Foreigners Account for 70.4% of Total Short Selling Transactions

Individual Investors Strongly Oppose ... Authorities Are Cautious

[Asia Economy Reporter Lee Seon-ae] Last year, the short-selling transaction amount by foreign investors surpassed 100 trillion won, sparking widespread complaints from individual investors. Moreover, with the stock market downturn leaving many individual investors in an unrealized loss position, the long-standing conflict over short selling appears to be reigniting.

Short selling is an investment method where investors borrow stocks expected to decline in price, sell them, and then buy them back at a lower price to repay the loan, thereby making a profit. The financial authorities completely banned short selling in March 2020 when the stock market crashed due to the COVID-19 pandemic. Since May 2021, short selling has been partially allowed only for stocks included in the KOSPI 200 and KOSDAQ 150 indices.

Foreign investors are demanding a full lifting of the short-selling ban. Individual investors, already suffering significant losses from falling stock prices, are opposing this and calling for a complete abolition of short selling. The authorities, mindful of public opinion, are focusing on cracking down on illegal short selling.

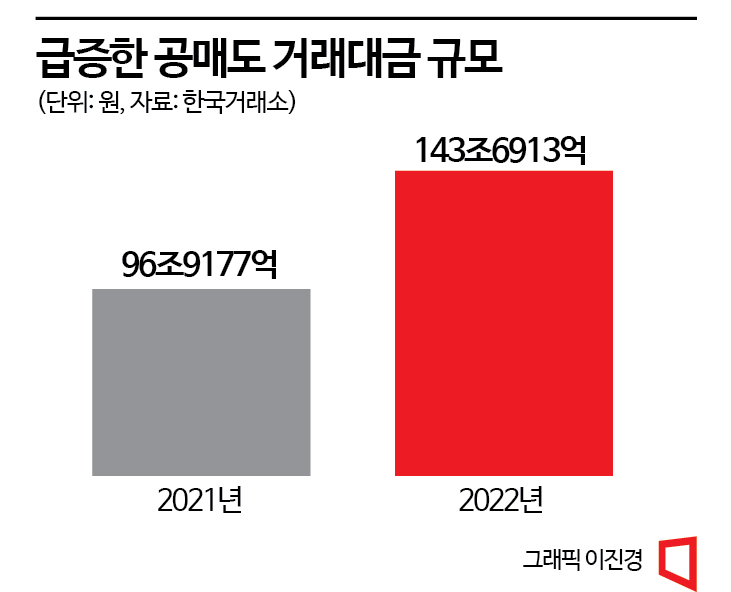

According to the Korea Exchange on the 5th, the cumulative short-selling transaction amount in the domestic stock market last year was 143.6913 trillion won, an increase of 48.2% compared to the previous year (96.9177 trillion won). This was due to the period when short selling was banned for some time, coupled with a rise in investors betting on a market decline amid successive interest rate hikes and fears of an economic recession.

