Multi-Ministry Platform Development Plan Reveals Numerous Regulations

Concerns Over Side Effects of Core Platform Information Disclosure and Strengthened M&A Review

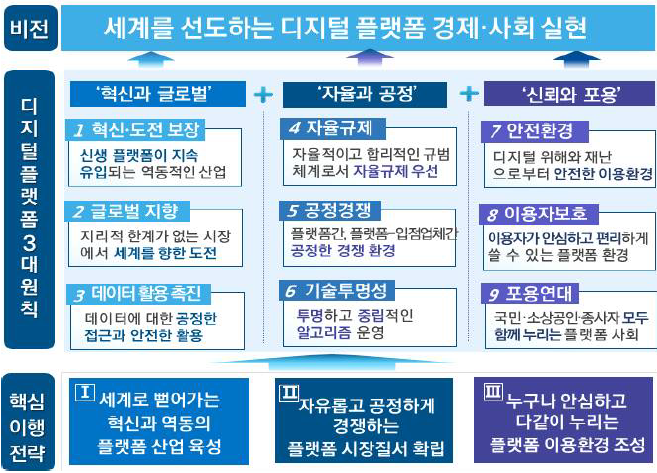

Vision and Promotion Strategy for the Development of Digital Platforms (Source: Ministry of Science and ICT)

Vision and Promotion Strategy for the Development of Digital Platforms (Source: Ministry of Science and ICT)

[Asia Economy Reporter Yuri Choi] Large platform companies such as Naver and Kakao have been sighing since the beginning of the year. This is because the government announced a series of regulations in response to the platforms' monopolistic practices and unfair transactions. In particular, there is strong opposition from the industry as the government is pushing to disclose core platform information to tenant companies.

On the 29th, the Ministry of Science and ICT announced the "Digital Platform Development Plan for Innovation and Fairness." It was prepared jointly with related ministries including the Ministry of Economy and Finance, Ministry of Employment and Labor, Ministry of SMEs and Startups, Fair Trade Commission, Korea Communications Commission, and Personal Information Protection Commission. The plan presented nine key tasks to resolve side effects caused by platforms while fostering healthy corporate growth.

First, to prevent abuse of market dominance by large platforms, a "Monopoly Review Guideline" will be established. This is because the current Fair Trade Act is based on traditional industries and is deemed unsuitable for platforms that cross industries. Additionally, to prevent platforms from expanding their business in a segmented manner, the "Merger and Acquisition (M&A) Review Criteria" will be strengthened.

To create a fair competitive environment, the plan promotes tenant companies' access to data held by platforms. For example, it involves disclosing the criteria that determine the exposure ranking of tenant companies in platform search and recommendation services. The government stated that it will support private organizations to discuss such measures and leave it to self-regulation. Besides this, platform nurturing strategies such as building large-scale artificial intelligence (AI) computing resources and establishing a service-based cloud ecosystem were also introduced.

The industry perceives this as a mere development plan in name only, effectively a regulatory threat. Among the nine key tasks, six are regulations. Moreover, measures to check global big tech companies that threaten the growth of domestic platforms are missing. A representative from a large platform company said, "While saying they want to grow domestic platforms, there is no mention of overseas big tech, and support measures lack budget or methodology," adding, "Although they say it is voluntary, it feels like a government-wide intention to strengthen regulations." Another official expressed dissatisfaction, saying, "In the situation where platform companies cannot speak out due to the Kakao incident, some contents were announced without proper public hearings."

There is particularly strong opposition to the plan allowing tenant companies to access platform data. This is because the criteria for exposing search information are core business secrets of platform companies. If disclosed, there is a possibility of abuse such as gaming the system. Demanding data disclosure on the premise that platforms are engaging in unfair practices may only generate unnecessary conflicts.

The suspicion of Kakao Mobility's call favoritism is a representative example. The taxi industry accused Kakao Mobility of manipulating the dispatch algorithm to favor calls to its affiliated taxis. Kakao Mobility concluded through verification by external experts that there was no manipulation. However, the taxi industry remains skeptical, and the Fair Trade Commission is conducting an investigation.

Some say the startup sector has been hit by the platform regulations. If M&A review criteria are strengthened, the path to recover investment funds through acquisition by platform companies will narrow. Amid an economic downturn where funding sources are drying up and initial public offerings (IPOs) are difficult, there are even concerns that startups will be forced to close without an exit. A startup official questioned, "Leaving M&A aside, investment will also be blocked," adding, "Who would provide funds if there is no strategic investment value?"

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.