SK Hynix, Borrowings Surpass 20 Trillion Won for the First Time

LG Energy Solution's Debt Increases by Over 3 Trillion Won

[Asia Economy Reporters Oh Hyung-gil and Moon Chae-seok] Semiconductor and battery companies, which are proactively making large-scale investments, are struggling with financial risks such as borrowings and debt. SK Hynix's borrowings surpassed 20 trillion won for the first time in history, and LG Energy Solution's debt increased by more than 3 trillion won. Amid growing management uncertainties due to the 'three highs' (rapid rise in exchange rates, prices, and interest rates), concerns are emerging that the declining financial stability of companies will act as a future management risk.

Financial Risk Alert Issued for Semiconductor, Packaging, and Display Sectors

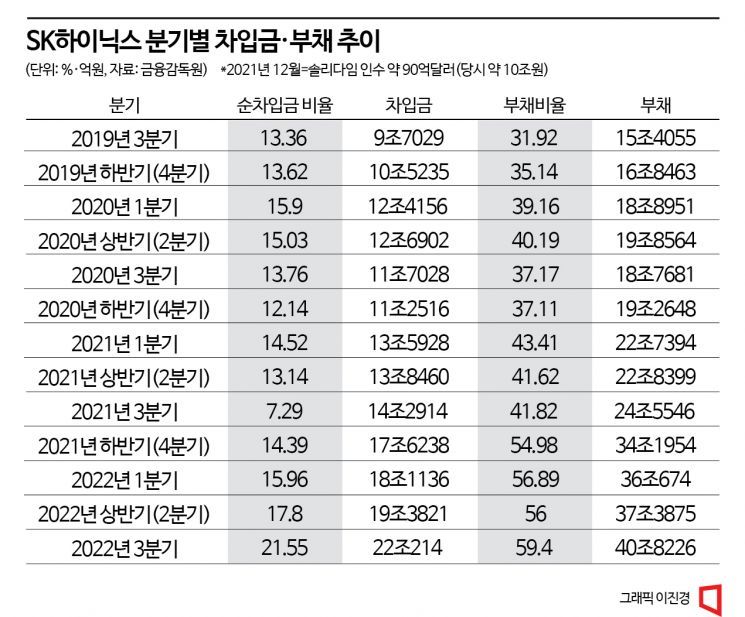

According to industry sources and the Financial Supervisory Service on the 29th, SK Hynix's borrowings in the third quarter reached 22.0214 trillion won, surpassing 20 trillion won for the first time. After crossing 10 trillion won at 10.5235 trillion won in the fourth quarter of 2019, it more than doubled in 11 quarters (2 years and 9 months). The net borrowing ratio is also rising sharply. Debt also surged. Debt increased by 6.6272 trillion won from 34.1954 trillion won at the end of last year to 40.8226 trillion won in the third quarter. The debt ratio rose from 54.98% at the same time to 59.4% in the third quarter.

A simple increase in borrowings is often seen as 'stockpiling ammunition' for future investments due to the nature of the high-priced equipment industry, but some companies are criticized for the steep rise, which could shake financial stability. In the worst case, this could weaken institutional investors' investment sentiment in the financial investment industry, making it difficult to secure funds appropriately, and lead to a vicious cycle negatively affecting stock prices and credit ratings.

Within the industry, there are voices suggesting that the lowered financial stability partly influenced the declaration of a "50% reduction in investment next year." It is speculated that the underlying reason is the inability to make bold facility investments like Samsung Electronics, a competitor in memory products DRAM and NAND businesses, and the resulting hesitation.

SK Hynix stated that the sharp increase in borrowings 'this year' is unrelated to the acquisition of Solidigm conducted 'last year.' The rumor of a 'failed corporate bond issuance' circulating in some quarters was firmly denied as "absolutely untrue." An industry insider said, "The increase in borrowings is a result of proactive liquidity securing in preparation for this year's semiconductor market downturn and high interest and exchange rate environment, as well as an illusionary effect from the rise in foreign currency bond valuation due to exchange rate increases. It does not seem to indicate a sign of deterioration in the business fundamentals."

