The Bank of Korea Holds Price Situation Review Meeting

December Inflation Rate at 5%... Same as Previous Month

High Inflation and High Interest Rates to Continue Next Year

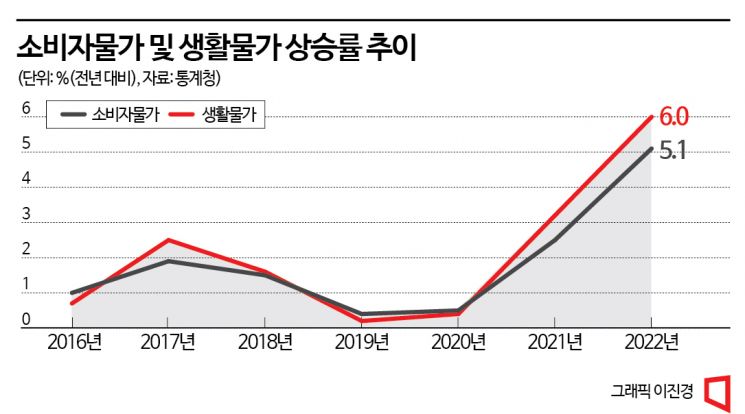

With the consumer price inflation rate maintaining the 5% range until the last month of this year, the high interest rate trend is expected to continue into next year. Although the inflation rate rose to 6.3% in July and has since shown signs of gradual slowdown, a high inflation rate around 5% is still expected through the first half of next year, making it inevitable to operate monetary policy focused on inflation for the time being. The Bank of Korea is expected to raise the base interest rate to at least around 3.5% and maintain it for a considerable period.

On the morning of the 30th, the Bank of Korea held a 'Price Situation Review Meeting' chaired by Deputy Governor Ihwan Seok at the main building conference room in Seoul to review the recent inflation situation and future trends. According to the consumer price trend announced by Statistics Korea on the same day, the inflation rate this month remained at 5%, the same as last month, marking over eight consecutive months above 5%. Although the upward trend has slowed, the Bank of Korea had previously predicted that the inflation rates for November and December this year could be somewhat lower due to the base effect from last winter's sharp rise in vegetable prices and oil prices, so there are opinions that it is difficult to conclude that the upward trend has completely stopped.

Earlier, Bank of Korea Governor Lee Chang-yong said at a press conference following last month's Monetary Policy Committee meeting, "From our perspective, even if the inflation rate drops significantly in November and December, it is important to be cautious about considering inflation stabilized," adding, "At the beginning of the year, as the base effect disappears, inflation rates around 5% are expected again in January and February."

Deputy Governor Ih also said on the same day, "The inflation rate in December showed 5% again following the previous month, as the rise in service prices slowed but the increase in industrial product prices expanded, which aligns with the forecast made in November," and added, "Consumer prices are expected to continue rising around 5% in early next year."

Accordingly, the Bank of Korea is likely to maintain a moderately tight monetary policy stance considering the high inflation rate for the time being. At the last Monetary Policy Committee meeting of the year held on the 24th of last month, the Bank of Korea raised the base interest rate by 0.25 percentage points. Many in the market expect the Bank of Korea to raise the base interest rate by another 0.25 percentage points at the January Monetary Policy Committee meeting next year to reach 3.5% annually and maintain this level until inflation is clearly under control.

Lee Chang-yong, Governor of the Bank of Korea, is holding a press conference after the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul on the 24th of last month. [Image source=Yonhap News]

Lee Chang-yong, Governor of the Bank of Korea, is holding a press conference after the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul on the 24th of last month. [Image source=Yonhap News]

However, if inflation in the first half of next year shows more instability than expected, the final interest rate level could rise. Even this month, electricity, gas, and water prices rose by 23.2%, and processed food recorded a 10.3% increase, the highest since April 2009. Dining-out prices also remain above 8%. Electricity rates are scheduled to increase further next year, and there is potential for a wider rise in agricultural and marine product prices due to the holiday effect.

Governor Lee said at a press conference on the operation of the inflation stabilization target on the 20th, "Discussions on lowering interest rates will only take place when there is more definite evidence that the inflation trend is converging to the medium- to long-term target level; before that, it is premature." Regarding the mention of the final interest rate of 3.5%, he explained, "It was for communication with the market, not a policy promise," adding, "It can change anytime if the economic situation changes."

However, the speed of next year's economic recession and China's With-Corona policy could be variables. If the economy slows rapidly next year due to this year's sharp interest rate hikes, the monetary policy stance will inevitably ease, but if the economy revives due to China's transition to the With-Corona policy, inflation could become unstable again. Deputy Governor Ih said, "There is great uncertainty regarding oil price trends, easing of quarantine measures in China, and the resurgence of COVID-19."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.