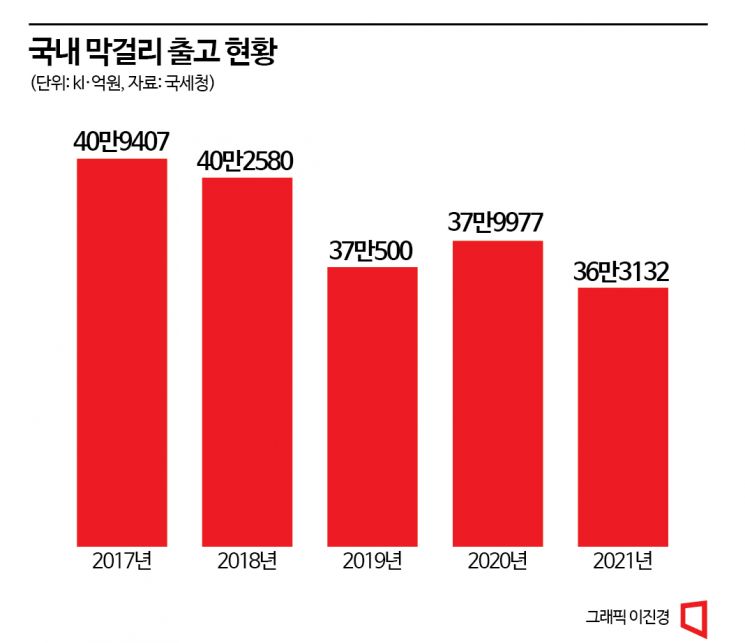

Makgeolli shipments last year totaled 363,132㎘, down 4.4% YoY due to reduced entertainment market from COVID-19

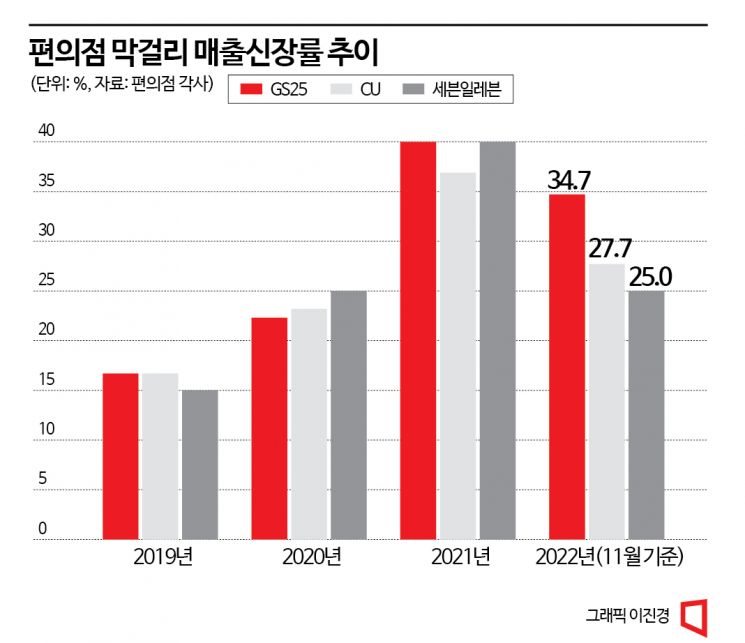

Despite shipment decline, retail sales grew... Convenience stores saw 30-40% growth last year

Premium Makgeolli emergence boosts demand with hip image transformation

[Asia Economy Reporter Koo Eun-mo] A trend toward premiumization is sweeping the Makgeolli market. Although the overall shipment volume has decreased due to the adverse effects of COVID-19 on the entertainment industry, the market continues to grow as more consumers seek differentiated products that emphasize quality and value, such as high-quality ingredients and producers' stories.

According to the National Tax Service on the 8th, last year's shipment volume of Takju (Makgeolli) was 363,132 kiloliters (kL), down 4.4% compared to the previous year. Domestic Makgeolli shipments, which were around 409,407 kL in 2017, dropped to 370,500 kL in 2019, falling to about 300,000 kL. Since then, shipments were 379,977 kL in 2020 and decreased to approximately 360,000 kL last year.

The decline in Makgeolli shipments over recent years is attributed to reduced dining-out consumption and the contraction of the entertainment sector, a major part of the alcoholic beverage market, due to COVID-19. While home drinking and solo drinking became popular, boosting demand in the home-use market, the entertainment sector, which was a key distribution channel, suffered, leading to an overall decrease in shipments. An industry insider explained, "The home-use market centered on convenience stores and supermarkets has improved, but entertainment venues in major commercial areas and establishments near hiking trails have been hit hard." However, with social distancing measures lifted this year and a clear recovery in the alcoholic beverage market, the industry expects shipment volumes to rise again.

Despite the overall decrease in shipment volume, the growth trend in the Makgeolli market is clear. The emergence of premium Makgeolli with relatively higher price points has raised the shipment price per bottle, and the overall selling price of Makgeolli has increased due to rising costs of raw materials and ingredients. A representative from Baesangmyeon Brewery said, "A new trend of valuing quality and worth has emerged in Makgeolli. Efforts to enhance the added value and premiumize Makgeolli, such as producing Makgeolli without additives, are driving market growth despite the decline in shipment volume."

Additionally, traditional liquors like Makgeolli have successfully transformed their image into 'hip' drinks, especially among younger consumers, increasing overall demand. In the past, Makgeolli was strongly associated with older generations, but recent new retro trends, along with various emerging breweries offering unique flavors and sophisticated designs, have attracted consumers seeking distinctive products. The relatively low alcohol content also lowers the entry barrier, synergizing well with the trend of casual home drinking.

As demand rises, retail market sales have also shown clear growth. Last year, Makgeolli sales at E-Mart increased by 30% compared to the previous year, with premium Makgeolli priced over 10,000 won seeing a sales growth rate of 290%. This year, despite last year's high growth, sales continued to grow by 2% as of November compared to the previous year.

Convenience stores, popular among younger consumers, have shown even more pronounced growth. GS25's Makgeolli sales grew 16.7% in 2019 compared to the previous year, then 22.3% in 2020, and surged 40.0% last year, showing unstoppable growth. This year, as of November, sales increased by 34.7%. CU also grew 36.9% last year and continues strong growth of 27.7% this year, while Seven Eleven recorded sales growth rates of 40.0% and 25.0% during the same period.

The performance of Makgeolli manufacturers has naturally improved as well. Kooksoondang's sales increased from 53.4 billion won in 2019 to 65.2 billion won last year, with Makgeolli sales growing 18.9% from 15.9 billion won to 18.9 billion won during that period. Jipyeong Brewery, which had sales around 11 billion won in 2017, saw its sales jump nearly fourfold to 40.5 billion won last year over four years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.