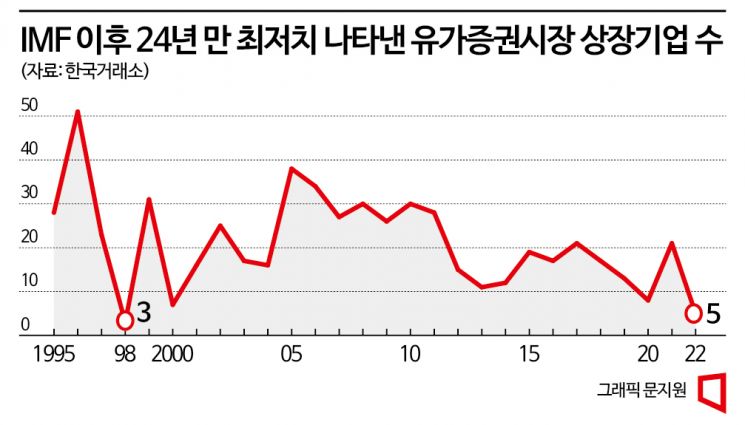

Only 3 New KOSPI Listings in 1998, Just 5 This Year

Stock Prices Plunge Amid Recession Fears... IPO Prices Often Far Below Expectations

[Asia Economy Reporter Son Sunhee] Concerns over an economic recession have intensified this year, leading to a sharp decline in the number of new listings on the stock market. In particular, the number of companies newly listed on the KOSPI, which is preferred by relatively large-scale companies, has fallen to its lowest level in 24 years since the 1998 foreign exchange crisis. With high interest rates expected to continue next year, it is forecasted that it will be difficult for both the stock market and the initial public offering (IPO) market to regain momentum anytime soon.

According to the Korea Exchange on the 22nd, only five companies (excluding REITs and SPACs) were newly listed on the KOSPI this year. This is less than a quarter of the 22 companies listed just a year ago and the lowest number since 1998 (three companies).

Except for LG Energy Solution, which raised a record-breaking amount through its public offering in the first half of the year, there were no new listings. The unexpected outbreak of the Russia-Ukraine war and the global focus on monetary tightening caused companies to adopt a wait-and-see approach and become cautious about IPOs. Companies that had attracted market attention, such as Hyundai Engineering, One Store, and Golfzon Commerce, consecutively withdrew their listings.

In the second half of the year, four companies?Susan Industry (August 1), Socar (August 22), LX Semicon (November 3), and Bionote (December 22)?were listed on the KOSPI. However, their stock prices have performed poorly due to the accelerated interest rate hikes and economic recession in the latter half of the year. As of the closing price on the 20th, Susan Industry’s stock price was 22,200 KRW, significantly below its public offering price of 35,000 KRW. Socar also recorded 20,800 KRW, about 25% lower than its public offering price of 28,000 KRW. Bionote set its public offering price at 9,000 KRW, half of the lower end of its initially hoped price band, resulting in what can be described as a 'humiliating listing.'

The outlook for next year is not optimistic either. With the global tightening trend continuing, it is expected to take time for investor sentiment to recover. However, since many companies that postponed their listings this year are preparing to go public next year, there is a possibility that the situation may change. According to the Korea Exchange, about 50 companies are currently undergoing preliminary listing reviews.

Choi Jong-kyung, Senior Research Fellow at Heungkuk Securities, explained, "In the past, the years when the KOSPI peaked were 2010, 2015, and 2021. Typically, IPO booms occurred on a roughly five-year cycle, leading to a smooth landing into the following year. However, this year, many companies withdrew their listings, so such a pattern did not appear."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.