Financial Supervisory Service Revises Standard Automobile Insurance Terms Effective January 1 Next Year

Submission of Evidence Required for Long-Term Treatment in Minor Injuries

Towing Cost Compensation Specified, Encouragement of Replacement Repairs

Standards for Electric Vehicle Rental Fees and Depreciation Also Adjusted

[Asia Economy Reporter Minwoo Lee] It will no longer be possible to receive excessive long-term hospital treatment for minor injuries sustained in car accidents. Additionally, to prevent intentional hospitalization in premium rooms (1-3 person rooms) to overcharge insurance premiums, premium room charges will only be recognized at hospital-level facilities, not at clinic-level ones. Furthermore, compensation for towing costs will also be specified in the terms and conditions.

On the 26th, the Financial Supervisory Service announced that it will revise the standard automobile insurance terms and conditions based on these points, to be applied from January 1 next year. First, the compensation criteria for minor injury patients, such as those with simple bruises without accompanying spinal sprains or fractures, will be rationalized.

Excessive Long-Term Treatment for Minor Injuries No Longer Possible... Evidence Required

Accordingly, it will now be impossible to receive excessive long-term treatment despite having minor injuries. Treatment costs will be covered without a medical certificate for up to 4 weeks, but if the treatment period exceeds 4 weeks, insurance payments will be made according to the treatment period stated in the medical certificate. This change aims to prevent the practice of receiving treatment and claiming insurance payments without submitting proof such as medical certificates, regardless of the treatment duration after an accident. According to the Financial Supervisory Service, there was even a case where a rear-end collision caused slight damage to the license plate with zero repair costs, yet the patient received 69 outpatient treatments over 14 months without a medical certificate and was paid 9.5 million KRW in insurance benefits.

It has also become impossible to intentionally be hospitalized in premium rooms to claim excessive insurance payments. Clinic-level facilities are excluded from the recognition of premium room charges, which now only include hospital-level or higher facilities. The current standard terms allow full payment of hospitalization fees for up to 7 days if a traffic accident patient is hospitalized in a premium room due to 'room availability.' However, some clinics abused this by installing only premium rooms and charging high premium room fees. This led to an increase in insurance premiums for the majority of good-faith policyholders.

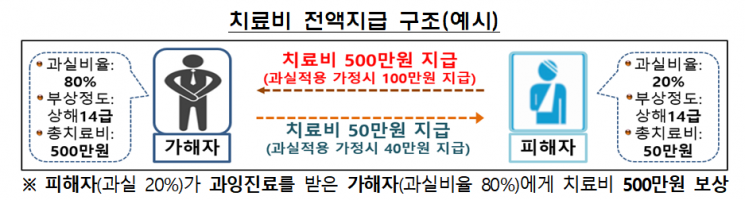

For minor injury patients, the portion of treatment costs corresponding to the patient's own fault under Bodily Injury II can now be covered by the patient's own insurance (personal injury or automobile injury) or paid out-of-pocket. The compensation limit for personal injury insurance (self-injury) will also be increased. For example, the compensation for injury grade 14 was 400,000 KRW but will now increase to 800,000 KRW. However, to protect victims, pedestrians (including two-wheelers and bicycles) other than vehicle drivers will be fully covered for treatment costs even if they are at fault.

Until now, treatment costs were fully paid by the opposing party's insurer regardless of the degree of fault (except in 100:0 accidents). This caused excessive treatment due to the mismatch between fault and responsibility and raised fairness issues related to fault reduction.

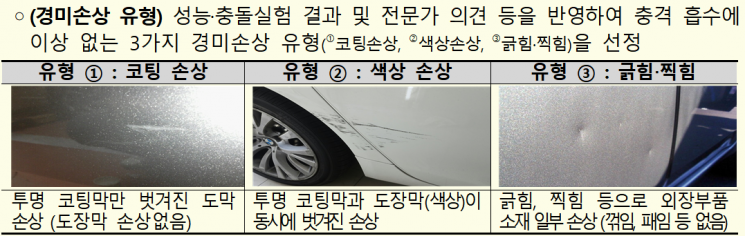

Towing costs will also be specified in the terms and conditions for property damage compensation. This is expected to reduce disputes between victims and insurers regarding towing cost compensation. Additionally, for property damage and own vehicle damage coverage, when repairing minor scratches and dents, replacement repairs using new quality-certified parts will be allowed only for three types: coating, color damage, and scratches/dents.

Depreciation Standards for Electric Vehicle Rental Fees Also Updated

Meanwhile, compensation standards for eco-friendly vehicles have also been revised. First, the criteria for recognizing rental fees have been clarified. Since it is difficult to properly reflect vehicle performance based solely on engine displacement, 'vehicle size' will also be considered as a criterion for determining the same class. The depreciation application standards for major parts of eco-friendly vehicles have also changed. Previously, only internal combustion engine vehicles' major parts such as engines and transmissions were subject to depreciation under property damage compensation, but now motors and drive batteries of electric vehicles and other eco-friendly vehicles are included.

These changes will apply to automobile insurance contracts commencing liability from January 1 next year. However, the provisions regarding fault in treatment costs for minor injury patients and submission of medical certificates for long-term treatment will apply to accidents occurring from January 1 next year. The improved payment standards for premium room hospitalization fees have already been in effect since the 14th of last month.

A Financial Supervisory Service official explained, "Customers will be able to reduce their automobile insurance burden by preventing insurance benefit leakage. Through establishing reasonable rental fee payment standards for eco-friendly vehicles and allowing replacement repairs using new quality-certified parts for minor damages, drivers' rights will be enhanced, related disputes will decrease, and consumer trust in the automobile insurance system will increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)