"High Performance → Low Power Future Semiconductor Competition Shift"

Samsung DDR5·SK SSD Visible Achievements

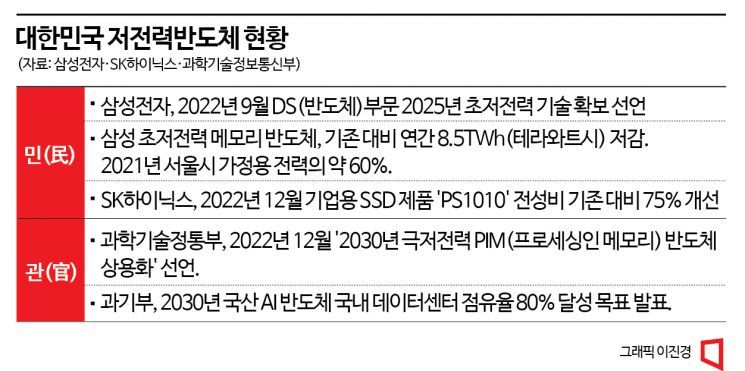

Government "Commercialization of PIM Semiconductors by 2030"

[Asia Economy Reporter Moon Chaeseok]

"Replacing the world's data center HDDs (hard disk drives) with data-dedicated SSDs (solid-state drives) that consume about half the power, and upgrading server DRAMs to next-generation DDR (double data rate) 5, can reduce power consumption."

Samsung Electronics' core achievement in building an 'energy-efficient semiconductor' ecosystem, declared in its 'New Environmental Management Strategy' last September, is gradually becoming visible. SK Hynix has also recently announced groundbreaking power reduction results in its enterprise SSD products, signaling fierce competition in the related market.

According to the semiconductor industry on the 5th, the competition to secure technology called ultra-low power or extremely low power is intense. Despite the market downturn caused by falling DRAM and NAND flash prices, often referred to as a 'harsh winter' or 'ice age,' the industry is focusing on energy-efficient semiconductors as a 'game changer' that can transform the situation.

Samsung Electronics has declared at the DS division level that it will have ultra-low power semiconductor technology by 2025. It is already accelerating technology development, such as reducing the power consumption of mobile DRAM LPDDR (low power double data rate) 5X by 20%. The industry estimates that applying ultra-low power semiconductor technology can reduce the annual power consumption of memory in global data centers by 8.5 TWh (terawatt-hours), equivalent to about 60% of Seoul's household electricity consumption last year, enough to power approximately 2.4 million households.

SK Hynix also announced on the 27th of last month that it improved the power efficiency of its enterprise SSD 'PS1010' by 75% compared to before. Power efficiency is an indicator that calculates the amount of data processed per second per unit of power, serving as a standard to gauge SSD power reduction levels.

SK Hynix's new enterprise SSD (Solid State Drive) 'PS1010' improves power efficiency by 75% compared to existing products. (Photo by SK Hynix)

SK Hynix's new enterprise SSD (Solid State Drive) 'PS1010' improves power efficiency by 75% compared to existing products. (Photo by SK Hynix)

The semiconductor industry recognizes securing power to support the rapidly increasing data demand in the digital transformation (DX) era as an urgent issue. According to market research firm IDC, the global data volume, which was only 33 ZB (zettabytes, 1,000 trillion bytes) in 2018, is expected to increase by about 60% annually to reach 175 ZB by 2025. Additionally, compared to foundries (semiconductor contract manufacturing) that are subject to numerous variables through collaborations with external companies like Apple, the risk is considered lower. It is even said that Samsung and SK are the only players who can become global semiconductor game changers.

It is also a way to contribute to carbon reduction from the ESG (environmental, social, and governance) management perspective. There is also a cost reduction effect, as product efficiency is improved to deliver the same performance with fewer raw materials. An industry insider emphasized, "The low-power trend is a major trend applied evenly across products, including B2B (business-to-business) products like SSDs and B2C (business-to-consumer) products like DDR5. It is a market that cannot be missed."

As much as the industry's determination to develop 'ultra-low power' semiconductors, the government's efforts to commercialize 'extremely low power' products are also urgent. According to academia, ultra-low power and extremely low power both refer to processes that reduce power consumption to one-tenth to one-hundredth of the existing levels. This is necessary to activate the AI semiconductor ecosystem. Among various memory products, the competition to develop 'PIM (processing in memory)' semiconductors, which perform computation as well as storage, is the fiercest, and achieving a 'low-power super-gap' in this area is essential.

The Ministry of Science and ICT declared on the 12th of last month that it aims to catch up with the world's best, the United States, in AI semiconductors by 2030. The plan is to commercialize PIM semiconductors by then and increase the domestic data center share of domestically produced AI semiconductors to 80%. Although there are criticisms that the achievement timeline will be much slower than the government's announced timeline, as was the case with 5G (5th generation mobile communication), the direction is undoubtedly aligned between the public and private sectors, with no disagreements.

Kim Jeong-ho, a professor in the Department of Electrical Engineering at KAIST and an AI semiconductor expert, said, "As AI semiconductors become larger, it is a semiconductor and computer limitation whether the rapidly increasing power consumption can be managed, and there is no clear breakthrough yet. If the current innovation competition in the semiconductor industry focuses on 'hyperscale (high-performance)' semiconductors, in the long term, it will shift to 'low-power' semiconductors, and only by securing a super-gap position in this field can Korean semiconductors survive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.