Domestic Soy Milk Market Sales... Slight Decline Expected Again This Year Compared to Last Year

Stagnation as Plant-Based Drinks Like Oat and Almond Continue to Launch Besides Soy

'Vegemil' Jeong Sik Food Firm Holds Firm No.1 Position... Followed by Samyook Food

[Asia Economy Reporter Eunmo Koo] The status of soy milk, a representative plant-based beverage that has been steadily loved since the 1970s, is being shaken. As consumers' interest in healthy drinks grows day by day, plant-based beverages made from various grains such as almonds, rice, and oats, in addition to the traditional soybeans, are increasing.

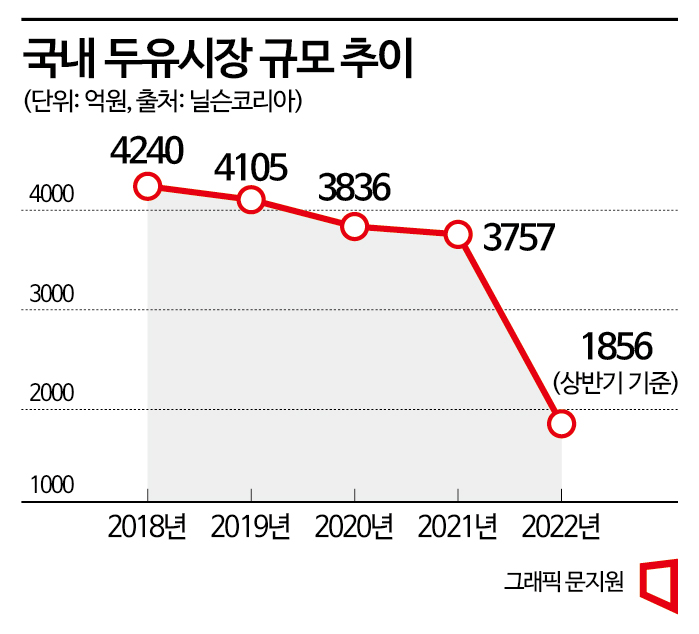

According to market research firm Nielsen Korea on the 1st, last year, the domestic soy milk market sales amounted to 375.7 billion KRW, a 2.1% decrease compared to the same period the previous year. The size of the domestic soy milk market has been slightly but steadily shrinking in recent years. The market, which was around 424 billion KRW in 2018, decreased to 410.5 billion KRW in 2019 and further dropped to 383.6 billion KRW in 2020, falling below the 400 billion KRW mark. This year, based on the first half, sales were 185.7 billion KRW, down 0.5% from the same period last year (186.7 billion KRW), making it difficult to recover to the 400 billion KRW level.

By manufacturer, as of the first half of this year, Jeongsik Food holds an overwhelming position with a market share of 54.3%, accounting for more than half of the market, followed by Samyook Food with 25.7%. Dairy companies such as Yonsei Milk (5.7%), Namyang Dairy Products (4.3%), and Maeil Dairy (3.4%) recorded market shares around 5% each.

Among soy milk product groups, black soybean soy milk accounted for about two-thirds at 66.0%, followed by white soybean soy milk (23.2%) and other soy milks (10.8%). Given the high market share of black soybean soy milk, most of the top products in individual categories were black soybean products. Jeongsik Food’s ‘Vegemil Black Soybean High Calcium (13.4%)’ and ‘Vegemil Black Soybean and Black Sesame (5.7%)’ ranked first and fifth in sales respectively, while Samyook Food’s ‘Black Soybean (9.7%)’ ranked third.

Despite the steady growth of the health-related market due to increased interest in health, the soy milk market, a representative player in plant-based beverages, shows some stagnation because alternative products are also increasing. As consumer demand for healthy drinks rises, companies are introducing products using various plant-based ingredients such as almonds, rice, and oats in addition to soybeans.

In particular, dairy companies, whose soy milk product market share is relatively low, are actively moving. Maeil Dairy launched the plant-based beverage brand ‘Amazing Oat’ in August last year. It is an alternative milk made by importing and processing Finnish oats, and Maeil Dairy plans to develop Amazing Oat as a core brand. A Maeil Dairy official said, “The plant-based beverage market is expected to grow into a 1 trillion KRW market by 2025,” adding, “We will more than double sales next year compared to this year by increasing not only consumer sales but also business-to-business (B2B) supply of barista products to cafes.”

Namyang Dairy Products also introduced ‘Almond Day,’ a plant milk made from 100% almonds, in September. Almond Day features enhanced aroma and flavor through roasting and freeze-grinding methods to improve the bland taste typical of almond beverages. A Namyang Dairy Products official explained, “We focused on developing healthy and delicious products for consumers whose interest in health and plant-based foods has increased due to COVID-19,” adding, “It will also be a good alternative for consumers who cannot drink milk due to lactose intolerance or who have soy milk allergies.”

However, since soy milk sales tend to increase in convenience store warmers during the colder year-end and early-year seasons, new product launches targeting this market continue. Recently, Yonsei Milk launched ‘Real Black Medicinal Soybean Soy Milk,’ using domestically grown black medicinal soybeans, which are smaller than regular black soybeans but rich in protein and other nutrients, to expand its market share.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.