Operating Profit Expected to Be Negative in Q4

Five Consecutive Days of New Lows

Deficit to Continue Until First Half of Next Year

Some Advise Buying at Low Prices

[Asia Economy Reporter Kwon Jae-hee] SK Hynix's stock price, which is expected to report an operating loss in the fourth quarter of this year, continues to hit new lows day after day. The securities industry forecasts that SK Hynix's streak of losses will continue until the first half of next year. Some suggest that since the stock price is already reflecting negative factors in advance, now is the time to buy at a low price.

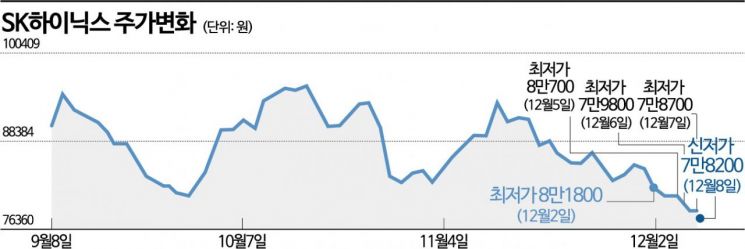

According to the Korea Exchange on the 9th, SK Hynix recorded a low of 78,200 won, marking a new five-day consecutive low. As of 9:02 a.m. that day, SK Hynix was trading at 79,500 won, up 0.89% from the previous trading day.

The reason behind SK Hynix's continuous weak stock performance is the forecast that its operating profit will turn negative in the fourth quarter of this year. According to financial information provider FnGuide, four securities firms that published reports on SK Hynix this month estimated the fourth-quarter operating loss to range from a minimum of -448 billion won to a maximum of -2.231 trillion won. Ebest Investment & Securities and Kiwoom Securities projected SK Hynix's operating loss in the trillion-won range, with Ebest estimating -1.159 trillion won and Kiwoom estimating -2.231 trillion won. This is the largest estimate among securities firms.

The securities industry is also lowering its price targets for SK Hynix's stock. Kiwoom Securities lowered its target from 120,000 won to 110,000 won, Shinhan Investment Corp. from 115,000 won to 110,000 won, and Korea Investment & Securities from 140,000 won to 113,000 won.

Nam Dae-jong, a researcher at Ebest Investment & Securities, analyzed, "SK Hynix has announced that it will begin production adjustments from the first quarter of next year, and the increased inventory due to this is expected to be reflected as an impairment loss at least until the second quarter of next year, with a considerable scale."

However, since stock prices tend to reflect negative factors in advance, there is also advice that now is the time to buy at a low price. Kiwoom Securities lowered SK Hynix's stock price target from 120,000 won to 110,000 won but named it the industry's 'top pick' and gave a 'buy' investment opinion.

Park Yoo-ak, a researcher at Kiwoom Securities, said, "Although next year's performance is expected to fall short of expectations, SK Hynix is also expected to begin supply adjustments and production cuts by the end of this year, which will help improve the supply and demand of memory semiconductors. In this case, signals of market improvement are likely to be observed in the first quarter of next year, and the stock price is also likely to show an upward trend, so now is the time to buy at a low price."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.