Office Building Vacancy Rate at 2.2% in Q3

Down 5.1 Percentage Points in One Year

Gangnam Area Records Historic 0% Level

Vacancy Resolved as IT Companies Flood In

[Asia Economy Reporter Ryu Tae-min] This year, the average vacancy rate of Grade A office buildings in Seoul has reached an all-time low. It is interpreted that IT and pharmaceutical companies, which expanded their presence due to the COVID-19 special circumstances, have flocked to major areas such as Gangnam, downtown, and Yeouido, resulting in an unprecedented boom.

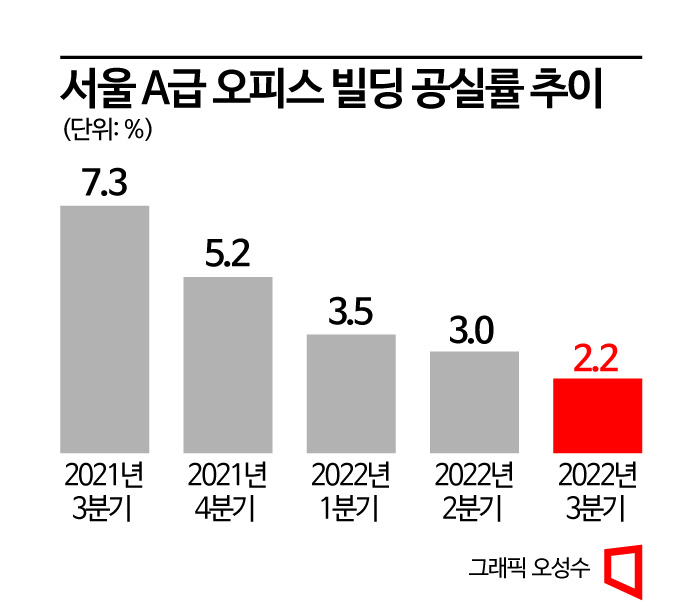

According to the office market report published by Cushman & Wakefield on the 29th, the average vacancy rate of Grade A office buildings in Seoul in the third quarter of this year was 2.2%, down 0.8 percentage points from the previous quarter. This is the lowest figure in 13 and a half years since the first quarter of 2009.

The vacancy rate of Grade A office buildings in Seoul has been declining since the third quarter of last year (7.3%). In the fourth quarter of the same year, it dropped by 2.1 percentage points to 5.2%, and then gradually decreased from 3.5% to 3.0% and 2.2% from the first quarter of this year.

The reason for the decline in vacancy rates is interpreted as the recent increase in corporate leasing demand while the supply of large buildings to support this demand has been insufficient. Cushman & Wakefield expects that "since new office supply will remain limited, a landlord-favorable market will continue for the time being."

Among Seoul's major districts, the vacancy rate in the Gangnam area stood out. In the first quarter, the vacancy rate dropped to as low as 0.4%, recording an unprecedentedly low vacancy rate. Dyson Korea moved into Gangnam Finance Center, and SSG and Moloco signed contracts at Centerfield. Due to the shortage of vacant space, competition among tenants has intensified, and benefits such as rent-free periods previously offered during lease contracts have disappeared, leading to an increase in effective rents, according to Cushman & Wakefield. The average vacancy rate in the Gangnam area remained in the 1% range, recording 1.2% in the third quarter.

The reason major IT companies are settling in Gangnam is due to fierce competition to attract developers. Gangnam is a representative office cluster area preferred by MZ generation employees of IT companies. It has excellent transportation accessibility and symbolic significance in terms of location, which is advantageous for talent recruitment. Additionally, the concentration of IT companies and startups in Gangnam fosters a collaborative atmosphere.

The Yeouido district showed the largest decrease among the districts. Although it recorded a high vacancy rate of 10.4% in the third quarter of last year, it rapidly declined to 3.1% in the first quarter and 1.5% in the second and third quarters. This is believed to be due to the expansion of leasing demand from IT companies that could not find vacancies in the overheated Gangnam area to Yeouido. Vacancies, especially in prime-grade offices that had been vacant for a long time, were quickly resolved. Additionally, the signing of lease contracts for Park One Tower 1 and Tower 2 (NH Financial Tower) contributed to resolving large vacancies.

The downtown district also saw a significant drop in vacancy rates compared to last year. Starting from a high vacancy rate of 9.9% in the third quarter of last year, it steadily declined to 6.4% in the first quarter, 5.2% in the second quarter, and 3.3% in the third quarter, alleviating vacancy issues. Kakao Entertainment signed a lease contract for Centropolis, where vacancies occurred due to the departure of an e-commerce company, and Hyundai Capital signed a lease for 11 floors in Grand Central, quickly resolving large vacancies. Although it has become difficult to find large spaces, attention is focused on the fourth quarter as the Myeongdong SK Networks Building completes remodeling and enters new supply.

Meanwhile, as the supply shortage continues relative to corporate office demand, rents are rising sharply. Office building rents increased by 15.7% cumulatively from the first to the third quarter, showing rapid growth. Furthermore, with recent high inflation rates and consecutive interest rate hikes, it is expected that rent and maintenance fee increases will accelerate.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)