64% of Overdraft Balances at 5 Major Banks Held by 40s and 50s

Overall Overdraft Accounts Decline Due to High Interest, but Accounts Increase Among 60s

[Asia Economy Reporter Bu Aeri] #Single-income office worker Lee Hoseop (44) is using a minus account (overdraft) with a limit of 30 million KRW. As prices rise, living expenses have increased, and the education costs for his two children are impossible to cover with just his salary. Lee said, "Every time I see news about rising loan interest rates, I think I should get rid of the overdraft, but realistically, it's not easy to cut living expenses," adding, "The government always worries that young people are struggling, but middle-aged people are also living in a really tough world."

As the era of the three highs (high inflation, high interest rates, high exchange rates) arrives, even middle-aged and elderly people are crying out. Although loan interest rates are rising sharply due to the Bank of Korea's base rate hikes, middle-aged people have been less able to reduce their use of overdrafts compared to other age groups. Overdrafts have no early repayment fees and, unlike other credit loans where a lump sum is received at once, they allow users to freely deposit and withdraw money as needed, so many use them for living expenses or emergency funds.

According to the financial supervisory data on overdraft loan handling by age group from the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) received by Asia Economy from Rep. Jin Sunmi of the Democratic Party, as of the end of August, the overdraft balance recorded 45.0199 trillion KRW, with 3.007 million accounts.

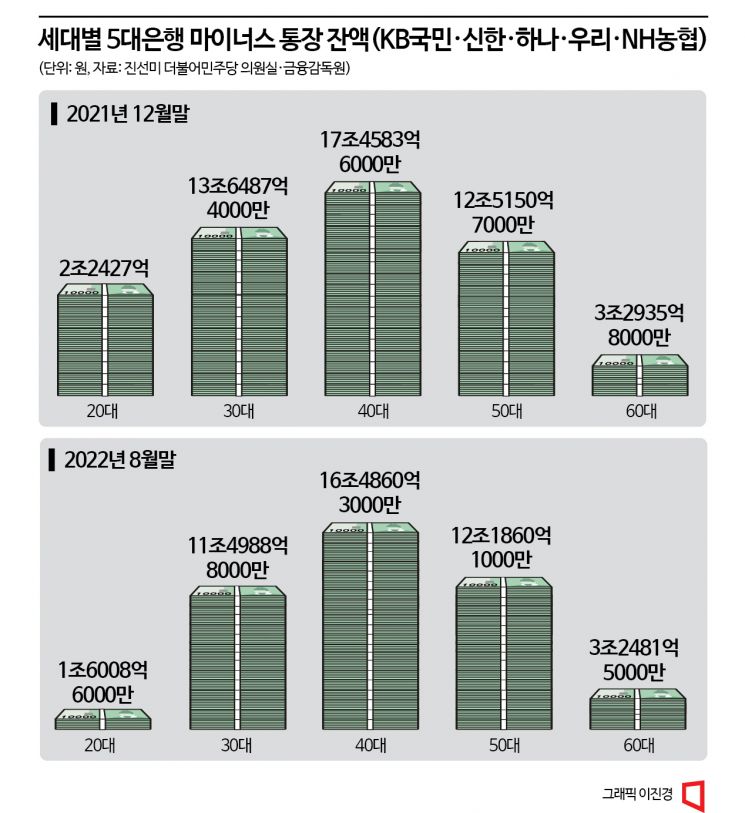

Among these, the overdraft balance of the 40s and 50s age group accounted for about 28.672 trillion KRW, or 64%. Those aged 60 and over had about 3.2482 trillion KRW, about 7% of the total. The 20s and 30s age group had a balance of 13.0997 trillion KRW, or 29% of the total. Compared to the end of last year, the proportion of the 20s and 30s decreased by 3%, while the 40s and 50s increased by 3%.

While many borrowers are reducing loans during the high-interest period, the middle-aged and elderly have actually increased their use of overdrafts. At the end of August, the overdraft balance for those in their 50s was 12.186 trillion KRW, and for those in their 60s, 3.2482 trillion KRW, increasing by 0.05% and 0.7% respectively compared to the second quarter.

However, the overdraft balance and number of accounts have slightly decreased recently as interest rates have risen sharply. The number of overdraft accounts decreased by 3.3% compared to the end of last year (3.111 million accounts), and the total overdraft balance dropped by about 8.4% compared to the end of last year (approximately 49.1585 trillion KRW).

In particular, the scale of overdrafts among those in their 20s has significantly decreased. During the same period, the number of accounts fell from 121,000 to 101,000, a 16.5% decrease, and the overdraft balance dropped from 2.2427 trillion KRW to 1.6009 trillion KRW, a 28.6% decrease.

On the other hand, the decline among those in their 40s, 50s, and 60s was much more gradual. For those in their 40s, the number of accounts and balance decreased by 3.4% and 5.6%, respectively. For those in their 50s, the number of accounts decreased by 1.1%, and the balance by 2.6%. For those in their 60s, the number of accounts actually increased by 1.7%, from 535,000 to 544,000 accounts, while the balance decreased by 1.4%.

The situation with newly opened overdraft accounts is similar. As of the end of August this year, the number of newly opened overdraft accounts for the 40s and 50s was 95,000, which was 20,000 more than the 75,000 accounts opened by the 20s and 30s. Although the overall number of new overdraft accounts is decreasing due to high interest rates, the proportion by age group is increasing for those in their 50s and those aged 60 and above.

Last year, 83,000 overdraft accounts were newly opened by those in their 50s, accounting for 19.4%, and 45,000 accounts were opened by those aged 60 and above, accounting for 10.5%. This year, 44,000 accounts were opened by those in their 50s, accounting for 22.2%, and 26,000 accounts by those aged 60 and above, accounting for 13.1%.

Regarding this, Rep. Jin said, "As interest rates rise sharply, borrowers' interest burdens increase significantly, raising concerns about defaults," adding, "We need to closely examine the causes of loans and the possibility of defaults and proactively manage them to prevent the crisis from spreading throughout the financial market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.