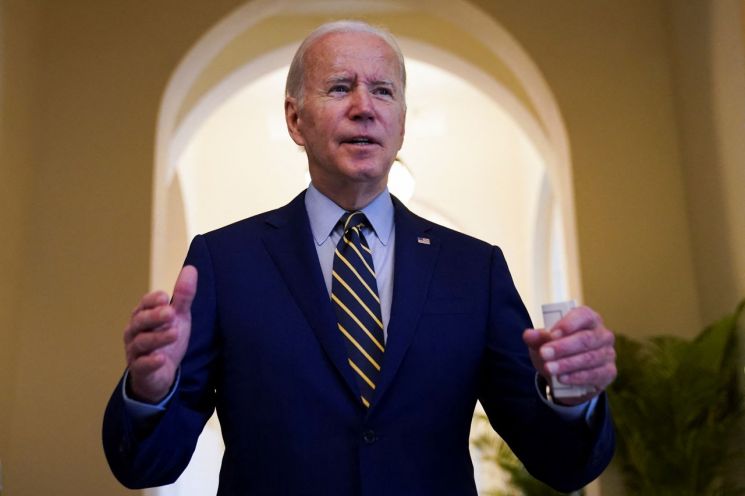

Biden Visits SK Siltron CSS Plant

SiC Semiconductors Rising in the Electric Vehicle Era

Market Expected to Exceed 6 Trillion Won by 2026

[Asia Economy Reporter Han Ye-ju] Attention is focused on the 'silicon carbide (SiC) wafers' produced at the SK Siltron CSS factory as U.S. President Joe Biden visited the facility. SiC is a next-generation power semiconductor core material used in electric vehicles, electronic devices, and 5G networks, and investments in this area have recently surged. Although a few semiconductor companies currently dominate the market, it is still in the early stages of commercialization, making it a field where domestic companies are expected to expand their market share.

According to industry sources on the 30th, U.S. President Joe Biden visited SK Siltron CSS's factory in Michigan, USA, which produces SiC wafers, on the 29th (local time). While President Biden visited Samsung Electronics' semiconductor plant in Pyeongtaek during his visit to Korea in May, this is his first visit to a Korean business site located in the United States.

SK Siltron CSS is a local subsidiary of SK Siltron in the U.S. and is regarded as a symbol of Korea-U.S. semiconductor cooperation. This is because SK has contributed to the revival of the automotive industry in the North American "Rust Belt" by acquiring a U.S. semiconductor materials company and reinvesting.

SK Siltron CSS's SiC wafers are mainly used as semiconductor materials for electric vehicle manufacturing due to their superior power efficiency and durability compared to conventional silicon wafers. As a result, SK Siltron CSS's continuous local investment in the U.S. also contributes to stabilizing the semiconductor materials and eco-friendly electric vehicle supply chain.

In fact, SiC power semiconductors are known to improve electric vehicle power efficiency by about 7%. Since Tesla first introduced SiC power semiconductors in the Model 3 in 2018, one-third of all electric vehicles currently use SiC power semiconductors. This adoption rate is expected to rise to 60% by 2025.

Currently, due to high technological entry barriers, there are only a few SiC wafer manufacturers. However, the market potential is substantial. According to market research firm Yole D?veloppement, the SiC power semiconductor market is expected to grow about tenfold from $500 million (approximately 653 billion KRW) in 2019 to $4.9 billion (approximately 6.4 trillion KRW) in 2026. Due to the surge in electric vehicle demand, this market forecast is likely to be revised upward.

Domestically, SK Group is the most active in investing in SiC-related fields. In addition to SK Siltron CSS's factory in Michigan, USA, the Gumi plant is expanding its SiC wafer manufacturing facility with an investment of 190 billion KRW. SK Group's holding company, SK Inc., acquired Yes Power Technics, the only SiC producer in Korea, last April.

DB HiTek has also begun preparations for SiC semiconductor production. The production facilities are expected to be established at the Chungbuk Eumseong plant. The plan is to manufacture SiC semiconductors using 6-inch (150 mm) and 8-inch (200 mm) wafers.

LX Semicon, a fabless semiconductor design company under LX Group, which separated from LG, also shows strong interest in SiC. Last year, it declared its full-scale entry into the business by acquiring tangible and intangible SiC-related assets from LG Innotek, and is currently gathering SiC research personnel in Cheongju, Chungbuk.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.