November 3.14% Decline... 1.39%p Increase from Previous Month

Fell 6.97% in Last 5 Months

'Smart One-Home' Demand Also Collapses

Concerns Over Reverse Jeonse Crisis Grow

[Asia Economy Reporter Ryu Tae-min] The prices of so-called 'leading apartments,' which drive local market prices, have fallen by the largest margin ever. Due to interest rate hikes and economic downturns freezing the housing market, coupled with a worsening reverse jeonse (key money deposit) crisis, there has been an increase in urgent sale properties priced several hundred million won below their peak prices.

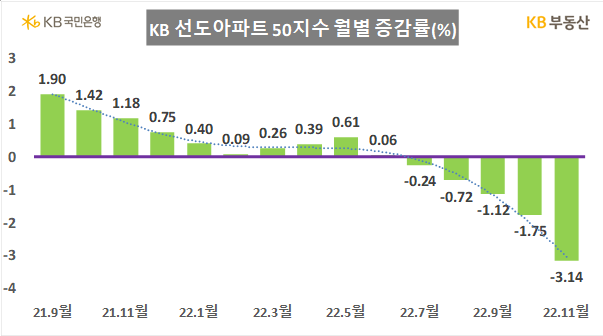

According to the monthly housing trend report released by KB Kookmin Bank on the 28th, the 'KB Leading Apartment 50' index for November fell by 3.14% compared to the previous month. This is an increase of 1.39 percentage points from the previous month's decline (-1.75%) and marks the largest drop in 13 years and 11 months since the index began in December 2008. After recording -0.24% in July and turning negative, the decline rate increased 13-fold over four months, resulting in a total drop of 6.97% over five months. Notably, compared to the 1.42% decline in Seoul apartment sale prices this month, the drop in leading apartments is more than twice as large.

The KB Leading Apartment index selects the top 50 apartment complexes nationwide by market capitalization and reflects changes in their market capitalization. It is highly sensitive to price fluctuations and leads the national apartment market, making it a leading indicator often used to forecast the housing market. Major complexes in the Gangnam area, such as Acro River Park, Eunma, and Jamsil Jugong 5 Complex, are included.

This appears to be the result of the downward trend that began in the outskirts earlier this year spreading to the Gangnam central area in the second half. Until the first half of this year, the leading index rose by a total of 1.81%, maintaining an upward trend. However, in the second half, even the remaining demand for the so-called 'smart one house' decreased, leading to a surge in declining transactions in leading apartment complexes in Gangnam, and the leading index continues to fall.

According to weekly apartment price trend data from the Korea Real Estate Board, apartment sale prices in Songpa-gu have recorded negative growth for 27 consecutive weeks since the third week of May, falling by 5.12%. Gangnam-gu has seen a decline for 21 consecutive weeks, dropping 2.63%, while Seocho-gu (10 consecutive weeks, -1.56%) and Gangdong-gu (24 consecutive weeks, -3.89%) have also continued to decline.

Declining transactions are occurring frequently across various locations. According to the Ministry of Land, Infrastructure and Transport's real transaction price disclosure system, an 84.9㎡ (exclusive area) unit in Helio City, Garak-dong, Songpa-gu, changed hands on the 11th for 1.68 billion won, down 690 million won from the highest price of 2.37 billion won in January. An 84.8㎡ unit in Jamsil Els, Jamsil-dong, was sold for 1.9 billion won on the 19th of last month, down 770 million won from the highest price of 2.67 billion won in March. A 76㎡ unit in Eunma Apartment, Daechi-dong, Gangnam-gu, was sold for 1.77 billion won on the 8th, down 860 million won from the highest price of 2.63 billion won in November last year.

The reverse jeonse crisis is also believed to have had an impact. As jeonse prices have fallen compared to two years ago, landlords find it difficult to return the reduced jeonse deposits to tenants, leading to an increase in cases where properties are urgently put up for sale at prices lower than market value. According to weekly KB housing market trend data, Seoul apartment jeonse prices fell by 0.75% in the third week of November. Particularly, jeonse prices in Gangnam areas such as Seocho-gu (-1.22%), Gangnam-gu (-0.74%), and Songpa-gu (-0.89%) have also dropped significantly.

The characteristic of being large-scale complexes is also cited as a background for the sharp decline. Song Seung-hyun, CEO of Urban and Economy, explained, "Leading apartments consist of large complexes with many transactions, so price reflection is quick," adding, "As jeonse prices show a downward trend, urgent sale properties are also appearing frequently."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)