Unexpectedly, over 8% decline since January

Economic recession, surge in COVID-19 cases in China, and warm weather impact

[Asia Economy Reporter Minji Lee] As oil prices continue to fall sharply, expectations that they would rise in the first half of the year due to positive factors from China are proving to be misplaced. Above all, fears of a global economic recession are heavily weighing down oil prices. Investors who had bet on a change in oil price direction following China's easing of COVID-19 restrictions now appear to be betting on a decline.

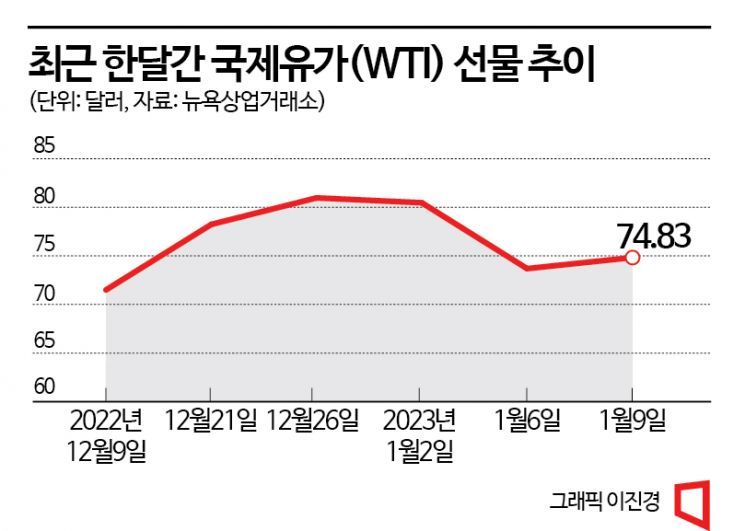

According to the New York Mercantile Exchange on the 9th (local time), the February West Texas Intermediate (WTI) price pointed to $74.83, down about 8% since the beginning of this month. When China, the world's second-largest oil consumer and largest importer, began to ease its COVID-19 restrictions in early December last year, WTI rose more than 10% from the $70 range to the $80 range, but it did not rise further. At that time, experts also expected that China's easing of COVID-19 restrictions would lead to economic revitalization policies and thus expand crude oil demand, but the forecast was clearly off the mark.

The number of COVID-19 infections in China increased faster than expected, weakening the outlook for demand expansion. Although the war between Russia and Ukraine continues and the European Union's (EU) price cap on Russian crude oil has increased supply uncertainties, concerns about demand contraction were greater. Hwan-Yeol Lim, a researcher at Shinhan Investment Corp., analyzed, "With the rapid spread of COVID-19 in China and the U.S. ISM Manufacturing Purchasing Managers' Index (PMI) continuing its slowdown (below the baseline of 50 for two consecutive months), concerns about an economic recession have increased."

Warmer-than-expected winter weather is also a factor in the oil price decline. When natural gas prices surged due to concerns about a colder-than-usual winter, oil was seen as an alternative demand source, but demand decreased as the weather turned out to be warmer than expected. The release of the U.S. Federal Open Market Committee (FOMC) minutes in December also dampened expectations for interest rate cuts, impacting oil prices. Recently, the dollar index has sharply declined to just above 100, but the U.S. Federal Reserve (Fed) has shown strong determination to raise interest rates, meaning the dollar's direction could change abruptly at any time. Since oil is traded in dollars, a sharp rise in the dollar's value causes oil prices to fall.

Experts say that considering the COVID-19 spread in China and the economic recession phase, oil prices may continue to decline in the short term. Investors also appear to be betting on falling oil prices. Among the top 10 individual Exchange-Traded Notes (ETNs) net purchases over the past 10 trading days are Samsung Inverse 2X WTI Crude Oil Futures ETN (3 billion KRW) and Shinhan Inverse 2X WTI Crude Oil Futures ETN (1.1 billion KRW).

In the long term, oil prices may rebound if China's crude oil demand increases after the second quarter, but some view it as difficult to sustain a trend of rising prices. Jaeyoung Oh, a researcher at KB Securities, explained, "In 2008 and 2009, after crude oil prices hit a bottom, rallies occurred due to China's growth and global demand expansion, but this time crude oil demand will not be as large as before," adding, "Both global economic growth rates and crude oil consumption relative to global GDP are on a long-term downward trend." He also added, "The spread of electric vehicles and the expansion of renewable energy shares are also factors contributing to the decline in international oil prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.