Kakao Pay Subsidiary Auditor Announces Sale of 4,083 Shares

Report Raising Target Price Emerges Amid Potential Roca Mobility Acquisition

[Asia Economy Reporter Lee Seon-ae] As KakaoPay's stock price has emerged from the bottom and shown signs of recovery, stock option sell-offs have immediately appeared. Having endured controversies over overvaluation and management 'eat-and-run' scandals, individual investors are viewing this situation with skepticism.

According to the Financial Supervisory Service, on the 12th, KakaoPay disclosed that Cho Sang-hyun (auditor of subsidiary KP Insurance Service) sold 4,083 shares of KakaoPay. The scale amounts to approximately 260 million KRW. He sold the shares less than a month after exercising stock options on November 18. It is interpreted that he took advantage of the recent stock price recovery to realize profits.

Previously, KakaoPay faced fierce criticism from individual investors and others due to management's eat-and-run controversy. One month after KakaoPay's listing in December 2021, eight executives sold 440,093 shares obtained through stock options (exercise price 5,000 KRW), earning a profit of 87.8 billion KRW. The management's eat-and-run controversy led to the introduction of mandatory prior disclosure measures for insiders such as executives of listed companies when exercising stock options and disposing of company shares. On September 12, the Financial Services Commission finalized and announced the introduction of a prior disclosure system for insider trading. It mandates that insiders such as executives or major shareholders of listed companies disclose related information at least one month in advance when trading company shares. The Financial Services Commission plans to submit amendments to the Capital Markets Act to the National Assembly within the year.

Shin Won-geun, CEO of KakaoPay, apologized for the stock option eat-and-run controversy at the earnings presentation in February this year and took steps to restore market trust by repurchasing company shares in June and September. However, KakaoPay, along with Kakao Group stocks, remains burdened with the reputation of being a 'national disliked stock.' Amid this, another case of profit-taking through stock options has occurred.

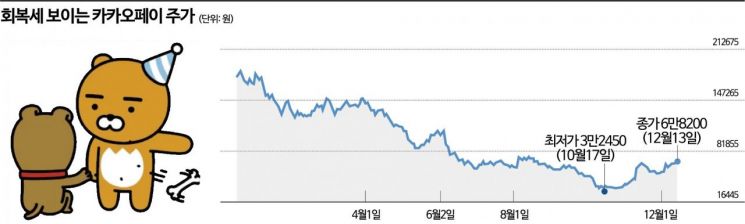

Despite these controversies, KakaoPay's stock price has recently shown an upward trend. This is due to positive factors that could enhance the company's corporate value. The stock price, which was 248,500 KRW immediately after listing in November last year, fell to the 30,000 KRW range by October. On October 17, it recorded 32,450 KRW, a plunge of 86.9% compared to right after listing. Since then, the stock price has gradually recovered. On November 14, it rose intraday to 70,900 KRW (closing price 68,200 KRW).

The possibility of KakaoPay acquiring Roca Mobility has acted as a positive catalyst. Roca Mobility is a subsidiary of Lotte Card and owns the brand Cashbee, which integrates regional transportation cards such as eB Card and Mybi. If KakaoPay acquires Roca Mobility, it is expected to increase sales and respond swiftly to Apple Pay's entry into the domestic market. Thanks to this, a report appeared for the first time since KakaoPay's listing that raised the target stock price.

Lim Hee-yeon, senior researcher at Shinhan Investment Corp., said, "If KakaoPay acquires Roca Mobility, KakaoPay's corporate value will rise from 7.4 trillion KRW to 9.4 trillion KRW due to increases in total payment volume (TPV), sales, and growth potential from offline merchant expansion," raising the target price from 40,000 KRW to 73,000 KRW, an 82.5% increase. Lim added, "Considering KakaoPay Securities' capital increase and active mergers and acquisitions (M&A), the current net cash held will be a source of future growth engines."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)