Global Nuclear Power Market Expected to Exceed 3,000 Trillion Won by 2050

'Oil Money' Middle East Anticipated to Invest 10 Times More by 2030

Yoon's State Visit to UAE... Team Korea's Comprehensive Efforts

Barakah Nuclear Power Plant Unit 2 in the United Arab Emirates (UAE) / Photo by Korea Electric Power Corporation

Barakah Nuclear Power Plant Unit 2 in the United Arab Emirates (UAE) / Photo by Korea Electric Power Corporation

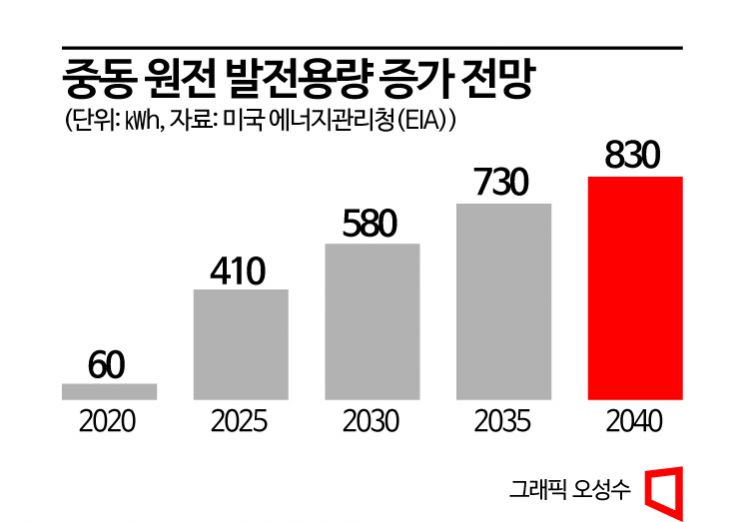

[Asia Economy Reporter Noh Kyung-jo] A major opportunity for nuclear power plant (NPP) projects is opening up in the Middle East, which is gaining attention as a "land of opportunity." The nuclear power capacity in the Middle East is expected to increase sixfold by 2025 and tenfold by 2030 compared to current levels. Saudi Arabia and Iraq have already announced plans to secure contracts worth 12 trillion won and 4 trillion won, respectively. The United Arab Emirates (UAE) and Iran are also preparing for additional construction. In response, the government and domestic companies are forming a "Team Korea," involving both public and private sectors, to aim for a resurgence as a nuclear power powerhouse. Last year, Korea secured a 3 trillion won nuclear power plant construction project in Egypt for the first time in 13 years. The goal is to export 10 nuclear reactors by 2030.

According to the status of nuclear power plants in major Middle Eastern countries as of June 2022, announced by the Overseas Construction Association on the 12th, besides the 3 trillion won El Dabaa NPP (Units 1-4) in Egypt contracted by Korea Hydro & Nuclear Power (KHNP), Saudi Arabia is pushing forward a project worth 12 trillion won. In May last year, Saudi Arabia sent a request for bids to four countries including Korea, France, China, and Russia, expressing its intention to build nuclear power plants. Iraq announced plans to build eight nuclear reactors in 2021, with a project cost of 4 trillion won.

The government is focusing on the Middle Eastern market by forming "Team Korea," which includes Korea Electric Power Corporation (KEPCO), KHNP, financial institutions, and private companies. A Ministry of Land, Infrastructure and Transport official said, "Nuclear power plant orders are generally rare, but we expect the Middle Eastern nuclear market to grow due to the influx of oil money," adding, "The public and private sectors are moving comprehensively to restore the nuclear ecosystem and regain export competitiveness." According to the U.S. Energy Information Administration (EIA), the nuclear power capacity in the Middle East is expected to surge to 41 billion kWh by 2025, six times the current level, and to 58 billion kWh by 2030, ten times the current level.

Nuclear power is one of the markets with high entry barriers. It takes a long time to plan construction considering site conditions, and few countries have the technology and infrastructure required. On the other hand, the global nuclear power market is expected to open up with 600 reactors and at least 3,000 trillion won in scale by 2050. The role of nuclear power has become important again during the transition to renewable energy, and the investment environment is improving as the European Union (EU) Commission conditionally included nuclear power in the green taxonomy last July.

The British magazine The Economist included Korea among the top five nuclear power exporting countries alongside Russia, China, France, and the United States. Although there was a period of "nuclear phase-out" during the Moon Jae-in administration, Korea's competitiveness remains strong. However, experts point out that fundamental "structural reform" is necessary to become a nuclear power leader. Considering the characteristics of recent new nuclear power plant orders, large-scale financing and collaboration with companies possessing core technologies are also required.

Lee Jong-ho, senior researcher at the Nuclear Future Technology Policy Research Institute at Seoul National University, emphasized in the "Nuclear Export Market Outlook and Export Promotion System Enhancement Report," "While respecting the division of tasks among institutions (KEPCO, KHNP), the nuclear export system should be reorganized so that governance and decision-making are carried out in a unified manner," adding, "Measures to specialize the oversized operating organizations should also be considered to enhance competitiveness in each field."

Meanwhile, President Yoon Suk-yeol will make a state visit to the UAE from the 14th to the 17th. This is the first state visit since diplomatic relations were established in 1980. During this tour, which focuses on four core areas: nuclear power, energy, investment, and defense, President Yoon will visit the Barakah Nuclear Power Plant, Korea's first exported nuclear power plant and the Middle East's first. This visit is interpreted as a move to continue achievements in the Middle East, a region with great potential, after securing nuclear power plant construction projects in Poland and the Czech Republic worth 40 trillion won and 8 trillion won, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.