[Asia Economy Sejong=Reporter Dongwoo Lee] The price of lithium, a key material for electric vehicle batteries, has turned bearish after six months. It is analyzed that this is influenced by the outlook that the global battery industry, burdened by the nearly 400% surge in lithium prices over the past year, may begin adjusting production volumes.

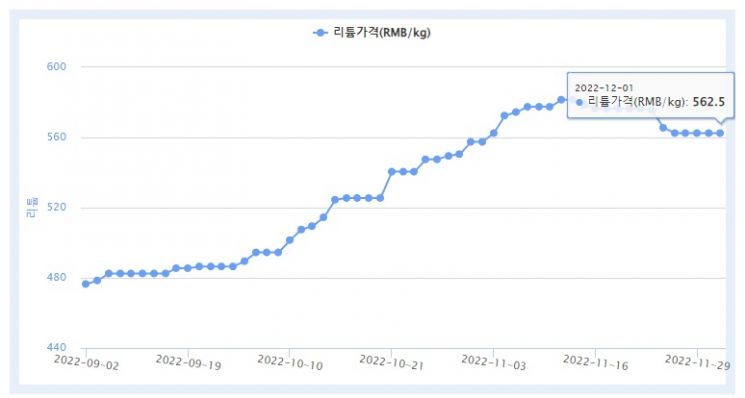

According to the Korea Resource Information Service on the 2nd, the price of lithium (based on 99% lithium carbonate) was 562.5 yuan per kg (about 104,315 KRW) as of the previous day, down 2.4% from the previous week. This is the largest decline in nearly a year since the all-time high of 581.5 yuan was recorded on the 11th of last month. Lithium prices have more than tripled from an average of 185.5 yuan per kg (about 34,400 KRW) in November last year to last month.

Lithium is a metal that generates electricity through a chemical reaction in which ions move between the cathode and anode materials inside the battery. Due to the recent price surge, its share in the cost of cathode materials has risen to 60-70%. It is known that about 700 tons of lithium are required to produce 1 GWh of electric vehicle batteries (enough for 15,000 electric vehicles).

The dominant view behind the recent bearish turn in lithium prices is that the price of lithium carbonate peaked after surpassing 100 million KRW per ton. There is growing possibility that the battery industry may begin adjusting production to prevent loss of competitiveness caused by excessively high lithium prices. Due to the nature of lithium production, supply cannot immediately respond to demand fluctuations, so if there is a change in supply and demand in the battery industry, prices can fall rapidly. Jihoon Lim, a researcher at the Korea International Trade Association (KITA), said, "Although lithium supply is increasing due to the surge in demand for batteries for electric vehicles and ESS, the supply structure is inelastic to price changes, causing frequent mismatches in supply and demand."

It is also analyzed that the U.S. government's Inflation Reduction Act (IRA) and its potential easing are affecting lithium prices. From next year, to qualify for electric vehicle tax credits in the U.S., a certain percentage of critical minerals used must be produced in the U.S. or in countries that have free trade agreements (FTA) with the U.S. The required percentage for receiving subsidies starts at 40% next year and must increase to 80% by 2027.

However, due to strong opposition from the automotive industries in Korea, Europe, and Japan regarding this IRA measure, there is increasing weight on the possibility of adjustments to some U.S. executive orders. It is expected that the outcome of the trade and technology council (TTC) meeting scheduled this month between the U.S. and the European Union (EU) to find solutions to the IRA will directly impact lithium price adjustments. Cheonggu Kang, an invited professor in the Department of Energy Resources Engineering at Inha University, said, "Recently, major countries including China, which accounts for 65% of global refined lithium compound production, are entering a trend of production adjustment," adding, "Although external factors may influence lithium prices, the prevailing view is that the adjustment trend will not be prolonged."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.