As financial stability declines, institutional investors in the financial investment industry are also giving harsher evaluations of SK Hynix's corporate value. The consensus average for SK Hynix's operating profit in the fourth quarter stood at -173 billion won as of the 27th. It is expected that turning a profit will not be easy at least until the fourth quarter of next year. In particular, the company's NAND flash business market share, part of its memory semiconductor products, dropped one rank from second to third globally in the third quarter, leading to harsher evaluations.

The semiconductor substrate and packaging industry is also steadily increasing borrowings by 1 to 2 trillion won quarterly while expanding investments. Samsung Electro-Mechanics borrowed around 2 trillion won from 2019 until the first half of last year. LG Innotek borrowed around 2 trillion won quarterly over three years.

The display industry is also receiving criticism that its financial indicators are too poor to be seen as simply increasing borrowings for investment purposes. LG Display's net borrowing ratio surged 10 percentage points from 74% to 84% over three years, and borrowings including bonds increased by 1.8625 trillion won (13.9%) from 13.4288 trillion won to 15.2913 trillion won.

Rapid Debt Increase in Battery and Material Companies Accelerating Investments

Battery and material companies making large-scale investments in North America and Europe are also seeing a rapid increase in debt as borrowings rise.

As countries worldwide declare the phase-out of fossil fuel vehicles and investments in electric vehicle batteries to replace them take on a 'money game' aspect, securing funds ahead of others makes debt inevitable. However, if electric vehicle sales fall short of expectations or the capital market shrinks due to high interest rates, causing problems in cash flow, the companies will inevitably bear the full impact.

LG Energy Solution's debt on a consolidated basis increased by 24% from 150 trillion won at the end of last year to 187 trillion won as of the end of the third quarter this year. Borrowings also rose from 70 trillion won to 83 trillion won during the same period. However, capital also increased significantly from 87 trillion won to 211 trillion won, reducing the debt ratio from 171.8% at the end of last year to 88.5%.

Samsung SDI, which is pursuing additional joint ventures in North America following Stellantis, also saw its debt increase by about 3 trillion won. Debt rose from 106 trillion won at the end of last year to 134 trillion won, with the battery business (Energy Solution division) accounting for nearly 97.9% of total debt. This is a slight increase from 95.5% at the end of last year, maintaining an absolute share.

SK On's debt ratio is approaching 293.4%. SK On plans to invest a total of 23 trillion won by 2025 and is currently raising pre-IPO investment funds. However, the slow progress is contributing to the increase in debt of its parent company, SK Innovation. SK Innovation's total debt rose nearly 14 trillion won from 300 trillion won at the end of last year to 438 trillion won in the third quarter this year.

Mid-sized battery material companies are also experiencing rapid debt increases. EcoPro BM, a cathode material producer, had debt of 1.8681 trillion won at the end of the third quarter, with borrowings due within one year reaching nearly 1.4411 trillion won. L&F, which is pushing plans to enter the U.S. market aiming for mass production in 2025, also saw a sharp increase in debt to 1.6185 trillion won.

The battery industry recognizes the increasing debt as an inevitable result of proactive investments. With the U.S. Inflation Reduction Act (IRA) set to take effect from next year, companies must endure financial risks to seize the golden time for investment.

However, many companies feel burdened by securing large-scale funds. A recent example is Iljin Materials, a battery copper foil material company, which was sold amid rumors that the continuous investment burden played a role. This implies that mid-sized material companies with weaker financial power could face worsening financial conditions at any time.

Especially as interest rate hikes and a strong dollar trend are expected to continue beyond next year, concerns are growing that the burden of securing additional investment funds will increase further.

Park Jong-il, Senior Researcher at NICE Credit Rating, pointed out, "Compared to the past when the focus was on production capacity scale, the nature of investments has diversified to localization and supply chains, increasing uncertainty. If the strong dollar trend continues, the burden of investment converted to Korean won will increase, and with the growing proportion of overseas bases, the burden of foreign currency debt and interest expenses will inevitably rise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)