Submission of Securities Registration Statements by 10 Companies at the End of Last Year

High Proportion of Electric Vehicle-Related Firms and Large Public Offering Size

[Asia Economy Reporter Hyungsoo Park] Expectations for growth in electric vehicles and secondary batteries are likely to be an important variable influencing the early atmosphere of the new year's initial public offering (IPO) market. Among the prospective listed companies that have submitted securities registration statements and are preparing for public subscription, the proportion of electric vehicle-related companies is high, and the expected market capitalization size is relatively large.

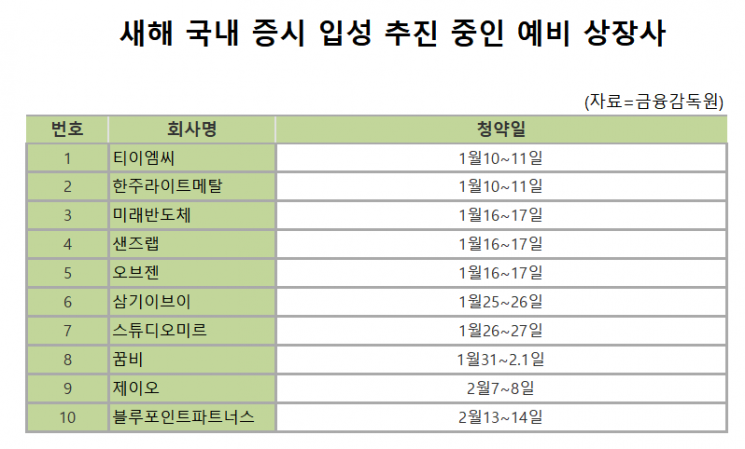

According to the Korea Exchange on the 2nd, as of the end of last year, 10 companies have submitted securities registration statements for listing on the domestic stock market: TMC, Hanju Light Metal, Mirae Semiconductor, Sands Lab, Obzen, Samgi EV, Studio Mir, Kkumbi, J.O, and Bluepoint Partners. Among them, Hanju Light Metal, Samgi EV, and J.O have electric vehicle and secondary battery parts as their core growth engines.

TMC, aiming to enter the stock market for the first time this year, is a producer of special gases for semiconductors. The desired public offering price range is 32,000 to 38,000 KRW, and the expected market capitalization is 353.7 billion to 420.1 billion KRW. The investment banking (IB) industry expects that if TMC is listed on the market as scheduled, its corporate value will reach around 500 billion KRW. It has grown rapidly amid strong demands for domestic production of semiconductor special gases, and the IB industry views the desired public offering price range as appropriate.

If TMC successfully takes the first step, electric vehicle-related companies such as Hanju Light Metal, Samgi EV, and J.O will follow with public offerings. Hanju Light Metal and Samgi EV are manufacturers of electric vehicle-related parts. Hanju Light Metal, which mainly produces aluminum casting parts for automobiles, is increasing investments to boost sales of electric vehicle parts. It reorganized its alloy wheel division, which was the main business in its early days, at the beginning of this year and replaced existing facilities with production facilities for electric vehicle parts.

Samgi EV produces aluminum parts used in secondary battery modules for electric vehicles. It is the domestic market leader in end plates that protect electric vehicle secondary batteries from external shocks. Through LG Energy Solution, it supplies parts to automakers such as Porsche, Volkswagen, and Ford. In response to the implementation of the U.S. Inflation Reduction Act (IRA), it is promoting the establishment of a local factory in the United States. Its cumulative operating profit for the third quarter of 2022 was 7.6 billion KRW, surpassing the 2022 operating profit of 7.4 billion KRW. Samgi EV's expected market capitalization exceeds 230 billion KRW based on the upper limit of the desired public offering price range of 16,500 KRW.

Among the prospective listed companies that have scheduled public subscription dates, J.O, which has the second-largest expected market capitalization after TMC, also focuses on carbon nanotubes for electric vehicle secondary batteries as its core product. J.O will conduct its public subscription on February 7-8. The scale of J.O's public offering is at least 40 billion KRW, and the expected market capitalization ranges from 313.6 billion to 407.4 billion KRW. It is expected to focus on highlighting growth potential in the secondary battery materials sector during its investor relations (IR) sessions. Kang Deuk-joo, CEO of J.O, said, "We plan to continue facility investments and expand production capacity to 5,000 tons by 2025," adding, "We will lead the next-generation secondary battery materials market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)