Ruling and Opposition Parties Agree on Government Budget and Supplementary Bills

Corporate Tax Top Rate Reduced by 1%P Across All Brackets

Police Bureau and Personnel Management Unit Operating Costs Cut by Half

Lee Jae-myung's 'Jiyeok Sarang Gift Certificates' Budget Included

Two-Homeowners Pay Basic Tax Rate Regardless of Region

Joo Ho-young, floor leader of the People Power Party, and Park Hong-geun, floor leader of the Democratic Party of Korea, shake hands after concluding a joint press conference announcing the agreement on next year's budget and tax law at the National Assembly in Yeouido, Seoul, yesterday afternoon. [Image source=Yonhap News]

Joo Ho-young, floor leader of the People Power Party, and Park Hong-geun, floor leader of the Democratic Party of Korea, shake hands after concluding a joint press conference announcing the agreement on next year's budget and tax law at the National Assembly in Yeouido, Seoul, yesterday afternoon. [Image source=Yonhap News]

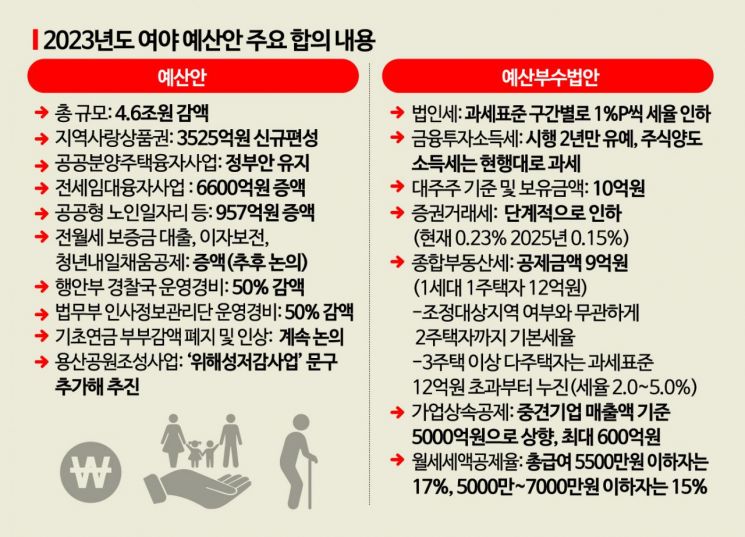

[Asia Economy Reporter Song Seung-seop] On the 23rd, the ruling party will process the 2023 government budget bill and supplementary budget-related bills such as tax laws at the National Assembly plenary session. The legal deadline for budget approval (December 2) was exceeded by three weeks, and a dramatic agreement was reached the day before the deadline (December 23) announced by National Assembly Speaker Kim Jin-pyo.

Budget Reduced by 4.6 Trillion Won... Corporate Tax Rates Cut by 1 Percentage Point Across All Brackets

According to the budget agreement announced the day before by Joo Ho-young, floor leader of the People Power Party, and Park Hong-geun, floor leader of the Democratic Party, the government-proposed budget was reduced by 4.6 trillion won from the original 639 trillion won. The size of national debt and government bond issuance will not be increased from the government proposal. The agreement will be processed at the National Assembly plenary session on the same day.

The biggest issue in the budget and supplementary budget-related bills was the reduction of the highest corporate tax rate. The ruling and opposition parties agreed to lower the highest corporate tax rate by 1 percentage point across all taxable income brackets. For profit-making corporations, the highest corporate tax rate for companies with a taxable income exceeding 300 billion won was adjusted from 25% to 24%. For taxable income between 20 billion and 300 billion won, the rate is 21%; between 200 million and 20 billion won, 19%; and for 200 million won or less, 9%. This is the first change in corporate tax rates in five years since 2017. At that time, former President Moon Jae-in created a new bracket for taxable income exceeding 300 billion won and raised the highest corporate tax rate to 25% through tax law amendments.

