Seoul Districts Except Songpa and Guro See Reduced Decline

Transaction Recovery Still Pending Amid Additional Rate Hike Forecast

View of apartment complexes in Seoul city from Seoul Sky, the observation deck of Lotte World Tower in Songpa-gu, Seoul / Photo by Yonhap News

View of apartment complexes in Seoul city from Seoul Sky, the observation deck of Lotte World Tower in Songpa-gu, Seoul / Photo by Yonhap News

[Asia Economy Reporter Noh Kyung-jo] The decline in Seoul apartment prices narrowed for the second consecutive week, but the transaction market remained cold due to the forecast of additional interest rate hikes. Jeonse prices saw some inquiries driven by school district relocation demand but continued to decline without forming a trend line.

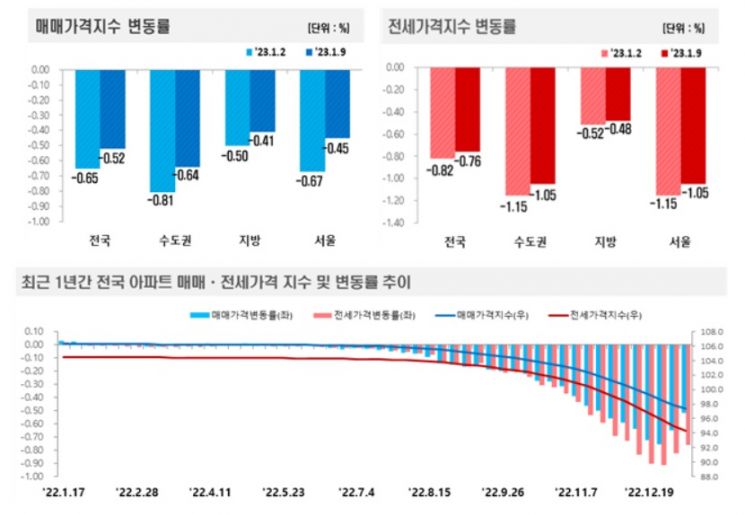

According to the weekly apartment price trend announced by the Korea Real Estate Board on the 12th, Seoul apartment prices fell by 0.45% in the first week of January (as of the 9th), narrowing the decline by more than 0.2 percentage points compared to the previous week (-0.67%). The downward trend has continued for 33 consecutive weeks since the end of May.

The Real Estate Board stated, "The government's announcement of real estate regulation easing measures partially reflected market recovery expectations in listing prices. However, only intermittent purchase inquiries centered on urgent sales existed due to the possibility of additional interest rate hikes."

By district, Dobong-gu (-0.77%) declined mainly in older apartments in Banghak, Ssangmun, and Changdong areas, and Nowon-gu (-0.70%) fell mainly in small to medium-sized units in Junggye, Sanggye, and Hagye-dong. Jung-gu (-0.62%) saw price drops in small-scale complexes within the old downtown area. South of the Han River, Gangseo-gu (-0.60%) experienced the largest decline, followed by Geumcheon-gu (-0.53%), Guro-gu (-0.44%), and Yeongdeungpo-gu (-0.43%). Among these, Guro-gu (-0.24%→-0.44%) and Songpa-gu (-0.37%→-0.42%) increased their decline compared to the previous week.

Gyeonggi (-0.72%) and Incheon (-0.73%) also saw a slowdown in the rate of decline. However, Seongnam-si Sujeong-gu in Gyeonggi (-1.13%) dropped due to price adjustments in Sinheung and Changgok-dong listings, and Goyang-si Deogyang-gu (-1.04%) declined mainly in major complexes in Donae, Haengsin, and Hwajeong-dong. Hwaseong-si (-1.02%) continued its downward trend centered on Dongtan New Town, where transaction sentiment was subdued.

In Incheon, Yeonsu-gu (-1.01%) saw the decline spread to nearby areas due to the fall in Songdo New Town. Seo-gu (-0.70%) declined mainly in Gajeong and Geomam-dong, affected by new housing supply. Gyeyang-gu (-0.70%) saw a slight reduction in the decline as some urgent sales were absorbed amid expectations of regulatory easing.

The five major metropolitan cities in the provinces also saw a reduced rate of decline (-0.50%) compared to the previous week (-0.60%). Among nationwide cities and provinces, Sejong recorded the largest decline for six consecutive weeks, falling 1.14% due to an accumulation of listings.

The tenant-favored jeonse market showed a reduced rate of decline due to inquiries from the spring moving season and school district relocation demand. However, this was insufficient to resolve the transaction freeze.

Nationally, prices fell by 0.76%, with the Seoul metropolitan area and Seoul each declining by 1.05%. The decline rates in Gyeonggi-do and Incheon were 1.06% and 0.96%, respectively. In the provinces, Busan (-0.67%→-0.70%), Daejeon (-0.59%→-0.68%), Jeonbuk (-0.27%→-0.31%), and Jeju (-0.19%→-0.20%) saw an expanded rate of decline compared to the previous week. Sejong (-1.12%) had the largest drop.

The Real Estate Board explained, "As sale prices fall, some listings are converted to jeonse, continuously accumulating, but transaction sentiment remains subdued, causing jeonse prices to decline."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)