[Asia Economy Sejong=Reporter Kim Hyewon] From this year, it will be more convenient for over 180,000 people annually to claim lottery winnings, including 150,000 third-prize Lotto winners and 28,000 third- and fourth-prize Pension Lottery winners. This is due to the government's revision of the Income Tax Act, raising the tax-exemption threshold for lottery winnings from 50,000 won to 2 million won.

According to the Lottery Commission Secretariat of the Ministry of Strategy and Finance on the 3rd, the amendment to the Income Tax Act, which raises the tax-exemption threshold for lottery winnings to 2 million won, has been in effect since the 1st of this month.

Even if the lottery was won last year, tax exemption benefits can be claimed if requested after January 1 of this year.

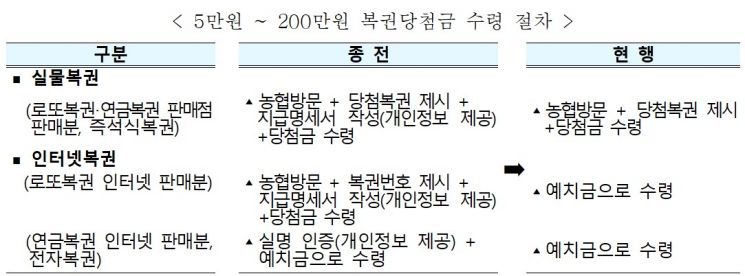

Previously, to claim winnings between 50,000 and 2 million won, personal information such as resident registration numbers had to be provided for taxation purposes (preparation of payment statements). However, from this year, winners can visit the bank directly to claim their winnings without such complicated procedures. It is expected that more than 180,000 people annually will benefit from this change.

The Ministry of Strategy and Finance stated, "With the convenience of claiming lottery winnings improved, it is expected that unclaimed winnings not collected within one year after winning will decrease starting this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.