This Year, China's Beer Import Value Tops $31.16 Million, Surpassing the Netherlands

Japanese Beer Doubles Growth as Boycott Fades

Beer Import Declines... Wine, Whiskey Popularity and Craft Beer Growth

[Asia Economy Reporter Koo Eun-mo] This year, the most imported beer in South Korea was Chinese beer. Japanese beer, which saw a significant decline in market share due to the boycott movement, showed a clear recovery as the 'No Japan' sentiment faded and the alcoholic beverage market rebounded, with import value more than doubling compared to last year.

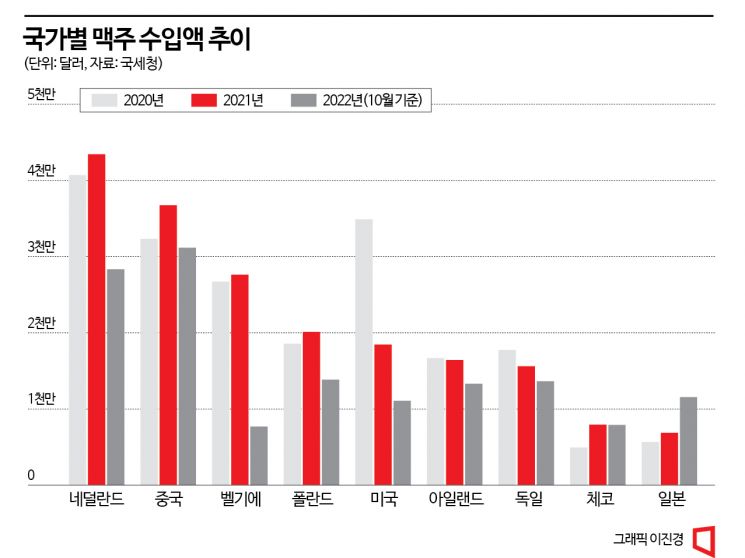

According to customs export-import trade statistics as of October this year, the import value of Chinese beer was $31.161 million (approximately 41.3 billion KRW), a 3.0% increase from the same period last year ($30.251 million). This is the highest import volume among beers by country. China, which ranked second last year with an import value of $36.749 million, overtook the Netherlands, which was the leader last year, by promoting brands such as Tsingtao and Harbin, rising to first place this year.

The growth of Japanese beer this year is particularly notable. The import value of Japanese beer reached $11.559 million (approximately 1.53 billion KRW), a 107.0% increase compared to the same period last year. It has already surpassed last year's import value ($6.875 million) by a large margin. Japanese beer imports peaked at $78.3 million in 2018 but plummeted to $39.756 million in 2019 following Japan's export restrictions on South Korea and the ensuing boycott movement, then shrank further to $5.668 million in 2020. Although there was a slight increase last year, the import value was still only about one-tenth of the 2018 level.

Japanese beers such as Asahi, Sapporo, and Kirin, which ranked first in import value in 2018, seemed to disappear from shelves in major domestic supermarkets and convenience stores, yielding space to other imported beers. However, with the easing of the 'No Japan' sentiment and the rapid recovery of the alcoholic beverage market following the lifting of social distancing measures this year, imports and sales of Japanese beer are also recovering quickly.

In contrast to the increase in imports of Chinese and Japanese beers, the Netherlands, led by Heineken, which was the leader last year with an import value of $43.432 million, saw its import value fall to $28.335 million, a 22.2% decrease compared to the same period last year ($36.442 million), dropping one rank. Belgium, a stronghold of wheat beers such as Hoegaarden, also performed poorly, with import value dropping 66.4% year-on-year to $7.69 million.

The origins of imported beers ranked after China and the Netherlands were Poland ($13.85 million), Germany ($13.633 million), Ireland ($13.311 million), Japan ($11.559 million), the United States ($11.067 million), and the Czech Republic ($7.898 million).

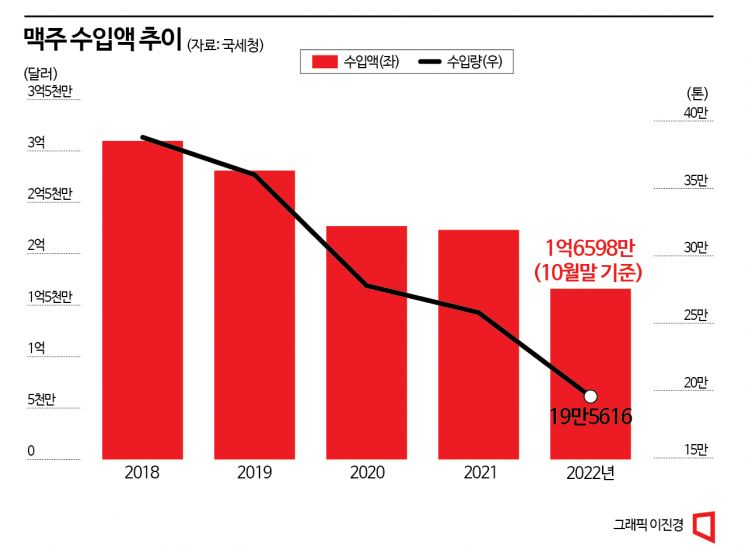

Meanwhile, beer import values have steadily declined over the past few years. Last year, the total beer import value was $223.1 million (approximately 295.8 billion KRW), down 1.7% from the previous year. This is the lowest level in five years since 2016 ($181.556 million). This year, the total import value as of October was $165.98 million (approximately 220 billion KRW), falling short of last year's same period ($185.07 million), indicating that the decline in beer imports is expected to continue.

The recent decrease in beer import value is attributed to the rising popularity of other alcoholic beverages such as wine and whiskey, as well as the growth of the domestic craft beer market. Last year, wine import value was $506.16 million (approximately 671.3 billion KRW), a 53% increase from 2020 ($330.01 million), and this year, as of October, it reached $482.75 million (approximately 640.2 billion KRW), a 5.5% increase compared to the same period last year ($457.58 million). Last year, the import value of distilled spirits such as whiskey, gin, and vodka also approached beer import values at $210.9 million (approximately 279.7 billion KRW).

The growth of the domestic craft beer market has expanded consumer choices, which is another reason why imported beer has slowed down compared to before. According to the Korea Craft Beer Association, the sales revenue of domestic craft beer companies last year was 152 billion KRW, nearly a 30% increase from 118 billion KRW a year earlier, and nearly tenfold growth since 2014 (16.4 billion KRW) over seven years. The 2020 revision of the Liquor Tax Act, which changed the taxation method from ad valorem tax to specific tax, ignited the growth of the domestic craft beer market. This lowered the manufacturing cost of craft beer and created a background for accelerating the growth of the craft beer market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)