The government had planned to lower the highest corporate tax rate from 25% to 22% and simplify the taxable income brackets from four to two or three stages to strengthen corporate competitiveness. However, the opposition party rejected this as a 'tax cut for the ultra-rich,' causing a deadlock in budget approval. Within the Democratic Party, a compromise proposal emerged suggesting a 1 percentage point reduction across all brackets for fairness and equity, which the government accepted, leading to the agreement.

One of the contentious issues was the operating expenses for the Ministry of the Interior and Safety's Police Bureau and the Ministry of Justice's Personnel Information Management Unit, which were cut by 50% from the original 510 million won. The government and ruling party insisted that the related budget should be fully reflected, arguing that since these are legally established national institutions, withholding the budget without grounds is unacceptable. On the other hand, the opposition party opposed recognizing the Police Bureau and Personnel Information Management Unit as legitimate organizations and demanded a full cut. As a compromise, half of the budget will be provided first, and the remaining budget will be reflected once legal grounds are established.

Some Pledges of President Yoon and Leader Lee Reflected Through 'Give and Take' in Budget Formation

During the ruling and opposition parties' agreement process, pledges from President Yoon Seok-youl and Democratic Party Leader Lee Jae-myung were also reflected. The budget for issuing 'Local Love Gift Certificates,' a key budget item favored by Leader Lee, amounting to 352.5 billion won, was included. Although it was not in the government proposal, it was newly allocated during the agreement process. The opposition party demanded restoration after President Yoon cut the related budget of 700 billion won entirely. The ruling and opposition parties reached a resolution by agreeing to compromise and split the budget equally.

President Yoon secured a reduction in the comprehensive real estate holding tax for multi-homeowners, a core project. For the comprehensive real estate tax, the deduction amount was increased from 600 million won to 900 million won (for single-homeowners in one household, from 1.1 billion won to 1.2 billion won), and the basic tax rate will apply to owners of up to two homes regardless of region. This means that even two-homeowners in regulated areas will not be considered multi-homeowners and will be taxed at the general rate. Originally, the concept of 'multi-homeowners' required owning three or more homes, but in regulated areas, owning two homes was enough to be considered a multi-homeowner.

Notably, the Democratic Party accepted the People Power Party's demand to reduce the comprehensive real estate tax for owners of three or more homes. The government and ruling party proposed unifying the tax rate to a single rate of 0.5% to 2.7%, eliminating the heavy tax rate imposed on multi-homeowners and slightly lowering the general tax rate. The opposition party insisted on maintaining the dual tax rate system with general and heavy tax rates. The agreement maintains the dual tax rate system as requested by the Democratic Party but taxes up to 1.2 billion won of the tax base for owners of three or more homes at the general tax rate as requested by the People Power Party. The heavy tax rate applied to them was also lowered from 6.0% to 5.0%.

In the financial and securities sectors, the ruling and opposition parties each achieved their goals. The introduction of the financial investment income tax was postponed for two years until 2025. The financial investment income tax is a system that separately taxes 20% (25% for income exceeding 300 million won) of income exceeding 50 million won from financial investment products such as stocks. Although the Democratic Party opposed it, considering the stock market downturn, a two-year postponement was agreed upon.

The threshold for major shareholders subject to capital gains tax on stock transfers was set at the existing 1 billion won. The government and ruling party had intended to raise this threshold to 10 billion won. This time, the ruling party accepted the opposition party's demand. However, the securities transaction tax will be reduced to 0.2% in 2023, 0.18% in 2024, and 0.15% in 2025.

Additionally, the Yongsan Park Development Project, which the opposition strongly opposed, will be promoted under the new name 'Yongsan Park Development and Risk Reduction Project.' Agreements were reached to increase the scale of support for interest subsidies on jeonse and monthly rent deposit loans and temporary special guarantees for vulnerable borrowers, but the exact scale will be decided later. Discussions will continue on the abolition of the couple reduction in basic pensions and phased increase plans.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.