KCCI Analyzes 'Health of Korean Companies' Through Financial Statements

Debt Ratio Higher Than During COVID

Inventory Accumulating and Turnover Rate Declining

Decreased Corporate Vitality Could Hinder Recovery

[Asia Economy Reporter Choi Seoyoon] A survey has revealed that although Korean companies have grown in size, their fundamentals have weakened. With growth speed and activity slowing down, warning lights have turned on for the Korean economy, which must prepare for a cold economic wave next year.

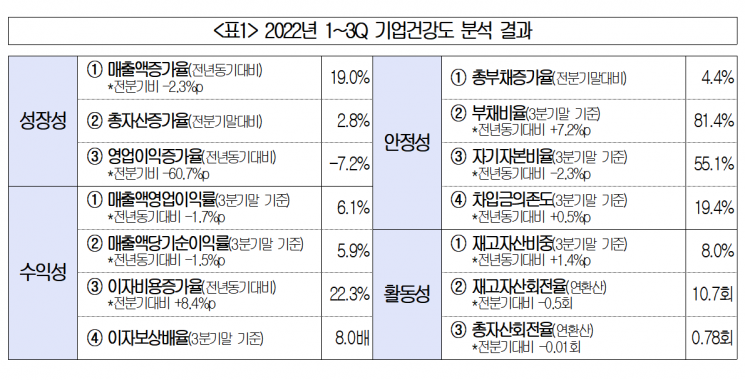

The Korea Chamber of Commerce and Industry recently announced on the 26th that it analyzed the financial status of 1,612 listed companies (160 large enterprises, 778 mid-sized companies, and 674 small and medium enterprises) up to the third quarter of this year, categorizing them into four areas: growth, profitability, stability, and activity, in collaboration with Korea Evaluation Data (KoDATA). The analysis showed that while growth indicators such as corporate sales and total assets improved, the sales growth rate slowed and operating profits decreased. Profitability, stability, and activity all deteriorated simultaneously.

◆Growth Slowing... Assets built on debt= The cumulative sales of the target companies up to the third quarter of this year increased by 19.0% compared to the same period last year, maintaining growth, but the growth rate somewhat slowed. From the second to the third quarter of last year, the sales growth rate rose by 0.5 percentage points, but this year it decreased by 2.3 percentage points. By company size, large enterprises grew by 17.8%, mid-sized companies by 23.4%, and small and medium enterprises by 10.2%, but compared to the previous quarter, large enterprises decreased by 2.8 percentage points, mid-sized companies by 0.6 percentage points, and small and medium enterprises by 2.0 percentage points respectively.

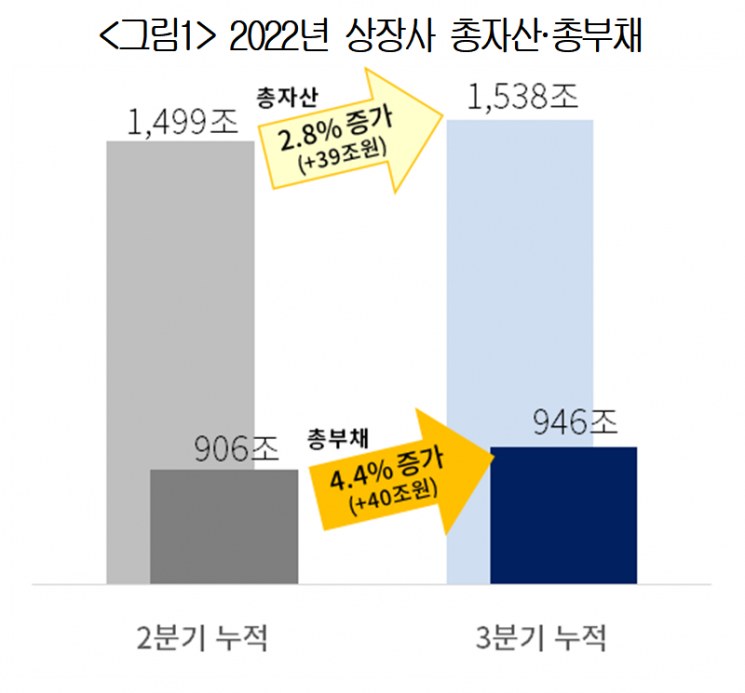

Total assets increased by 2.8% compared to the previous quarter, but total liabilities also rose by 4.4% during the same period, leading to the assessment that assets were "built on debt." In fact, the combined total assets of the analyzed companies increased by 39 trillion KRW, but total liabilities rose by 40 trillion KRW, with the increase in liabilities surpassing the increase in assets. For large enterprises, total assets rose by 2.6% while liabilities increased by 4.1%; mid-sized companies saw total assets increase by 4.0% and liabilities by 5.9%; small and medium enterprises had total assets up by 1.2% and liabilities by 1.1%.

