KCCI Announces Related Analysis Report

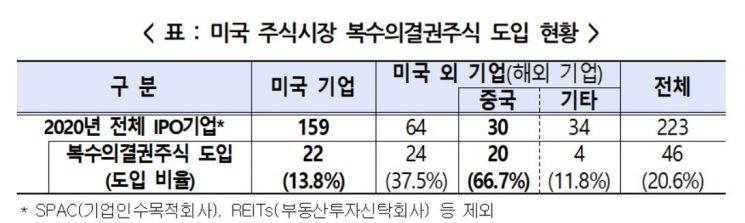

[Asia Economy Reporter Kiho Sung] Among companies listed in the United States, 20.6% have utilized the system to introduce multiple voting rights shares, and founders of companies that have adopted multiple voting rights exercise 63.0% of voting power with an average ownership of 29.9% of shares.

The Korea Employers Federation (KEF) analyzed the status of multiple voting rights shares adoption among companies that went public (IPO) in the U.S. stock market in 2020 and announced the "Status of Multiple Voting Rights Shares Adoption among U.S. Market IPO Companies."

Currently, unlike most advanced countries, South Korea prohibits the introduction of multiple voting rights, making it difficult to stabilize management rights for venture companies. A legislative amendment allowing venture companies to issue multiple voting rights shares (amendment to the Special Act on Venture Businesses) has been promoted and passed through the relevant standing committee, but the bill has yet to pass the Legislation and Judiciary Committee.

On the other hand, it was found that advanced countries such as the United States actively utilize the multiple voting rights system.

As a result of investigating the status of multiple voting rights adoption among companies that went public in the U.S. in 2020, 20.6% of the surveyed companies introduced multiple voting rights shares. In particular, Chinese (nationality) companies have a very high adoption rate of multiple voting rights shares, indicating active utilization of the system.

Specifically, founders held 29.9% of total shares (22.3% multiple voting rights shares, 7.6% other shares), but their voting power reached 63.0%.

KEF pointed out, "Considering the adoption status of the system in major advanced countries and recent institutional changes in Asian competitors such as China, Hong Kong, and Singapore, it is necessary to introduce the multiple voting rights system in South Korea as soon as possible."

Hahm Sang-woo, head of KEF’s Economic Research Department, emphasized, "To actively foster venture companies, it is urgent to introduce an effective multiple voting rights system so that founders can focus on management activities without concerns about management rights, and legislation should be enacted during this regular National Assembly session."

He also mentioned, "As seen in recent cases where China, Singapore, and Hong Kong have allowed listings of companies issuing multiple voting rights shares, more bold deregulation will also help secure the competitiveness of our stock market."

Furthermore, he stressed, "We should actively consider introducing poison pill (preemptive rights) widely adopted in advanced countries," and "Along with the responsibility to enhance corporate transparency, we must establish management rights defense systems comparable to those of competing countries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.