[Asia Economy Reporter Changhwan Lee] An analysis has emerged suggesting that South Korea's base interest rate hikes will conclude earlier than those in the United States.

According to the report titled "Consumer Price Outlook and Implications Viewed Through International Oil Prices," authored by Senior Researchers Seonghoon Yoon and Yongsik Jeon of the Korea Insurance Research Institute on the 27th, the period when the U.S. consumer price inflation slows down is expected to be later than in South Korea, indicating that the end of interest rate hikes will also occur later in the U.S. than in South Korea.

The report states that international oil prices, which had driven the steep rise in consumer prices, have recently declined and are projected to remain somewhat lower in 2023 compared to 2022.

According to the U.S. Energy Information Administration (EIA), the average annual international oil price (WTI) was $39.2 per barrel in 2020, $68.2 in 2021, and was recorded at $95.7 in 2022, with a forecast of $88.6 for 2023.

Considering only international oil prices, the timing for the 2023 consumer price inflation rate to fall below 4% is estimated to be May in South Korea and August in the U.S., while the timing for it to drop to the 2% range is projected to be October in South Korea and January 2024 in the U.S.

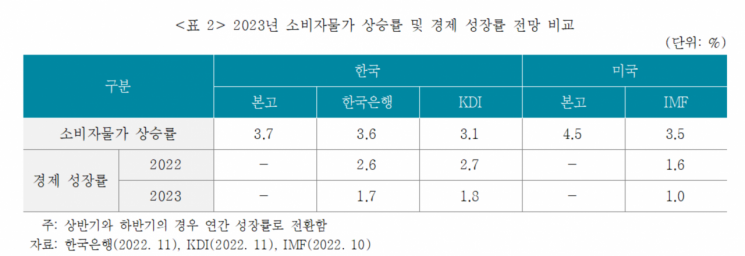

The 2023 consumer price inflation forecast for South Korea in the report is 3.7%, slightly higher than that of the Bank of Korea (3.6%) and the Korea Development Institute (3.1%). The U.S. consumer price inflation forecast of 4.5% for 2023 is also significantly higher than the IMF's 3.5%.

The report analyzes that for the 2023 consumer price inflation rate to decline to the 3% range, South Korea would need only a slight slowdown in demand compared to previous trends, whereas the U.S. would require a much larger contraction in demand.

Therefore, if the monetary policy goal focuses solely on consumer prices, the Federal Reserve would need to raise the base interest rate more than the Bank of Korea and would likely have to sacrifice the economy relatively more.

Senior Researcher Seonghoon Yoon pointed out, "Compared to the U.S., South Korea's base interest rate hikes are expected to end earlier," and added, "There is a need to prepare for the possibility of an economic recession in the U.S."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.