62% Experienced Supply Chain Difficulties Last Year

40% Are "Considering Relocating Production Bases Due to Supply Chain Risks"

[Asia Economy Reporter Jeong Dong-hoon] Among companies belonging to the Battery, Bio, and Chip industries (hereinafter BBC), 7 out of 10 expect the supply chain situation in the new year to be similar to or worse than last year.

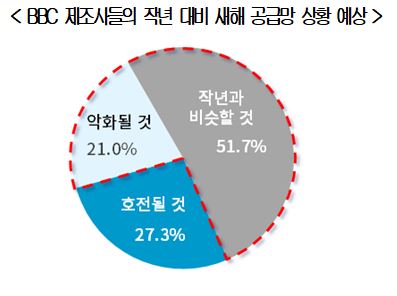

According to the 'BBC Manufacturing Companies' Supply Chain Perception Survey' released by the Korea Chamber of Commerce and Industry on the 4th, more than half of the companies responded that the supply chain situation in the new year compared to last year would be 'similar to last year' (51.7%). Companies that expected an 'improvement' accounted for 27.3%, while those who answered 'worsening' accounted for 21%.

By industry, the proportion of companies expecting an improvement in the supply chain situation was lowest in the order of 'Pharmaceutical Bio' ('Similar' 60.2%, 'Worsening' 20.5%, 'Improvement' 19.3%), 'Secondary Battery' ('Similar' 56%, 'Worsening' 17.9%, 'Improvement' 26.1%), and 'Semiconductor' ('Similar' 43%, 'Worsening' 23.4%, 'Improvement' 33.6%).

The Korea Chamber of Commerce and Industry analyzed, "Thanks to positive factors such as China's relaxation of the zero-COVID policy and the transition to endemic, the proportion of companies expecting an improvement in the supply chain situation is higher than those expecting deterioration," but added, "Including responses that the situation will be similar to last year, when supply chain damage was severe, it is appropriate to see that the entire BBC industry is concerned about supply chain uncertainty."

In fact, when asked whether they had experienced damage due to last year's supply chain crisis and difficulties, 6 out of 10 companies (62.3%) answered "Yes."

Specifically, damage was confirmed in areas such as 'Inventory management difficulties due to supply chain uncertainty' (3.8 out of 5 points, with higher scores indicating greater damage), 'Production difficulties due to raw material procurement disruptions' (3.5 points), and 'Sales and export difficulties due to logistics disruptions' (3.4 points).

Top Supply Chain Threat: Russia-Ukraine War... 4 out of 10 BBC Companies Considering Relocating Production Bases

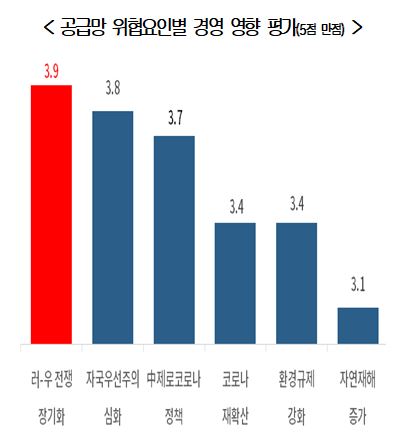

The biggest supply chain threat that BBC companies worry about in the new year is the 'prolongation of the Russia-Ukraine war.'

According to the evaluation of the 'degree of impact by supply chain threat factors' by BBC companies, the 'prolongation of the Russia-Ukraine war' received the highest score (3.9 out of 5 points, with higher scores indicating greater threat), followed by 'intensification of US-China hegemonic competition and nationalism' (3.8 points), and 'China's zero-COVID policy' (3.7 points).

In fact, due to the impact of the Russia-Ukraine war last year, the price of natural gases such as neon gas used in semiconductor production soared more than 20 times, causing disruptions in semiconductor production.

Amid the normalized supply chain instability, BBC companies are struggling to prepare countermeasures. About half of the responding companies (48.3%) answered that they are 'already responding or preparing countermeasures,' and 39% said they are 'not currently responding but plan to prepare countermeasures.' Only 12.7% answered that they have 'no plans to respond.'

The top priority countermeasures being implemented or planned are 'diversification of procurement and sales channels' (43.9%), 'strengthening technology and competitiveness' (23.2%), 'expanding product portfolio' (10.3%), and 'expanding localization strategies within the supply chain' (8.4%).

However, when asked whether they have experience or are considering relocating production bases or entering overseas markets as part of a localization strategy to resolve supply chain difficulties, 4 out of 10 companies (39.7%) answered 'have considered or are considering.' By industry, the response rates were highest in 'Secondary Battery' (45.2%), 'Semiconductor' (42.2%), and 'Pharmaceutical Bio' (30.7%).

As government policy tasks to resolve supply chain instability, companies cited 'support for discovering business partners' (35.3%), 'establishment of a supply chain cooperation ecosystem between large and small-medium enterprises' (16.3%), and 'expansion of subsidies and tax credits' (14.7%) in order. <'Support for R&D technology development' (11.7%), 'strengthening diplomatic policies' (11.3%), 'support for overseas production facilities and M&A' (8.3%), 'support for workforce supply and demand' (2.3%)>

63% of BBC Companies Plan to Reduce Investment Compared to Last Year; "Urgent Need for Parliamentary Efforts to Expand Investment Tax Credits"

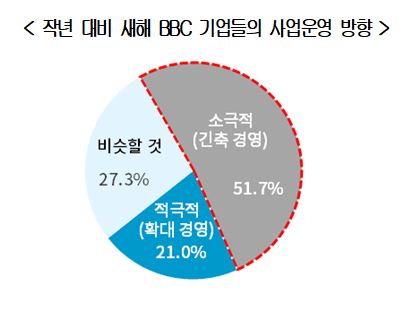

Meanwhile, the management activities of BBC companies in the new year are expected to be somewhat restrained compared to last year.

Regarding the business operation direction for the new year compared to last year, more than half of the companies (51.7%) answered that they plan 'conservative and tight management.' Responses indicating 'similar to last year' accounted for 27.3%, and 'active expansion management' accounted for 21%.

Regarding investment plans in the BBC sector, the proportion of responses saying 'will reduce compared to last year' (62.7%) greatly exceeded those saying 'will increase' (37.3%). By industry, the proportion of responses indicating investment reduction was highest in 'Semiconductor' (68.8%), followed by 'Pharmaceutical Bio' (67%), and 'Secondary Battery' (48.8%).

Regarding export outlook, the proportion of companies expecting a 'decrease compared to last year' (57.3%) was higher than those expecting an 'increase' (42.7%). Regarding hiring scale, the largest group answered 'similar to last year' (43%), while opinions favoring 'reduction' (41.3%) outnumbered those favoring 'expansion' (15.7%).

Kim Moon-tae, head of the Industrial Policy Team at the Korea Chamber of Commerce and Industry, said, "The fragmentation of supply chains will continue in the new year, and companies' efforts to overcome this, such as diversifying procurement sources, developing next-generation technologies, and relocating production bases, will also evolve. In this process, there will inevitably be investment burdens that advanced industry companies must bear, so it is essential that the National Assembly makes legislative efforts to implement government measures to expand investment tax credits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.