COVID-19 Restrictions Eased, Luna and FTX Crises Compound Setbacks Cooling Momentum

"Without Fundamental Changes in the Metaverse, Past Price Recovery Is Difficult"

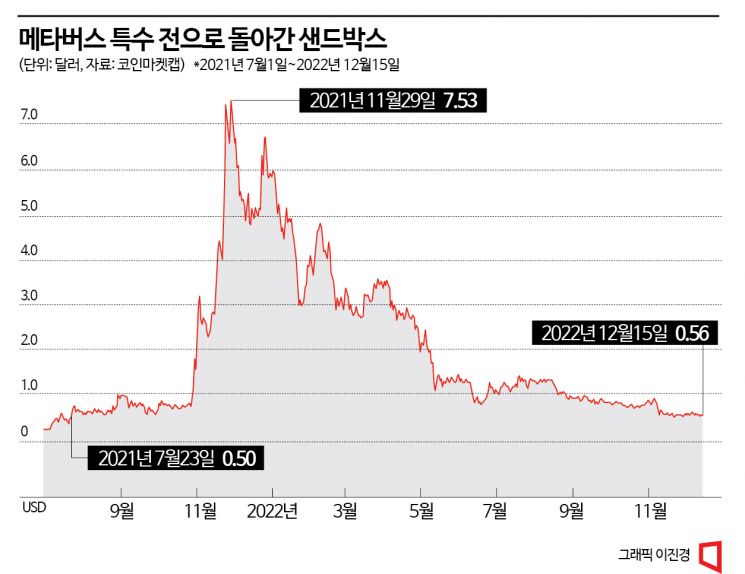

[Asia Economy Reporter Lee Jung-yoon] The metaverse, which actually enjoyed a boom during the COVID-19 pandemic, also brought attention to metaverse-related virtual assets. However, as the virtual asset market entered a downturn and face-to-face activities gradually increased, the enthusiasm for the metaverse cooled, causing coin prices to plummet. Compared to the peak period, prices have fallen to less than one-tenth.

According to the global virtual asset market tracking site CoinMarketCap, as of 3:33 PM on the 15th, the price of Sandbox was recorded at $0.56 (approximately 729 KRW), down 2.03% from the previous day.

Sandbox had risen to $7.46 (approximately 9,716 KRW) last November, more than 13 times the current price. This was during the boom in virtual asset investment and when the metaverse was in the spotlight. However, with multiple negative factors hitting the coin market such as interest rate hikes, the Luna incident, and the bankruptcy of the global virtual asset exchange FTX, along with the transition to the COVID-19 endemic era, the popularity waned and prices followed a downward trend, returning to the levels of July last year.

Sandbox refers to the virtual asset used in The Sandbox, a blockchain gaming platform where users can create and trade their own voxel assets using non-fungible tokens (NFTs). In The Sandbox, assets are composed of voxels, which extend the concept of pixels into three-dimensional space, and users can also create games to generate revenue. Although the number of The Sandbox users has increased, the price of Sandbox has declined as interest from coin investors in the metaverse has decreased during the virtual asset downturn.

Unlike the past when it was in the spotlight, the metaverse is now suffering from bubble concerns. Meta, the parent company of Facebook which even changed its name to emphasize the metaverse vision, has seen revenue growth but is struggling as its earnings per share (EPS) fell short of market expectations. Analysts attribute this to Reality Labs, Meta’s metaverse division, failing to show promising results despite increased costs.

Professor Hong Ki-hoon of Hongik University (Business Administration) said, "The cooling of the metaverse craze is a problem caused by chasing trends too quickly," adding, "Unless there is a fundamental change in the metaverse, it seems difficult for related virtual asset prices to recover to past levels."

The price of Decentraland, another metaverse-related coin, showed a similar pattern to Sandbox. At the same time, it was recorded at $0.38 (approximately 495 KRW), down 3.89% from the previous day. After hitting a peak of $5.20 last November, it declined and returned to the levels of March last year.

Decentraland refers to the coin used in Decentraland, a virtual reality (VR) platform based on the Ethereum blockchain. In the metaverse called Decentraland, users can purchase and sell virtual real estate such as land. Transaction information is recorded on the Ethereum blockchain, and virtual real estate is non-fungible but transferable. Although it attracted attention as metaverse real estate, the price of Decentraland has shown a downward trend.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)