Copper futures for 3-month contracts rise over 11% since last month

Demand expected to increase on China's economic stimulus hopes ... Best investment timing is the second half of next year

[Asia Economy Reporter Minji Lee] Copper prices, which had plummeted due to recession concerns, are showing an upward trend again. The factor moving copper prices, known as 'Dr. Copper (DR.Copper)' for its ability to predict economic trends, is China. Expectations for the lifting of 'Zero COVID' policies and other measures have grown, reflecting forecasts that copper demand may increase again due to rising economic activity. Experts believe that while copper prices are unlikely to soar dramatically, they will follow a long-term upward trend supported by solid demand from China and other countries.

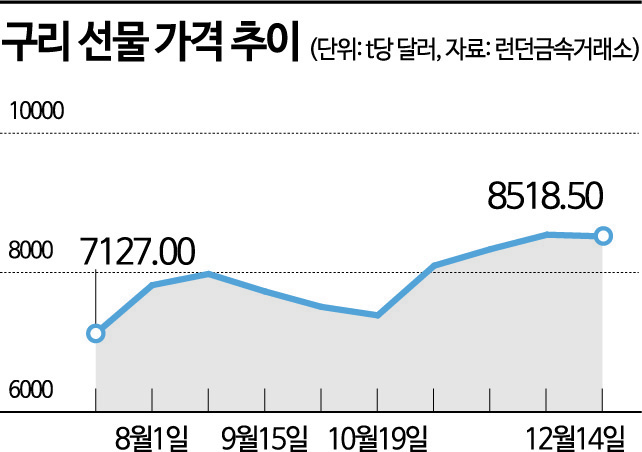

According to the London Metal Exchange (LME) on the 15th, the price of 3-month copper futures closed at $8,518.50 per ton as of the previous day, rising more than 11% since July 1 ($7,652.00). Copper prices surged to $8,543.00 (closing price on the 8th) this month, marking the highest level since the closing price of $8,773.00 on June 22. Copper, which traded at $10,600 earlier this year due to raw material supply shortages, fell to the 7,100 level in July amid recession fears but has shown a recovery supported by expectations of China's reopening.

The Federal Reserve's (Fed) slowing pace of interest rate hikes, which lowered the value of the dollar, also contributed to the rise in copper prices. On the New York Commodity Exchange (COMEX), the price of March copper futures is approaching around $4 per pound. Copper, which surged to $5 earlier this year, fell below $3.2 intraday in July.

The returns of products linked to copper prices are also not bad. The 'Shinhan Leverage Copper Futures ETN,' which tracks twice the return of copper futures traded on the Chicago Mercantile Exchange, rose 13.5% from August 1 to the previous day. The 'TRUE Copper Futures ETN,' which follows COMEX copper futures prices, jumped 4.5% during the same period. However, as physical demand has not yet grown noticeably, the 'TIGER Copper Physical ETF,' which invests in securities issued by copper physical storage warehouse operators, only rose 1.5%.

Since the Chinese economy has been in a prolonged slump due to the impact of COVID-19, copper demand is expected to increase further if reopening and economic stimulus measures begin. China, the largest raw material consumer, has accounted for 50% of copper usage so far. Overseas investment banks have also adjusted their copper price forecasts. Goldman Sachs raised its previous forecast by $3,000 from $9,000 per ton to $11,000. Bank of America (BOA) also expects prices to rise to $10,000.

For those considering investment, it is advisable to have a mid- to long-term perspective until the second half of next year. This is because concerns about supply disruptions have eased following the withdrawal of the strike by the union at Escondida, the world's largest copper mine in Chile, and inventory forecasts are expected to increase. Heesoo Ahn, a researcher at Ebest Investment & Securities, said, “The effect of infrastructure policies involves a time lag, and it generally takes one to two years for policy effects to appear in raw material demand. The period when the decline in the US dollar value and the recovery of Chinese imports become significant will be the second half of next year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)