New Themes Emerge During Presidential and General Elections, New Government Launch

Overheated Thematic Stocks Like Middle East Development, Drones, and Robots in the New Year

Investors Should Be Cautious Due to Large Price Fluctuations and Potential Losses

[Asia Economy Reporter Park Hyung-su] There is a stock market adage that says, "The higher the mountain, the deeper the valley." It means investors should be cautious of stocks that suddenly surge. In particular, theme stocks without real substance have often shown sharp fluctuations. Political theme stocks related to candidates surged during every presidential election. When a new government was inaugurated, theme stocks related to major policies also appeared. Moreover, new theme stocks emerged every year, tempting individual investors. Although regulatory authorities have urged caution in investing in theme stocks and established various systems to prevent overheating of stock prices, damage caused by sharp price fluctuations has not decreased.

This year, theme stocks have been rampant since the beginning of the year. Middle East development-related stocks, which fluctuated due to the 'NEOM City Project' issue promoted by Saudi Arabia in the second half of last year, gained momentum again with investment news from the United Arab Emirates (UAE). The stock price of Woojin INS surged more than 50% compared to the end of last year, and companies like Heerim and Kumho Construction also recorded excess returns compared to the market. Since North Korea's unmanned drone infiltrated Seoul's airspace at the end of last year, drone-related stocks such as Hancom With and JCHyun System have also been among the notable themes in the market. After Samsung Electronics invested in the robot company Rainbow Robotics, robot-themed stocks like Tirayutek, Hurim Robot, Yuil Robotics, and Neuromeka have attracted attention.

Experts advise that amid a sluggish stock market, capital inflows often concentrate on specific themes and then quickly exit, warning that investors aiming for high short-term returns may suffer significant losses. Reviewing past theme stock price trends also shows that it was not a highly successful investment strategy.

The Emergence of the 'Great Wall Quartet' in 1987

The history of theme stocks is long. Ahead of the 1988 Seoul Olympics, the government focused on northern diplomacy. During a period of growing expectations for improved relations with China, the so-called 'Great Wall' theme emerged. Rumors spread that the Chinese government decided to install windbreaks on the Great Wall and that all aluminum windows would be supplied by Daehan Aluminum, causing its stock to surge. Subsequently, rumors that rubber shoes would be supplied to workers involved in the construction boosted Taehwa's stock price. Even baseless rumors that domestic companies would supply snacks and digestive medicine to the workers caused stock price reactions in companies like Samlip Food (now SPC Samlip) and Handok Pharmaceutical (now Handok). Daehan Aluminum and Taehwa were delisted from the stock market in March 2001 and May 1999, respectively.

Since then, various themes have appeared, and political theme stocks surged strongly ahead of presidential and general elections. Presidential election theme stocks refer to stocks whose prices fluctuate sharply because the company's management or controlling shareholders are believed to be related to a leading presidential candidate through academic, regional, or blood ties.

Political Theme Stocks Emerging Every Presidential Election

Ahead of the 17th presidential election on December 2007, the Four Major Rivers theme misled individual investors in the domestic stock market. The stock price of Ewha Construction surged 26 times in just four months from August to December 2007. Adjusted for stock splits, the price rose from around 1,000 won to over 25,000 won. During the same period, Special Construction's stock price also rose more than sixfold. After Lee Myung-bak, the Grand National Party candidate who promised the Four Major Rivers project, was elected president, theme stocks plummeted. Ewha Construction's stock price fell 76% from immediately after the election to the end of that month. Special Construction's stock price, which had a relatively smaller increase, dropped 64% from its peak.

During former President Lee Myung-bak's tenure, Ewha Construction's sales remained around 70 billion won. Operating profit was also limited to between 400 million and 800 million won. Although the government pushed forward the Four Major Rivers maintenance project, Ewha Construction's performance did not fluctuate significantly. By the end of 2012, the fourth year of Lee's presidency, the stock price had fallen back to pre-theme levels.

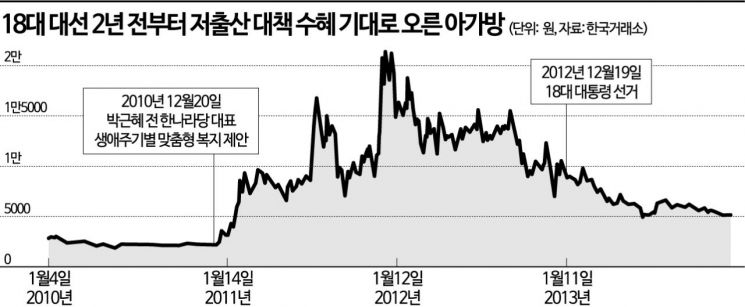

Political theme stocks also appeared without fail ahead of the 18th and 19th presidential elections. Agabang's stock price rose tenfold over one year amid expectations for solving the low birthrate issue, one of former President Park Geun-hye's pledges. The stock price, which hovered around 2,100 won at the end of 2010, exceeded 22,000 won in January 2012. After reaching an all-time high, the stock price fell 82% over three years.

Before the 19th election, stocks related to Moon Jae-in, the Democratic Party candidate, attracted attention more than policy-related ones. Stocks of companies with academic or regional ties surged. The women's clothing brand company Daehyun saw its stock price surge due to an unrelated photo. A photo circulated showing one of the company's executives hiking with former President Moon Jae-in, leading to Daehyun being classified as a political theme stock. The stock price tripled within a month but plunged after it was revealed that the person in the photo was not an executive of Daehyun. Daehyun's stock price volatility is cited as a representative case of 'blind investment' in political theme stocks.

Nam Gil-nam, Senior Research Fellow at the Korea Capital Market Institute, explained, "The phenomenon of political theme stocks unrelated to corporate value and fundamentals commonly showed a tendency for stock prices to decline as the election day approached, based on past presidential election cases."

Ahead of last year's 20th presidential election, more than 80 stocks related to the two candidates with the highest poll ratings appeared. The majority of these had vague relationships unrelated to the companies' businesses, such as mutual acquaintances between presidential candidates and corporate executives (44%), private connections with executives (18%), and academic ties (16%).

Although theme stock prices invariably surged sharply in the short term and then returned to their original levels, individual investors have not easily escaped the temptation to trade theme stocks. This is because magical occurrences where the principal investment multiplies within one to two months through political theme stock investments have happened right before their eyes. Investors who have experienced 'short-term surges' often justify their investments with the phrase 'high risk, high return.' Last year, the KOSPI and KOSDAQ indices fell by 25% and 34%, respectively. As the sentiment that 'even traditional blue-chip investments can incur losses' spread, interest in theme stocks remained strong.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.