Due to the US Inflation Reduction Act and the European Energy Crisis

Leading European Companies Move to North America

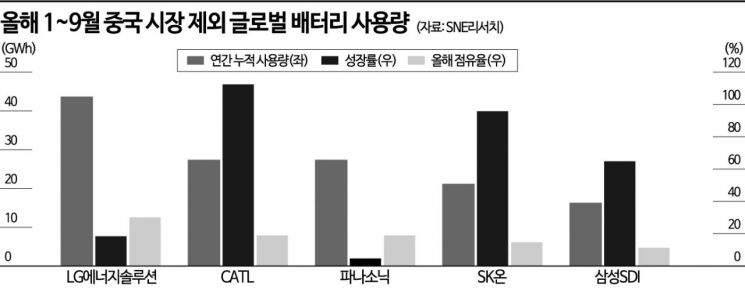

[Asia Economy Reporter Jeong Dong-hoon] The U.S. Inflation Reduction Act (IRA) is drawing battery companies to North America. This presents another opportunity for Korean companies. As European battery companies rush to enter the North American market rather than investing within the region, Korean companies are effectively gaining a 'no man's land.' It is expected that the market dominance of domestic companies, which entered the European market where the battery supply chain is still fragile, will increase.

On the 9th, leading European battery companies such as Northvolt and Italvolt are accelerating their North American investments in line with the implementation of the Inflation Reduction Act. Sweden's Northvolt, the largest electric vehicle battery company in Europe, has postponed the groundbreaking of its Heide battery plant in Germany and is pushing forward with establishing a new factory in the U.S. Northvolt expects subsidies of $600 million to $800 million (approximately 789.5 billion to 1.05 trillion KRW) from the IRA for its U.S. factory. This is compared to incentives of $160 million (about 210.5 billion KRW) offered by Germany. Northvolt, invested in by Volkswagen, BMW, and Goldman Sachs, is a Swedish electric vehicle battery manufacturer strategically nurtured by European governments and companies to reduce East Asia's dominance in the battery industry.

Las Carlstrom, CEO and founder of Britishvolt and Italvolt, battery companies from the UK and Italy, is also establishing a company called Statevolt in California, USA, aiming to build an electric vehicle battery plant with an annual capacity of 54 GWh.

The reason European battery companies are rushing to invest in North America is primarily due to the tax credits and subsidies provided by the Inflation Reduction Act. The IRA includes benefits such as a tax credit of up to $7,500 (about 9.85 million KRW) for electric vehicles finally assembled in the North American region. The law is expected to provide battery manufacturers with a tax credit of about $35 (approximately 46,000 KRW) per kWh of cells as early as next year.

The war between Russia and Ukraine has also caused energy costs in Europe to surge, encouraging battery companies to leave Europe. The European Energy Exchange (EEX) announced earlier this month that electricity prices in Germany reached 361 euros per MWh (about 500,660 KRW). In mid-last month, the price was around 108 euros (149,781 KRW). Even European companies feel burdened by new investments due to the European energy crisis.

For Korean companies, this is an opportunity to secure a foothold in the rapidly growing European electric vehicle market. Domestic companies, including the three major battery cell manufacturers, as well as materials, parts, and equipment companies, have already entered the European market and are operating factories.

LG Energy Solution is expanding the production capacity of pouch-type batteries at its Wroclaw plant in Poland and is planning to establish a separate base for cylindrical battery production within Europe. The company aims to secure production capacity exceeding 100 GWh locally in Europe by 2025.

SK On is operating its first and second plants in Hungary and plans to build a third plant in Iv?ncsa, Hungary, with a total investment of 3.31 trillion KRW. Samsung SDI will begin mass production at its second plant in G?d, Hungary, in the second half of this year, and will actively market its high-value-added medium-to-large battery ‘Gen5.’ Battery materials company POSCO Chemical is also planning to establish new anode and cathode material plants.

The European version of the Inflation Reduction Act, the Critical Raw Materials Act (CRMA), is also expected to further strengthen the market dominance of Korean companies. Like the IRA, this law includes subsidies for electric vehicles produced within Europe. Since European automakers such as Volkswagen and BMW are broadly cooperating with domestic companies, benefits are anticipated.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.