◆Profitability, Operating profit falls while interest burden rises due to rate hikes= The operating profit growth rate, which was 53.5% up to the third quarter of last year, dropped to -7.2% this year. The decline was particularly notable among large enterprises. Large enterprises showed a 58.3% growth rate up to the third quarter of last year but recorded a 12.5% decrease this year. Mid-sized and small and medium enterprises increased by 13.1% and 4.0% respectively compared to the same period last year, but these figures fell far short of last year's growth rates.

As companies sold more but incurred losses, the operating profit margin based on sales, which evaluates corporate profitability, also declined. The cumulative operating profit margin for the third quarter was 6.1%, down 1.7 percentage points from the same period last year. This is also 1.0 percentage point lower than the previous quarter. The net profit margin on sales was 5.9%, down 1.5 percentage points from 7.4% in the same period last year.

Meanwhile, interest expenses that companies must bear increased by 22.3% compared to the previous year. This is interpreted as a result of the sharp base interest rate hikes starting in the first half of this year. In fact, the interest expenses incurred by the target companies in the third quarter totaled 3.5 trillion KRW. Considering the interest expenses of 2.6 trillion KRW in the first quarter and 3.0 trillion KRW in the second quarter, the net interest burden is increasing by 400 to 500 billion KRW each quarter. The interest coverage ratio, which indicates the ability to pay interest from operating profit, plunged from 10.6 times to 8.0 times.

◆Stability, debt ratio and borrowing dependence rise, equity ratio falls= Indicators representing corporate stability all declined simultaneously. Due to increased external borrowing, the cumulative debt ratio (81.4%) and borrowing dependence (19.4%) of all companies in the third quarter rose compared to the debt ratio (74.2%) and borrowing dependence (18.9%) in the same period last year. In particular, the debt ratio, which indicates the size of corporate debt relative to equity, reached its highest level since the COVID-19 outbreak, and the increase of 7.2 percentage points compared to the previous year far exceeded the 2.6 percentage point rise during 2019-2020 (based on the end of the third quarter).

The equity ratio, which shows the proportion of equity capital excluding liabilities from total capital, also fell significantly to 55.1%, down 2.3 percentage points from the same time last year, indicating a significant deterioration in corporate financial soundness. During the COVID-19 period, it dropped by only 0.9 percentage points from 58.1% (third quarter 2019) to 57.2% (third quarter 2020).

The problem is that corporate vitality, which could reverse the worsening situation, has greatly declined. The report cited the significant increase in inventory assets as evidence. As of the end of the third quarter, the proportion of inventory assets in total assets sharply increased to 8.0% this year from 6.1% in 2020 and 6.6% in 2021. By company size, compared to the end of the third quarter last year, large enterprises increased from 5.5% to 6.8%, mid-sized companies from 9.7% to 11.4%, and small and medium enterprises from 7.9% to 8.4% respectively.

The inventory turnover ratio was recorded at 10.7 times, which is the same level as in the second quarter of 2020, when COVID-19 was at its worst. The inventory turnover ratio indicates the speed at which inventory assets are converted into sales; a lower turnover means slower inventory depletion. Large enterprises had 12.4 times, mid-sized companies 8.2 times, and small and medium enterprises 5.5 times, all slower than the previous quarter. The total asset turnover ratio, which indicates asset efficiency, slightly declined from 0.79 times last quarter to 0.78 times.

Kang Seokgu, head of the Korea Chamber of Commerce and Industry's Research Department, said, "Despite companies putting a lot of effort into exports and domestic sales amid a difficult economic environment, operating profits have rather decreased," adding, "The operating rate of domestic large enterprises has fallen compared to the COVID-19 period, and companies are rushing to lower their target performance for next year, indicating a bleak situation." He continued, "Although difficulties will persist for the time being, I hope that entrepreneurial spirit will emerge to turn this crisis into an opportunity and find new paths forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)