Real Estate Market Downturn, Rising Loan Interest Rates, and Soaring Raw Material Prices

Securities Firms Guaranteeing Real Estate PF Debt

Increased Risk for Credit Finance Companies and Savings Banks Providing Real Estate PF Loans

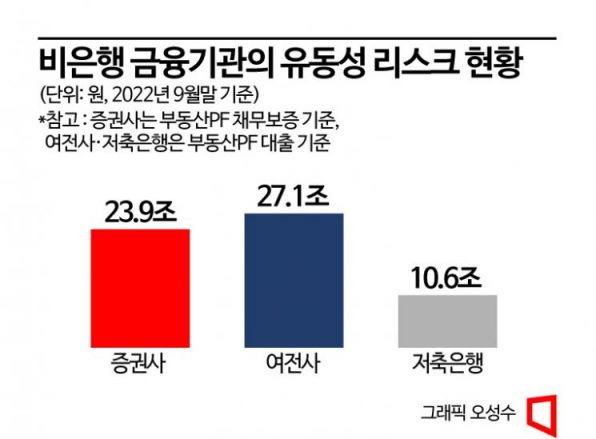

[Asia Economy Reporter Sim Nayoung] As the real estate market deteriorates, loan interest rates rise, and raw material prices soar, the risk of default in real estate project financing (PF) is increasing, and liquidity risks in non-bank financial institutions are also rising accordingly. This is because securities companies, specialized credit finance companies, and savings banks have directly engaged with real estate PF through debt guarantees or loans amounting to approximately 62 trillion won. Liquidity risk refers to the risk related to assets that can be immediately converted into cash.

According to the Bank of Korea's Financial Stability Report on the 22nd, liquidity indicators for securities companies and specialized credit finance companies worsened due to an increase in short-term liabilities caused by rising bond yields. The liquidity ratio of securities companies (liquid assets relative to liquid liabilities within 3 months) dropped by 13 percentage points before and after COVID-19 (from 133.7% at the end of 2019 to 120.6% in the third quarter of this year). The report analyzed, "Recently, liquidity risks in non-bank institutions have stemmed from concerns over real estate PF defaults and domestic and international financial market instability."

For securities companies, the scale of real estate PF debt guarantees reached 23.9 trillion won as of the third quarter. A Bank of Korea official explained, "Securities companies issue asset-backed securities based on real estate PF loans and provide guarantees for them. If refinancing does not proceed properly when maturity arrives, the securities company must repay the money, and since the maturities are short, liquidity risk is relatively high."

Specialized credit finance companies' real estate PF loans amount to 27.1 trillion won, among which bridge loans (loans to finance initial costs such as land acquisition before the main PF) are particularly seen as potential sources of liquidity risk. The report stated, "Most specialized credit finance companies raise funds through bond issuance, but due to financial market instability, conditions for issuing specialized credit finance bonds have worsened. Increasing short-term bond issuance has heightened refinancing risk."

Savings banks are also facing growing concerns over real estate PF loan defaults. As of the end of the third quarter this year, the amount reached 10.6 trillion won, a 28.8% increase compared to the same period last year. The ratio of PF loans to savings banks' own capital is 75.9%, the highest among financial sectors. Additionally, the Bank of Korea's analysis suggests that large deposits over 50 million won, which surged after 2018, are likely to withdraw, and the capacity to raise deposit interest rates is insufficient, increasing liquidity risk.

The report emphasized, "It is necessary to strengthen management and supervision of the liquidity situation of non-bank financial institutions, including reviewing emergency funding plans," and added, "Individual institutions should also expand the size of reserves to prevent funding difficulties caused by credit risk and increase credit extension agreements to secure emergency liquidity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)