Three Major Credit Rating Agencies Downgrade Ratings with Negative Outlook

Adverse Factors Including Interest Rate Uncertainty and Demand Slowdown Concerns

[Asia Economy Reporter Minji Lee] The three major domestic credit rating agencies forecast that companies will face a challenging year ahead. Amid ongoing uncertainties surrounding interest rate hikes, a contraction in consumption is expected to lead to weakened demand, resulting in a bleak business environment. Industries such as construction, securities, and petrochemicals were identified as sectors under significant downward rating pressure due to sluggish demand and concerns over the risk of real estate project financing (PF) defaults, raising worries about financial soundness.

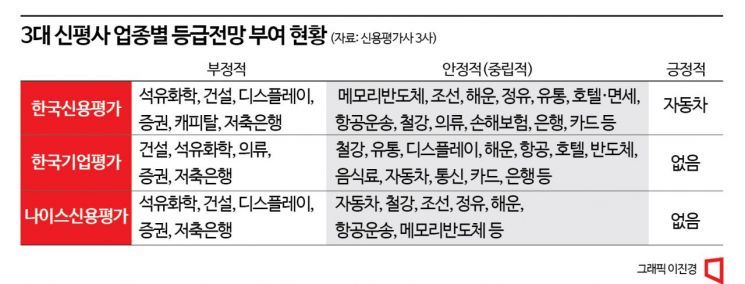

According to the credit rating industry on the 4th, sectors with negative rating outlooks from two or more credit rating agencies included petrochemicals, construction, and displays. Among financial firms, securities and savings banks were named. Korea Ratings assigned negative rating outlooks to petrochemicals, construction, displays, securities, capital, insurance, and savings banks. Korea Investors Service gave negative assessments to petrochemicals, construction, apparel, securities, and savings banks. NICE Investors Service classified petrochemicals, construction, displays, securities, savings banks, and real estate trust businesses as sectors to watch. A negative revision in credit rating outlook indicates a high possibility of a rating downgrade.

The petrochemical sector faces significant concerns due to weak demand. Specifically, Lotte Chemical (AA+), Yeochun NCC (A+), and Hyosung Chemical (A) received negative rating outlooks. Since 2019, the petrochemical industry has been under supply pressure from new and expanded ethylene production mainly in China. Although China’s economic stimulus policies are anticipated, a noticeable improvement in demand is unlikely due to the ongoing economic downturn.

Another worrisome factor is the decline in selling prices despite rising raw material (naphtha) costs. Individual companies are also facing increased investment burdens. Won Jonghyun, Head of Corporate Ratings at Korea Ratings, analyzed, “Lotte Chemical’s financial structure is under strain due to the acquisition contract of Iljin Materials (2.7 trillion KRW) and investments in new businesses such as battery materials. Hyosung Chemical has executed large-scale investments (1.3 billion USD), but unfavorable industry outlooks suggest that heavy financial burdens will persist for a considerable period.”

The display sector is also hindered by weak demand. As consumption of TVs and IT products declines, concerns over the performance of display companies have grown, while financial costs for investments in organic light-emitting diode (OLED) technology are increasing.

The construction industry is expected to struggle to improve performance as the real estate market enters a recession phase. Following the ‘Legoland’ incident last year, the financial market tightened sharply, leading to negative rating outlook revisions for Lotte Construction (A+) and Taeyoung Construction (A), both of which have significant PF contingent liabilities. New projects aggressively secured during the real estate boom have become a liability. Hong Sejin, Senior Researcher at NICE Investors Service’s Corporate Ratings Division, evaluated, “In the second half of last year, Lotte Construction responded to refinancing risks amounting to 7 trillion KRW through a rights offering and borrowings from financial institutions and affiliates, but it will be difficult to ease the debt burden in the short term. Taeyoung Construction’s PF borrowings increased from about 1.8 trillion KRW at the end of 2019 to 3.2 trillion KRW by the third quarter of last year, raising the possibility of realization of PF contingent liabilities.”

Among financial sectors, securities firms’ creditworthiness appears most precarious. With stock trading subdued, retail division performance is expected to decline, while the investment banking (IB) division faces growing concerns over PF defaults due to the real estate market downturn. Financial burdens are increasing mainly among small- and medium-sized securities firms with relatively smaller capital bases compared to large securities companies.

High Possibility of Kia’s Rating Upgrade

In light of this, Korea Ratings downgraded the rating outlooks of SK Securities (A) and Cape Securities (A-) from stable to negative last month. Kim Yein, a researcher at Korea Ratings’ Financial Ratings Division, explained, “SK Securities has a high level of debt guarantee risk composed of mezzanine real estate PF and bridge loans, while Cape Securities, an IB-specialized securities firm engaged in real estate-related underwriting and advisory, maintains operations but suffers from weakened market position and poor operating performance, resulting in inadequate capital adequacy.” Savings banks are also expected to face negative impacts on financial soundness due to decreased loan demand and reduced repayment capacity of borrowers.

In contrast, Kia Motors (AA, positive), a completed vehicle manufacturer, was identified as a company with a high possibility of a rating upgrade. While Korea Investors Service and NICE Investors Service viewed the credit rating direction of most industries and companies neutrally, Korea Ratings assigned a positive outlook to completed vehicle manufacturers. Song Minjun, Head of Corporate Ratings at Korea Ratings, forecasted, “Despite demand slowdown, abundant backorders and increased sales volume due to production normalization are expected. Prices of key raw materials such as aluminum and steel have declined, and a strong US dollar will support selling price strength.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.