'Red Ocean' Struggles of Mid-Range Brands in Domestic Coffee Market

Ediya Raises Prices on 22nd... Americano Price Frozen, Size Increased

Counterattack Against Low-Cost Brands Like Mega and Compose... Overseas Expansion as a Solution

[Asia Economy Reporter Moon Hyewon] As the domestic coffee franchise market reaches saturation, each brand is striving to strengthen its competitiveness.

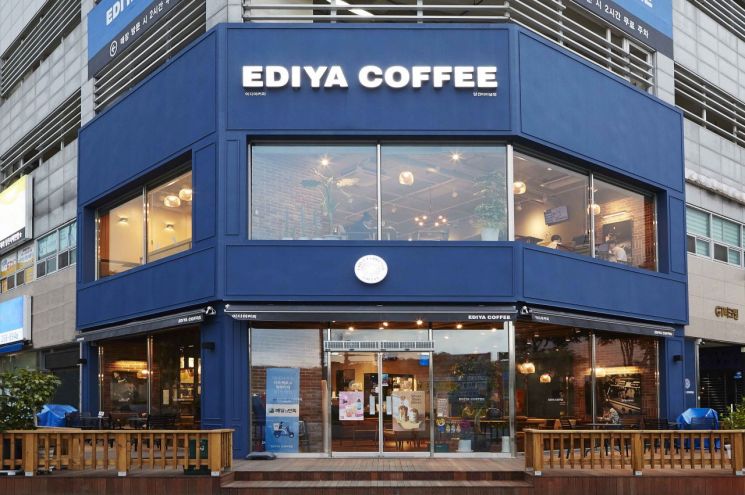

According to the industry on the 10th, Ediya Coffee, a representative mid-priced coffee brand, decided to raise the prices of 57 out of 90 beverage items by 200 to 700 KRW starting from the 22nd of this month. This price increase is the first in about four years since 2018.

However, the price of Americano will not only be frozen but the cup size will also be increased. The price of one Americano is 3,200 KRW. In terms of volume, it will increase by about 23%, from the existing 14oz (414ml) to 18oz (510ml).

The reason for maintaining the price of Americano, the top-selling menu item, while increasing the size is interpreted as a desperate effort not to fall behind in competition with rapidly growing low-priced coffee brands.

Ediya Coffee was the pioneer that first opened the domestic low-priced coffee franchise market in 2001. However, as other low-priced brands such as Baekdabang by The Born Korea, Juicy, Mega Coffee, Compose Coffee, and The Venti entered the market one after another, its price competitiveness weakened, resulting in a somewhat 'awkward' position. Based on one Americano, Starbucks, the number one in the domestic coffee industry, charges 4,500 KRW for a tall size (small), Ediya Coffee charges 3,200 KRW, and Mega Coffee charges 1,500 KRW.

While the growth of low-priced coffee has been very rapid over the past three years, mid-priced brands like Ediya Coffee have almost stopped growing.

According to the Fair Trade Commission and others, the number of Ediya Coffee franchises over the past three years was 2,661 stores (including 10 directly operated stores) in 2019, 2,885 stores (including 10 directly operated stores) in 2020, 3,018 stores (including 13 directly operated stores) in 2021, and 3,000 stores (including 15 directly operated stores) as of this month.

On the other hand, Mega Coffee, a representative low-priced coffee brand, rapidly grew from 798 stores in 2019 to 1,184 stores in 2020, and 1,593 stores in 2021, reaching 2,160 stores as of the 1st of this month. As the economy stagnates amid rising prices, demand for low-priced coffee is increasing, and recently Mega Coffee has appointed soccer player Son Heung-min, and Compose Coffee has appointed popular actor Jung Hae-in as promotional models to raise brand awareness.

Ediya Coffee is seeking solutions through developing and launching stick coffee products and exploring overseas markets.

They have begun to expand the sales proportion of stick coffee centered on the Dream Factory opened in Pyeongtaek, Gyeonggi Province, in April last year, and are focusing on the capsule coffee and RTD (Ready To Drink) beverage markets by expanding the BEANIST lineup.

In January this year, they opened a brand store on Tmall's global store, a Chinese online shopping mall, and started selling products. Last year, they exported coffee mix products to the United States, Mongolia, Australia, and Taiwan.

Moon Chang-gi, chairman of Ediya, held a press briefing at the Dream Factory on August 23 and said, "The domestic coffee market is already saturated," adding, "We have completed preparations to realize the plan to let people around the world taste Ediya Coffee. Based on the technology of the Dream Factory, we are continuously expanding overseas distribution networks by exporting coffee mixes to the United States, Mongolia, China, and Oceania."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.