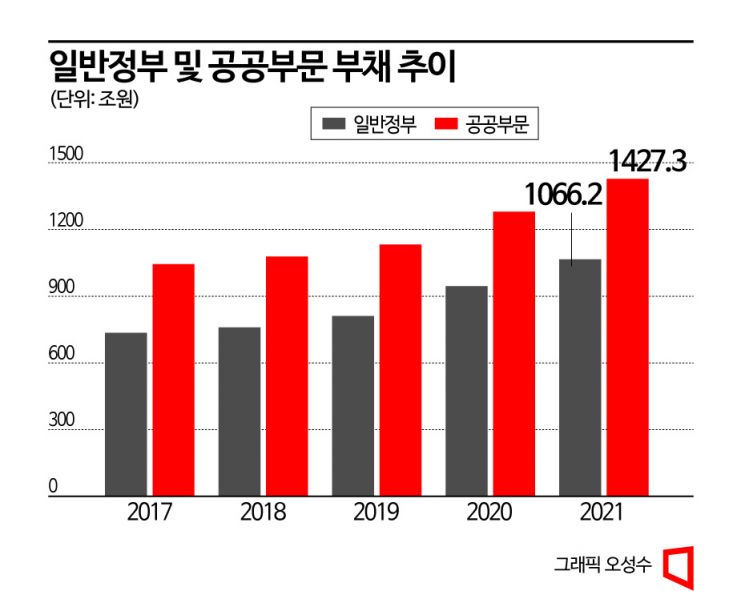

[Asia Economy Sejong=Reporter Kim Hyewon] Last year, the general government debt (D2) managed by the government and non-profit public institutions surpassed 1,000 trillion won for the first time in history. The ratio compared to the gross domestic product (GDP) also exceeded 50%.

Public sector debt (D3), including government and non-financial public enterprises, approached 1,430 trillion won, an increase of about 147 trillion won from the previous year, and the ratio to GDP also neared 70%.

On the 15th, the Ministry of Economy and Finance announced the results of the "2021 General Government Debt (D2) and Public Sector Debt (D3) Calculation" reflecting these details.

The government manages debt statistics in three types: national debt (D1), general government debt (D2), and public sector debt (D3). D1 is calculated by combining central and local government debts, D2 adds the debts of non-profit public institutions to D1, and D3 further includes debts of non-financial public enterprises on top of D2.

Commonly referred to as "national debt," D1 is used as a fiscal management indicator (National Fiscal Operation Plan) when the government drafts the budget. D2 is used by international organizations such as the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD) for comparing national debts. D3 is an indicator used to manage the soundness of the public sector. However, since only eight OECD countries calculate D3, it is considered limited for use as an international comparison metric.

Due to responses to the COVID-19 crisis and other factors, all types of debt in South Korea increased last year. D1 stood at 970.7 trillion won, representing 46.9% of GDP. This year, the era of annual national debt exceeding 1,000 trillion won is becoming a foregone conclusion.

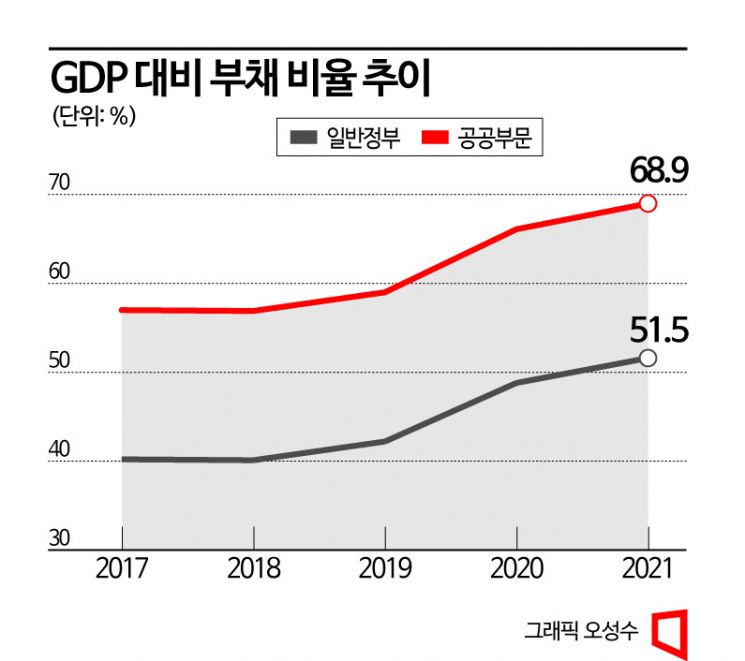

Last year, both D2 and D3 set new records in absolute scale and GDP ratio since statistics began in 2011.

Last year, D2 reached 1,066.2 trillion won, an increase of 121.1 trillion won from the previous year (945.1 trillion won). This is the first time D2 has exceeded 1,000 trillion won. The ratio to GDP surged to 51.5%, up 2.8 percentage points from the previous year. Notably, it approached the average of non-reserve currency advanced countries (56.5%).

The D2 ratio has maintained an upward trend since 2019, but the increase rate slowed compared to the previous year (6.6 percentage points). The Ministry of Economy and Finance explained, "The increase in total revenue, including national tax income, due to faster-than-expected economic recovery, reduced the debt growth compared to the previous year."

Among the increase in D2 compared to the previous year, the central government debt increase accounted for 118 trillion won, most of the total. Of this, the issuance of treasury bonds was 110.4 trillion won.

The increase in local government debt was 7.4 trillion won. Debt of educational autonomous bodies decreased by 1.7 trillion won due to favorable trends in educational finance grants.

Last year, D3 was 1,427.3 trillion won, an increase of 147.4 trillion won from the previous year (1,280 trillion won). The ratio to GDP rose by 2.9 percentage points to 68.9%. The D3 ratio has continued to increase since 2019.

82.2% of the D3 increase was due to the rise in D2, while pure non-financial public enterprise debt increased by 31.6 trillion won (0.2 percentage points) compared to the previous year. In particular, the debt of central non-financial public enterprises rose by 33.9 trillion won to 403.6 trillion won. This was influenced by an 11.6 trillion won increase in debt from borrowings and corporate bonds at Korea Electric Power Corporation and its power generation subsidiaries. Korea Gas Corporation also added 5.8 trillion won through borrowings and bonds.

The Ministry of Economy and Finance stated, "Considering mid- to long-term fiscal conditions such as low birthrate, aging population, and declining growth potential, it is necessary to strengthen efforts to manage fiscal soundness for sustainable finance."

It added, "We will promote the legislation of fiscal rules and the prompt enactment of the Local Education Finance Grant Reform Bill, and prepare follow-up legislative measures. Based on long-term fiscal forecasts, we will diagnose risk factors in our finances and establish mid- to long-term fiscal strategies such as 'Fiscal Vision 2050' to address them."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)