOSPI market but net purchased 461 billion KRW in the KOSDAQ market. By region, Asia (800 billion KRW), Europe (400 billion KRW), and the Middle East (100 billion KRW) continued net buying, while the Americas sold stocks worth 1.1 trillion KRW. By country, Singapore (800 billion KRW) and Australia (500 billion KRW) were net buyers, whereas the United States (1 trillion KRW) and the United Kingdom (700 billion KRW) were net sellers.

The total value of listed stocks held by foreigners amounted to 573.8 trillion KRW, accounting for 26.4% of the total market capitalization. By country, the United States accounted for 40% of foreign holdings, followed by Europe with 170.7 trillion KRW (29.7%), Asia with 81 trillion KRW (14.1%), and the Middle East with 20.5 trillion KRW (3.6%).

Regarding bond investment by region, Europe redeemed 1.6 trillion KRW, the Americas 800 billion KRW, while Asia made net investments amounting to 900 billion KRW. In terms of holdings, Asia led with 106.3 trillion KRW, representing 46.5% of total foreign holdings, followed by Europe with 69 trillion KRW (30.2%).

By bond type, monetary stabilization bonds (3.4 trillion KRW) and government bonds (1.1 trillion KRW) had the largest net redemptions. As of the end of last year, government bond holdings stood at 198 trillion KRW (84.4%) and special bonds at 33.9 trillion KRW (14.8%). By remaining maturity, bonds with less than one year to maturity were net redeemed by 7.4 trillion KRW, while bonds with maturities between one and five years (2.6 trillion KRW) and over five years (800 billion KRW) saw net investments.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)