SK On-Ford Joint Venture Targeting Turkey Factory

May Switch to LG Energy Solution

Multiple Variables Including Funding and Factory Yield

Complex Calculations in Mobility Industry This Year

[Asia Economy Reporter Jeong Dong-hoon] Signs of a seismic shift in the battery industry are emerging at the start of the new year. Although not confirmed, there are talks that Ford Motor Company in the United States might replace SK On with LG Energy Solution as its partner for building a factory in T?rkiye. Companies are investing tens of trillions of won each in constructing battery plants worldwide. Due to factors such as capital and risk diversification, mergers and alliances among battery and automaker companies are taking place.

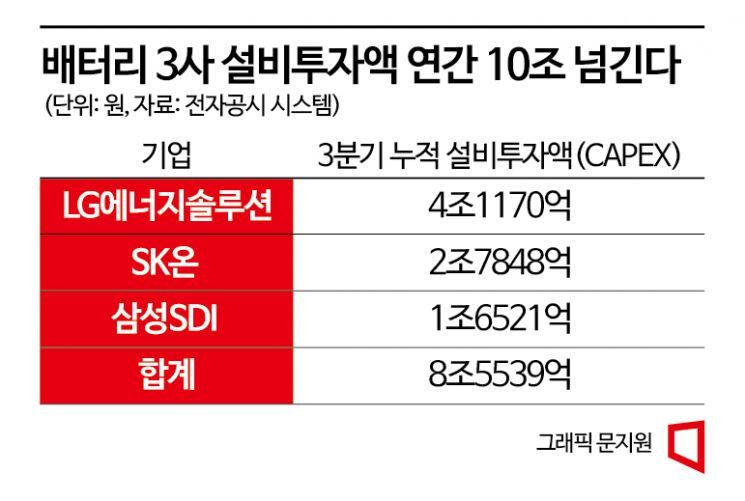

As of the third quarter of last year, the capital expenditures (CAPEX) executed by domestic battery cell manufacturers were 4.117 trillion won for LG Energy Solution, 2.7848 trillion won for SK On, and 1.6521 trillion won for Samsung SDI, totaling 8.5539 trillion won. Including fourth-quarter investments, the total is expected to exceed 10 trillion won significantly.

Even a single factory requires investments in the trillions of won. Although investments are made through joint ventures, all three battery companies are facing difficulties in raising funds. Continuously mobilizing such enormous capital in a high-interest-rate environment is challenging even for global conglomerates.

◆SK On’s Drying Cash Flow= The situation for SK On, which is pursuing aggressive investments, is not easy. The joint factory project with Ford in T?rkiye is reportedly at risk of collapse due to financial issues. As of the third quarter of last year, SK On’s operating cash flow was negative 1.4523 trillion won. Adding future capital expenditures, the free cash flow stands at negative 4.2371 trillion won. This means that while the cash generated from operations is in deficit, nearly 3 trillion won has been reinvested aggressively in building and expanding factories.

SK On has committed to investments totaling 23 trillion won, with 9.2614 trillion won already spent. The remaining amount is approximately 13 to 14 trillion won. Although funds are raised through joint ventures and other means, SK On still needs to invest an additional 6 to 7 trillion won on its own. Especially as new factories must be built to keep pace with the growth of the electric vehicle market, investment amounts could increase further.

Moreover, with SK Hynix, which has served as the 'cash cow' for the SK Group, experiencing a decline in performance, there is a strong possibility that group-wide investments may freeze. If the group’s flagship company falters, domestic and international investors may hesitate to invest in other SK affiliates. According to financial information provider FnGuide, SK Hynix’s operating loss for the fourth quarter of last year is expected to be 806.1 billion won. Securities firms such as Kiwoom Securities anticipate that the first-quarter loss this year will exceed 2 trillion won.

LG Energy Solution raised about 10 trillion won through an IPO early last year and holds cash equivalents of 6 trillion won as of the third quarter. Samsung SDI, with solid performance and relatively conservative new investments, maintains the best financial soundness among the three battery companies.

Professor Park Cheol-wan of the Department of Automotive Engineering at Seojeong University said, "(Although the change in the joint factory is not confirmed) from SK On’s perspective, there is no reason to push the T?rkiye factory recklessly amid tightening capital markets." He explained, "Demand for electric vehicles this year may not rise as expected due to the global economic slowdown, so the strategy could shift to 'strengthening fundamentals.'"

Visitors are viewing SK On's SF battery, which won the 'Best Innovation Award' at CES 2023, held in Las Vegas, USA, on the 5th (local time). Photo by SK On

Visitors are viewing SK On's SF battery, which won the 'Best Innovation Award' at CES 2023, held in Las Vegas, USA, on the 5th (local time). Photo by SK On

◆Factory Normalization and Value Chain Diversification= Variables inside and outside companies remain. Trial and error in process efficiency is the biggest issue in the battery industry. SK On, which entered the electric vehicle battery market somewhat later than other companies, is likely to experience such trial and error later as well. In particular, while LG Energy Solution built overseas electric vehicle battery plants in 2012 and Samsung SDI in 2015, SK On’s plants were constructed later in 2019. It usually takes 2 to 3 years to raise the yield rate (good product rate) to the breakeven point of over 90% in large-scale gigawatt-hour (GWh) production processes.

Professor Kim Pil-su of the Department of Automotive Engineering at Daelim University said, "Batteries are devices containing high-density energy and pose fire risks not only after being installed in electric vehicles but also during factory operations." He added, "Trial and error during factory construction and normalization is inevitable."

Ford’s 'T?rkiye change of heart' can also be explained by value chain diversification. Ford is building three factories in Kentucky and Tennessee in the United States with SK On, totaling 129 GWh by 2025. The investment alone exceeds 10 trillion won. Ford reportedly wants to choose a different battery company for the T?rkiye factory, which will produce batteries for European electric vehicles, to diversify risks such as battery defects and accidents.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)