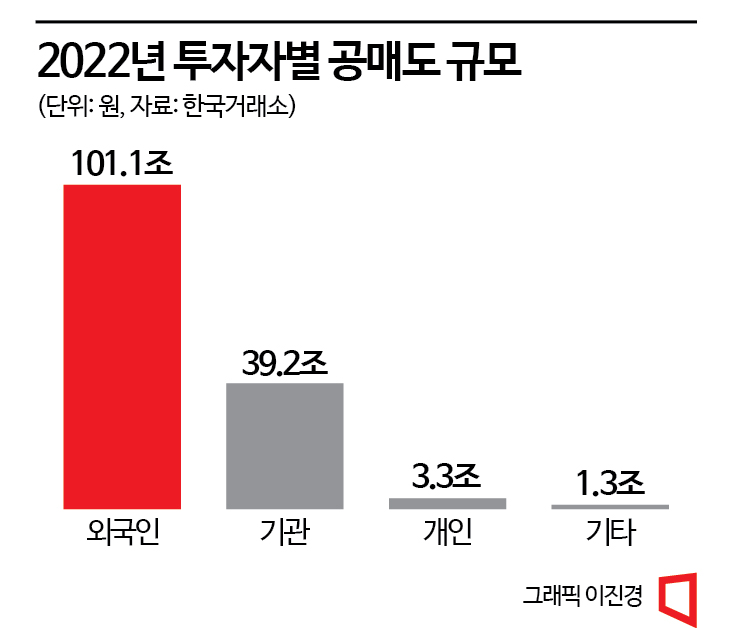

Foreign investors were the main players in short selling last year as well. They accounted for 70.4% (101 trillion won) of the total short-selling transaction amount, followed by institutions at 27% (39 trillion won), and individuals at 2.3% (3.3 trillion won). In 2021, foreign investors’ short-selling transaction amount was 71.4281 trillion won, increasing by 30 trillion won in one year. Given this situation, criticism that the "Korean short-selling market = foreign investors’ playground" is intensifying.

Foreign Investors’ Short-Selling Transaction Amount Increased by 30 Trillion Won in One Year

Since foreign investors dominate short selling overwhelmingly, individual investors’ dissatisfaction is high. For this reason, the full resumption of short selling remains uncertain this year as it was last year. In the first half of last year, the Financial Services Commission stated that it would be problematic for the short-selling system to be banned for more than two years. They emphasized that allowing short selling only for some stocks was 'abnormal' and that full resumption was necessary for 'normalization.'

However, as the stock market wavered, individual investors’ opposition grew stronger, and the politically sensitive public opinion also opposed the resumption of short selling. Meanwhile, some securities firms violated short-selling regulations and were fined, causing discussions on the timing of resumption to disappear. The financial authorities stepped back and focused on preventing unfair trading such as naked short selling (illegal short selling) and began to improve related systems.

Despite this atmosphere, foreign financial companies argue that short selling should be resumed. The Asia Securities Industry & Financial Markets Association (ASIFMA), which counts 160 global investment banks (IBs) and financial companies such as Goldman Sachs and JP Morgan as members, recently released a white paper on the Korean capital market, stating that "to resolve the Korea discount (undervaluation of the Korean stock market) and to be included in the Morgan Stanley Capital International (MSCI) developed market index, full resumption of short selling is necessary." They also warned that overseas fund managers using long-short strategies (simultaneously taking long and short positions on different stocks to hedge risk) would watch the Korean market until full resumption.

Of course, most market experts and financial authorities agree that full resumption of short selling is necessary for the advancement of the capital market. KB Securities researcher Ha In-hwan pointed out, "If the government’s goal is indeed inclusion in the MSCI developed market index, measures such as foreign exchange market-related actions and full resumption of short selling should be considered as representative steps."

Foreign Investors Demand "Full Resumption" vs. Individuals Demand "Abolition"

Individual investors’ opposition remains strong. Nearly 30,000 investors agreed to a petition titled "Temporary Abolition of Short Selling" recently posted on the National Assembly’s public petition board. Especially due to the sluggish stock market, they are calling for a temporary abolition. With the stock market expected to remain sluggish this year, there are concerns that full resumption of short selling could cause significant volatility. The Korea Stock Investors Association, with about 50,000 individual members, argued that due to global interest rate hikes and economic recession impacts increasing market volatility, a temporary ban on short selling is necessary.

The financial authorities are focusing on cracking down on unfair short-selling transactions while improving related systems. Recently, they mandated reporting of loan information for long-term short sellers holding positions for more than 90 days. This aims to strengthen monitoring to detect any illegal activities during the process where institutions and foreigners borrow stocks and maintain short-selling positions for extended periods. They are also considering disclosing the details of sanctions and the names of corporations subject to measures if domestic individuals, corporations, or foreign financial investment firms suspected as major forces behind illegal short selling violate regulations on short selling and related activities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)