Increase in Consumer Benefits is Short-Term

After Market Domination, Entry Barriers Rise... Monopoly Damage Increases

US, UK Impose Financial Institution-Level Sanctions... Innovation Focused on Fintech

[Asia Economy Reporter Minwoo Lee] An analysis has emerged suggesting that if 'big tech' companies like Naver and Kakao accelerate their entry into various financial sectors such as deposit and loan brokerage and insurance, the benefits to consumers will be limited, while the harm caused by market dominance could be greater. It is argued that, like major advanced financial countries such as the United States and the United Kingdom, regulations should be promptly revised and innovation should be driven mainly by fintech companies and existing financial institutions.

On the 8th, Jun-san Kim, a research fellow at KB Financial Management Research Institute, pointed this out in a report titled 'The Reality of Korea's Financial Product Brokerage System Compared to Overseas Countries like the UK.'

Big Tech's Entry into Finance: Limited Increase in Consumer Benefits

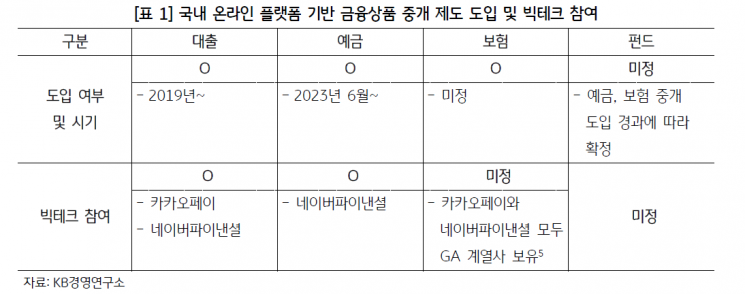

First, he noted that while big tech can easily dominate the financial product brokerage market, the resulting increase in consumer benefits is limited. He explained, "In Korea, only two companies classified as big tech?Kakao and Naver?are both participating in financial product brokerage, and the Financial Services Commission is pushing to expand the range of brokerage products from loans to deposits and insurance. Big tech companies possess far superior financial resources compared to other fintech firms and have platforms more powerful than financial companies, enabling them to quickly dominate the market."

The report criticized that such market dominance does not directly translate into benefits. Rather, it is expected to cause side effects such as reduced competition and increased consumer harm.

It expressed concern that the effect of increased consumer benefits, which financial authorities hope for through competition and innovation stimulated by big tech's market participation, is likely to be short-lived. Kim said, "Just as Meta, Facebook's parent company, acquired WhatsApp and Instagram, many cases domestically and internationally show that big tech suppresses competitors' market entry after dominating the market, enjoys monopolistic status, and monopolizes profits within the market. When competition declines due to monopoly, innovation will eventually slow down compared to before big tech's participation in financial product brokerage, causing the market to regress and consumer welfare to decrease."

He added that once big tech secures a monopolistic position, it changes various service policies to maximize profits. Kim predicted, "Big tech restructures the value chain and cost structure of products within each industry to align with profits, infringing on consumer benefits and choices. If they dominate the online financial product brokerage market, there is a very high possibility that brokerage fees will increase, and financial product sellers dependent on big tech will be unable to refuse, ultimately passing some costs onto consumers."

Sandbox Is a Temporary Fix... Need for Specialized Financial Regulation

The report analyzes that the first step in establishing a regulatory system to allow online financial product brokerage was flawed. It mainly cited the UK and the US as examples. While the UK and the US allow online platform financial product brokerage under financial industry laws, Korea temporarily eased regulations through a 'sandbox' system.

In fact, in the UK, to broker online financial products, registration with the Financial Conduct Authority (FCA) is required under the Financial Services and Markets Act (FSMA). The sandbox system is not aimed at big tech but is used more as a framework to support small companies unfamiliar with financial regulations, such as fintech startups, focusing first on developing new services and then providing them while complying with existing regulations.

Kim explained, "Most companies applying for the sandbox in the UK are startups. After application, an FCA officer is assigned who informs them in detail about which regulations apply to their service and the necessary requirements." Similarly, in the US, online platforms conduct financial product brokerage businesses under existing state laws.

Only Korea Is Big Tech-Centric... Need to Shift Focus to Fintech and Existing Financial Firms

The report views Korea as having a unique situation where big tech has deeply penetrated online financial product brokerage. According to the report, the UK's four major online financial product brokerage platforms?'MoneySuperMarket,' 'GoCompare,' 'Confused.com,' and 'CompareTheMarket'?and the US's major financial product brokerage platforms?'NerdWallet,' 'Bankrate,' 'Credit Karma,' and 'LendingTree'?are all fintech companies or subsidiaries of financial firms.

In contrast, in Korea, both Kakao and Naver, considered the only big tech companies, participate in online financial product brokerage. Kim explained, "Domestic online loan brokerage is mostly dominated by big tech Kakao Pay and fintech companies Toss and Finda, with Kakao Pay's market share at 41.1% (by number of cases) as of 2021. Naver Financial also provides online loan brokerage services and plans to launch deposit brokerage services this year."

He emphasized that since overseas countries are focusing on the risks of big tech entering the financial industry and establishing regulatory systems, similar efforts are urgently needed domestically. The UK's FCA publicly released a report in October last year titled 'The Impact of Big Tech's Entry and Expansion into Retail Financial Services on Competition,' which analyzed in detail big tech's impact on the financial industry in payment, deposit, loan, and insurance sectors.

Kim stressed, "In cases where the risks from big tech's participation in financial business are clear, as in online financial product brokerage, financial authorities should delay granting business licenses to big tech through sandbox designation and instead approve businesses centered on fintech and financial companies that can enhance consumer welfare. Big tech should only be allowed to operate after related laws such as the Financial Industry Act are amended to sufficiently control risks, thereby preventing consumer harm in advance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)