Owner's Investment Commitment... Building Battery-Display-Packaging Models Beyond Simple Orders

[Asia Economy Reporter Moon Chaeseok] Samsung and LG are beginning to reap the fruits of their long-term investments in the automotive electronics (auto electronics) business. The two companies stood out at CES 2023, the world's largest electronics and IT exhibition. Both companies also have related businesses such as batteries and driver assistance systems, enabling vertical integration in the automotive electronics sector.

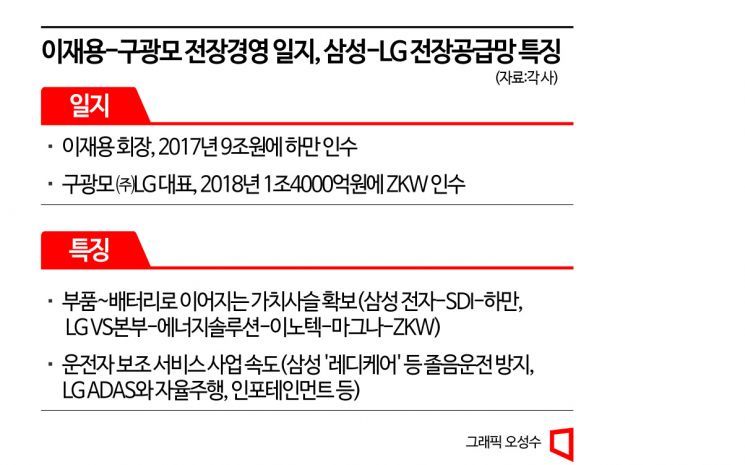

The automotive electronics business has been a passion project since Lee Jae-yong, Vice Chairman of Samsung Electronics, and Koo Kwang-mo, CEO of LG Corporation, began leading their companies.

In 2017, Vice Chairman Lee acquired the U.S. automotive electronics company Harman for 9 trillion won. CEO Koo purchased the Austrian automotive headlamp manufacturer ZKW for 1.4 trillion won in May 2018, just two months after the passing of former Chairman Koo Bon-moo.

LG Electronics' VS (Vehicle Components) Business Division announced on the 4th, a day before CES 2023 opened, that it had started autonomous driving collaboration with Magna and e-Powertrain. The VS division is at the center of the group's entire automotive electronics business value chain. After winding down the struggling mobile phone business, it was the first business CEO Koo focused on growing. At CES, Samsung Electronics drew a reaction from Oliver Zipse, CEO and Chairman of German automaker BMW, with the driver assistance device "Ready Care," prompting curiosity about whether it is a practically implementable service.

Looking at the business structures of the two groups explains why the industry is paying attention to the future of the automotive electronics business. Both own world-leading battery companies: Samsung SDI and LG Energy Solution. This structure is well-suited for collaboration with global automakers. LG's portfolio is particularly impressive, collaborating with U.S. General Motors (GM), the Italy-U.S.-France joint venture Stellantis, and Japan's Honda. SDI's premium brand Gen5 and LG Energy Solution's NCMA (Nickel Cobalt Manganese Aluminum) batteries are already dominant players in the battery cell supply chain.

Both companies are conducting research on next-generation solid-state batteries aiming for commercialization around 2026-2027. This indicates they are leading in research and development (R&D). There are also many favorable factors such as the U.S. Inflation Reduction Act (IRA), which aims to counter China, and the Korean government's increase in tax credit rates.

Samsung and LG are also preparing for the autonomous driving era by already developing driver assistance service solutions. South Korea's largest automakers, Hyundai Motor and Kia, plan to release Level 3 vehicles capable of autonomous highway driving within this year. They will then proceed with commercializing Level 4 robo-taxis for general roads in North America.

Samsung showcased drowsiness prevention solutions like Ready Care at CES 2023 through its subsidiary Harman, acquired in 2017. Samsung is accelerating the commercialization of automotive electronics by discussing Ready Care supply with automakers. Samsung Display's invitation to smartphone manufacturers during CES 2023 to unveil the vehicle display "New Digital Cockpit (driver's seat)" is also considered significant.

LG has long established a diverse portfolio including ADAS (Advanced Driver Assistance Systems), infotainment telematics, and LiDAR (Light Detection and Ranging, a technology that scans the vehicle's surroundings with 360-degree sensing) modules. LG Innotek even exhibited Level 5 automotive electronics components at CES 2023. Although commercialization is expected to take time, LG is regarded as leading in preparation speed. Vice President Eun Seok-hyun said, "We will provide differentiated customer experiences not only to global automaker clients but also to drivers and passengers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)