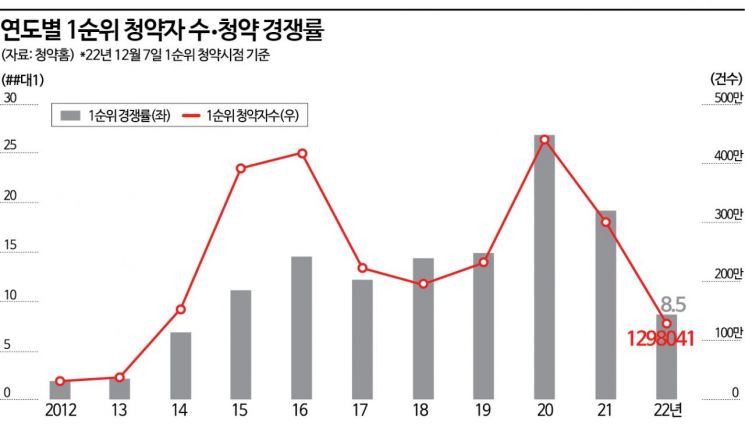

Nationwide Top Subscription Competition Rate 8.5 to 1

Less Than Half Compared to Last Year's 19.1

Market Slump Amid Rising Interest Rates and Sale Prices

[Asia Economy Reporter Kwak Min-jae] This year, the housing pre-sale market has rapidly cooled down, recording a single-digit subscription competition rate for the first time in eight years. While tens of thousands of applicants flocked to apply for a single household due to the expectation of billions of won in capital gains upon winning, consecutive interest rate hikes and rising pre-sale prices this year have hindered the market.

According to an analysis of subscription home data by real estate research firm Realtoday on the 20th, the nationwide first-priority subscription competition rate (as of December 7) averaged 8.5 to 1 this year. This is less than half compared to last year's average first-priority competition rate of 19.1 to 1. Notably, the nationwide average subscription competition rate recorded a single digit for the first time in eight years since 2014 (average 6.7 to 1).

The cooling of the subscription market is analyzed to be due to the increased burden of loan interest as the base interest rate rose. Until last year, the low-interest rate trend was maintained, but now the base rate has soared to 3.25%, increasing the interest burden on mortgage loans and interim payment loans.

It is also analyzed that the continuous rise in pre-sale prices amid falling housing prices has diminished the attractiveness of subscriptions. This year, the new government implemented policies to expand new housing supply by 'realizing the price of the pre-sale price ceiling system' and 'relaxing the high pre-sale price review system.' Except for some areas such as Seoul, Gwacheon, Seongnam, and Gwangmyeong, all regulatory areas were lifted, allowing them to escape the shadow of the 'high pre-sale price management system.'

As a result, pre-sale prices have risen significantly by region. Last year, the pre-sale price per 3.3㎡ in Seoul was about 29.45 million won, but this year it rose to 35.22 million won. Ulsan rose by 3.21 million won (from 14.88 million won to 18.09 million won), Daegu by 3.16 million won (from 17.16 million won to 20.32 million won), and Daejeon by 2.75 million won (from 13.30 million won to 16.05 million won) during the same period.

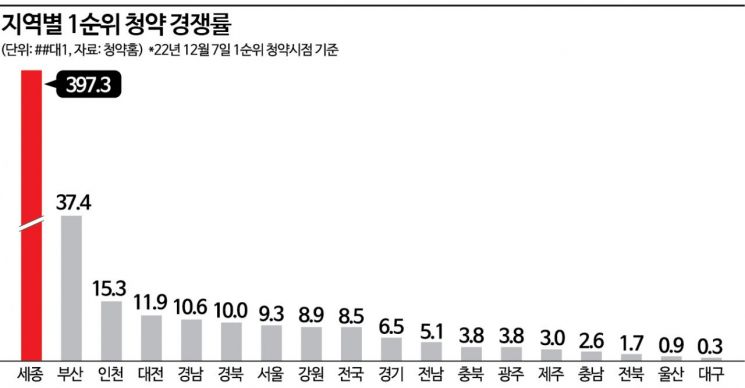

The region with the highest first-priority subscription competition rate this year was Sejong (397.3 to 1). This was because the market was flooded with subscription conversion units of affordable 10-year public rental housing available nationwide in Sejong, attracting applicants' attention. Busan recorded 37.4 to 1, Incheon 15.3 to 1, Daejeon 11.9 to 1, and Gyeongnam 10.6 to 1. The remaining 11 cities and provinces recorded single-digit competition rates. In particular, Daegu recorded the lowest competition rate nationwide at 0.3 to 1, with only 3,495 applicants for 11,500 households supplied in the first priority this year.

However, places with competitive pre-sale prices were chosen by demanders in the subscription market. A representative example is 'Centreville Asterium Yeongdeungpo' in Yeongdeungpo-dong, Yeongdeungpo-gu, Seoul, which was pre-sold in February. Although it is a small-scale residential-commercial complex apartment with only 156 households, the pre-sale price for a 59㎡ unit is around 650 million to 670 million won. The fact that it was priced at about half the surrounding market price was a strength, and 11,385 subscription accounts were submitted for 57 households, recording the highest competition rate (199.7 to 1).

Kim Byung-gi, team leader at Realtoday, said, "For the first time since 2014, the nationwide average subscription competition rate recorded a single digit, confirming the cooled response of demanders to the pre-sale market. However, places with competitive pre-sale prices attracted relatively many applicants, so pre-sale price setting is expected to become even more important in next year's pre-sale market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.